Wells Fargo Financial Organizer Form

What is the Wells Fargo Financial Organizer

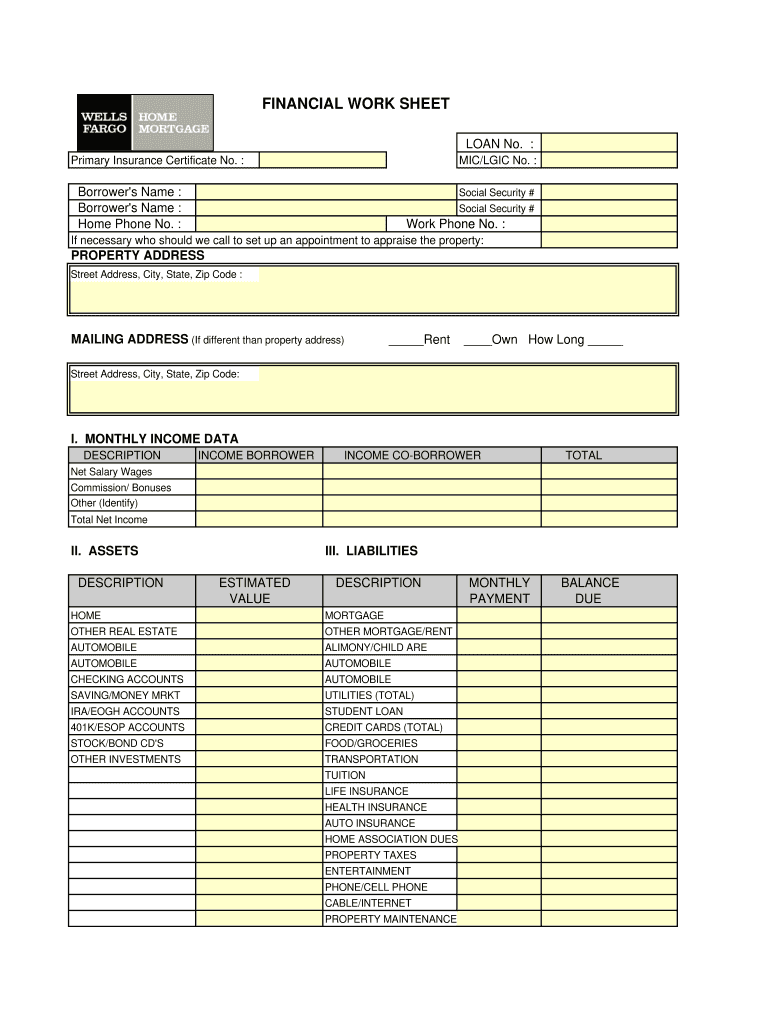

The Wells Fargo Financial Organizer is a comprehensive tool designed to assist individuals and families in managing their finances effectively. It provides a structured approach to tracking income, expenses, and assets, allowing users to gain a clearer understanding of their financial situation. This organizer includes various worksheets that help in budgeting, planning for future expenses, and assessing overall financial health.

How to use the Wells Fargo Financial Organizer

Using the Wells Fargo Financial Organizer involves several straightforward steps. First, gather all relevant financial documents, including bank statements, pay stubs, and bills. Next, fill out the income section to record all sources of income. After that, move on to the expenses section, detailing monthly expenditures. The organizer also prompts users to assess their assets and liabilities, providing a complete picture of their financial standing. Regularly updating this organizer can help track progress and adjust financial goals as needed.

Key elements of the Wells Fargo Financial Organizer

The Wells Fargo Financial Organizer includes several key elements that enhance its utility:

- Income Tracking: A dedicated section for recording all income sources, including salaries, bonuses, and other earnings.

- Expense Categories: Clearly defined categories for monthly expenses, such as housing, transportation, and entertainment.

- Asset and Liability Assessment: A section to evaluate assets like savings and investments against liabilities such as loans and credit card debt.

- Budgeting Tools: Worksheets that facilitate the creation of a personalized budget based on income and expenses.

- Goal Setting: Areas for setting short-term and long-term financial goals, helping users stay focused on their objectives.

Steps to complete the Wells Fargo Financial Organizer

Completing the Wells Fargo Financial Organizer can be broken down into a series of manageable steps:

- Gather all necessary financial documents.

- Start with the income section, listing all sources of income.

- Proceed to the expenses section, categorizing monthly expenditures.

- Evaluate assets and liabilities to understand net worth.

- Utilize the budgeting tools to create a financial plan.

- Set financial goals and review them regularly to track progress.

Legal use of the Wells Fargo Financial Organizer

The Wells Fargo Financial Organizer is designed to comply with applicable financial regulations and standards. Users should ensure that the information provided is accurate and up-to-date to maintain compliance with any legal requirements related to financial reporting or tax obligations. It is important to keep in mind that while the organizer is a helpful tool, it does not replace professional financial advice or services.

Examples of using the Wells Fargo Financial Organizer

There are various scenarios in which individuals can benefit from using the Wells Fargo Financial Organizer:

- A family planning for a vacation can use the organizer to budget for travel expenses.

- A recent college graduate managing student loans can track income and expenses to ensure timely payments.

- A small business owner can utilize the organizer to keep personal and business finances separate, aiding in tax preparation.

Quick guide on how to complete financial worksheet wells fargo form

The optimal approach to locate and sign Wells Fargo Financial Organizer

Across the entirety of your organization, ineffective procedures concerning paper authorization can take up a signNow amount of work hours. Signing documents such as Wells Fargo Financial Organizer is a fundamental aspect of operations in any sector, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the overall performance of the company. With airSlate SignNow, signing your Wells Fargo Financial Organizer is as straightforward and rapid as possible. This platform provides you with the latest version of virtually any form. Even better, you can sign it right away without the need to install external software on your computer or to print physical copies.

Steps to obtain and sign your Wells Fargo Financial Organizer

- Browse our collection by category or utilize the search function to find the form you require.

- View the form preview by clicking Learn more to ensure it's the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and incorporate any necessary information using the toolbar.

- Once finished, click the Sign tool to sign your Wells Fargo Financial Organizer.

- Select the signature method that works best for you: Draw, Generate initials, or upload a picture of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as required.

With airSlate SignNow, you have everything necessary to efficiently manage your documents. You can search for, complete, edit, and even send your Wells Fargo Financial Organizer in a single tab without any difficulty. Enhance your processes with one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

For the new 2018 W-4 form, do I also print out the separate A-H worksheet and fill that out for my employer?

No, an employee is not required to give the separate worksheet to the employer. Keep it for your own records.

-

What do financial analysts do in Wells Fargo? How about the financial analyst program in government and institutional banking group in Wells Fargo?

Thanks for A2A. The work you'll do in the institutional group is in principle the same you'll do at any other bank.The difference may be the proportion you actually work on deals versus making powerpoint pitch decks. This will depend on the strength of your bank's relationship with institutional clients

-

How do I get to the rooftop garden above Wells Fargo in the San Francisco financial district?

There are two paths:Enter the Crocker Galleria shopping mall and go up to the top level. There's a staircase labeled "Rooftop Garden" that will take you up there.Enter the Wells Fargo building but instead of going right, and into the bank, go to the left towards the elevators. You can take these up to the garden.

-

How do I find out if wells Fargo opened an account in my name?

In order to ensure that you are not a victim of the phony account scandal, the basic thing you can do is:Go through your monthly statements, look at the fees you have been charged, and any other charges for that matter. See if there are charges for a product or service you have not signet for.Login to your account, see what products and services are assigned to you. See if there is some product or services you should not have.Go to a Wells Fargo branch (other than the one you are constantly going), ask from the employee to give you a list of all products you have with the bank. See if their is something that you didn’t apply for.When doing this, look primarily at your deposit accounts as well as credit card accounts. See if you were paying any fees for this type of accounts. If yes, see if you have signed up for these accounts. Maybe, one of the reason that have resulted in the possibility for the phony accounts scandal is that we do not control what are we being charged for by the banks.

-

How do you order checks form Wells Fargo?

Simply log into your Wells Fargo online account and hover over “Accounts,” then “Checks & Deposit Tickets.” Or call 1–800-TO-WELLS to speak to a personal banker.

-

How long does it take to find out your pre-approval home loan from Wells Fargo?

Wells Fargo issues three types of approval letters. These vary by the level of analysis they perform on the file prior to issuing the letter and therefor the level of certainty the letter provides to the borrower and to potential sellers that the loan financing will come through.The types of letters are -Pre-qualificationGives you an option of your home price range and estimated closing costs based on non-verified information you provided. Doesn’t require a full mortgage applicationCan often be issued same-day through a Loan Officer or an Online ApplicationPre-approvalGives you an estimate of your home price range based on an initial review of your application and limited credit information only. It requires a mortgage application. Doesn’t require you to provide actual documentsTypically issued within two or three daysCredit approvalGives you an estimated loan amount based on an initial underwriter review of your credit and the information you provided. This letter is their highest standard of credit approval. Requires copies of financial documents (e.g. paystubs, tax returns, bank statements, etc.)This is the type of letter you want to obtain prior to making offers on homes as it will make your offer more solid and competitiveTypically issued within five days

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

Create this form in 5 minutes!

How to create an eSignature for the financial worksheet wells fargo form

How to make an eSignature for the Financial Worksheet Wells Fargo Form online

How to generate an eSignature for your Financial Worksheet Wells Fargo Form in Chrome

How to generate an eSignature for putting it on the Financial Worksheet Wells Fargo Form in Gmail

How to make an electronic signature for the Financial Worksheet Wells Fargo Form straight from your mobile device

How to create an eSignature for the Financial Worksheet Wells Fargo Form on iOS

How to make an electronic signature for the Financial Worksheet Wells Fargo Form on Android devices

People also ask

-

What is the Wells Fargo budget worksheet and how can it help me?

The Wells Fargo budget worksheet is a financial tool designed to help individuals and businesses manage their finances effectively. By outlining income and expenses, it provides a clear view of your financial situation, facilitating better budgeting decisions. Using the Wells Fargo budget worksheet can help improve your spending habits and achieve your financial goals.

-

Is the Wells Fargo budget worksheet free to use?

Yes, the Wells Fargo budget worksheet is available for free, allowing anyone to access valuable budgeting resources without any cost. This affordability means you can take control of your financial health without worrying about subscription fees or hidden charges. The Wells Fargo budget worksheet is an essential tool for those serious about financial planning.

-

Can I integrate the Wells Fargo budget worksheet with other financial tools?

The Wells Fargo budget worksheet is designed for easy integration with other financial management tools, enhancing its functionality. This capability allows you to sync your budget data, ensuring a cohesive approach to tracking and managing your finances. You can streamline your financial processes by using the Wells Fargo budget worksheet alongside your preferred applications.

-

What features are included in the Wells Fargo budget worksheet?

The Wells Fargo budget worksheet includes features such as customizable expense categories, automated calculations, and financial goal tracking. These features make it easier for users to monitor their spending and stay on track with their budgets. By leveraging the Wells Fargo budget worksheet, you can enhance your financial awareness and make informed decisions.

-

How can the Wells Fargo budget worksheet benefit small businesses?

Small businesses can benefit signNowly from the Wells Fargo budget worksheet as it provides a structure for tracking income and expenses efficiently. This tool helps owners identify spending patterns and areas where they can reduce costs, ultimately improving profitability. Additionally, the Wells Fargo budget worksheet aids in setting financial goals, ensuring long-term sustainability for small enterprises.

-

Is the Wells Fargo budget worksheet suitable for personal finances?

Absolutely! The Wells Fargo budget worksheet is highly versatile and ideal for managing personal finances. It helps individuals categorize their income and expenses, enabling them to budget effectively and save for future needs. By using the Wells Fargo budget worksheet, you can gain a better understanding of your financial health and instill disciplined spending habits.

-

What makes the Wells Fargo budget worksheet different from other budgeting tools?

The Wells Fargo budget worksheet stands out because of its user-friendly design and comprehensive features tailored specifically for financial planning. Unlike some other tools, it offers a straightforward approach to budgeting, making it accessible for users of all financial literacy levels. The Wells Fargo budget worksheet empowers users to take charge of their finances with simplicity and effectiveness.

Get more for Wells Fargo Financial Organizer

- Small business accounting package north carolina form

- Company employment policies and procedures package north carolina form

- Nc revocation power form

- North carolina consent form

- Newly divorced individuals package north carolina form

- Authorization health for form

- North carolina statutory form

- Contractors forms package north carolina

Find out other Wells Fargo Financial Organizer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile

- eSignature Maryland Roommate Rental Agreement Template Free