Real Estate Excise Tax Affidavit Prior to Jan 1, Real Estate Excise Tax Affidavit 2022-2026

Understanding the Real Estate Excise Tax Affidavit

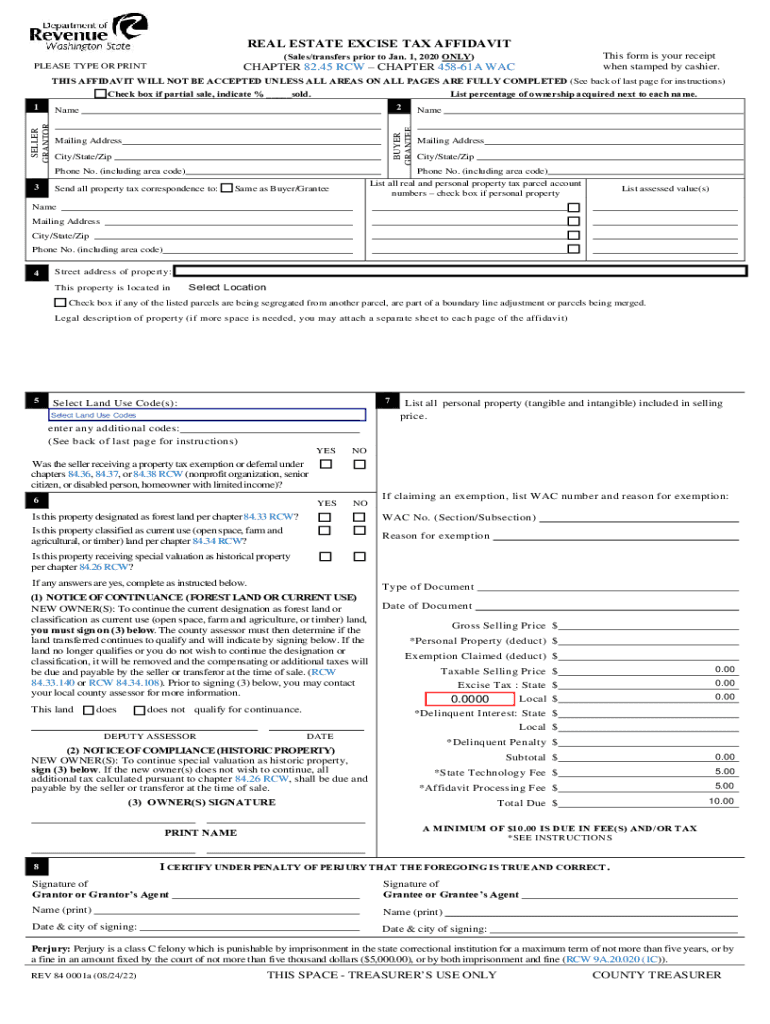

The Real Estate Excise Tax Affidavit is a crucial document used in the sale and transfer of real property in the United States. It serves to report the sale and ensure compliance with state tax regulations. This affidavit is typically required by the Washington Department of Revenue (DOR) and is essential for calculating the excise tax owed on the sale of real estate. Understanding the purpose and importance of this form helps ensure that all parties involved in a real estate transaction are aware of their tax obligations.

Steps to Complete the Real Estate Excise Tax Affidavit

Completing the Real Estate Excise Tax Affidavit involves several key steps:

- Gather necessary information about the property, including the address, sale price, and date of sale.

- Provide details about the buyer and seller, including names, addresses, and contact information.

- Calculate the excise tax based on the sale price using the applicable state tax rate.

- Complete the affidavit form accurately, ensuring all sections are filled out as required.

- Review the completed form for accuracy before submission.

Legal Use of the Real Estate Excise Tax Affidavit

The Real Estate Excise Tax Affidavit is legally binding and must be filed to comply with state tax laws. It is essential for the proper assessment of taxes owed on real estate transactions. Failure to file this affidavit can result in penalties and interest on unpaid taxes. The affidavit also serves as a public record of the transaction, which can be important for future property ownership verification and tax assessments.

Required Documents for Filing the Real Estate Excise Tax Affidavit

When preparing to file the Real Estate Excise Tax Affidavit, certain documents are typically required:

- Proof of sale, such as a purchase agreement or sales contract.

- Identification for both the buyer and seller, such as a driver's license or state ID.

- Any prior tax documents related to the property, if applicable.

- Documentation of any exemptions that may apply to the transaction.

Form Submission Methods

The Real Estate Excise Tax Affidavit can be submitted through various methods, including:

- Online submission via the Washington Department of Revenue's website.

- Mailing a physical copy of the completed affidavit to the appropriate DOR office.

- In-person submission at designated DOR locations.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Real Estate Excise Tax Affidavit can result in significant penalties. These may include:

- Monetary fines for late or non-filing of the affidavit.

- Accrued interest on unpaid excise taxes.

- Legal action taken by the state to recover owed taxes.

Quick guide on how to complete real estate excise tax affidavit prior to jan 1 2020 real estate excise tax affidavit

Easily set up Real Estate Excise Tax Affidavit Prior To Jan 1, Real Estate Excise Tax Affidavit on any device

Digital document management has gained traction among businesses and individuals. It serves as a fantastic eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to effortlessly create, modify, and eSign your documents promptly without any complications. Manage Real Estate Excise Tax Affidavit Prior To Jan 1, Real Estate Excise Tax Affidavit on any system with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

Effortlessly edit and eSign Real Estate Excise Tax Affidavit Prior To Jan 1, Real Estate Excise Tax Affidavit

- Obtain Real Estate Excise Tax Affidavit Prior To Jan 1, Real Estate Excise Tax Affidavit and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of the documents or conceal sensitive information with the specific tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), an invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Real Estate Excise Tax Affidavit Prior To Jan 1, Real Estate Excise Tax Affidavit to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct real estate excise tax affidavit prior to jan 1 2020 real estate excise tax affidavit

Create this form in 5 minutes!

People also ask

-

What is a real estate excise tax form?

A real estate excise tax form is a document required during the transfer of property ownership, outlining the tax owed based on the sale price. This form is essential for complying with local tax regulations when buying or selling real estate. Understanding how to accurately complete this form can prevent potential legal issues down the line.

-

How can airSlate SignNow help with the real estate excise tax form?

airSlate SignNow simplifies the process of completing and eSigning your real estate excise tax form. With its user-friendly interface, you can easily upload, fill out, and send your forms securely. This ensures a smooth process for both you and the other party involved in the transaction.

-

Are there any costs associated with using airSlate SignNow for the real estate excise tax form?

Using airSlate SignNow is cost-effective, with various pricing plans to fit your needs. You can choose a plan that allows for unlimited eSigning and document tracking features, which streamline the preparation and submission of the real estate excise tax form. This investment can save you time and money in the long run.

-

Is it easy to integrate airSlate SignNow with other applications for managing the real estate excise tax form?

Yes, airSlate SignNow offers seamless integrations with a variety of applications, enhancing your workflow. Whether you use CRM systems or document management tools, integrating these with our platform allows for efficient handling of the real estate excise tax form and related documents. This connectivity helps keep your process organized and efficient.

-

What features does airSlate SignNow provide for managing real estate excise tax forms?

airSlate SignNow includes features such as eSignatures, document templates, and secure cloud storage for managing your real estate excise tax form. You can also track the status of your documents in real time, ensuring that all parties have completed necessary actions promptly. These features make document management easy and reliable.

-

Can I use airSlate SignNow on my mobile device for the real estate excise tax form?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to complete and eSign your real estate excise tax form on the go. This flexibility means you can manage important documents anytime and anywhere, making it easier to handle real estate transactions efficiently.

-

What benefits do I gain from using airSlate SignNow for real estate transactions?

Using airSlate SignNow for real estate transactions, including the real estate excise tax form, provides numerous benefits such as ease-of-use, speed, and enhanced security. The platform helps reduce paperwork and streamline communication between parties. This leads to faster closing times and a more organized transaction process overall.

Get more for Real Estate Excise Tax Affidavit Prior To Jan 1, Real Estate Excise Tax Affidavit

- Power of attorney forms package oklahoma

- Uniform anatomical gift act donation oklahoma

- Employment hiring process package oklahoma form

- Oklahoma uniform act

- Employment or job termination package oklahoma form

- Newly widowed individuals package oklahoma form

- Employment interview package oklahoma form

- Employment employee personnel file package oklahoma form

Find out other Real Estate Excise Tax Affidavit Prior To Jan 1, Real Estate Excise Tax Affidavit

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe