Jefferson County Excise Tax Affidavit Form 2005

What is the Jefferson County Excise Tax Affidavit Form

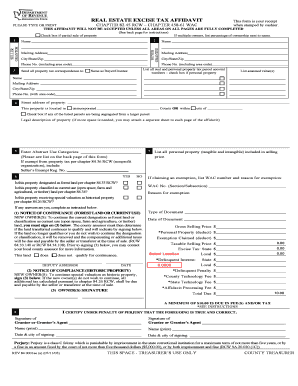

The Jefferson County Excise Tax Affidavit Form is a legal document used in Jefferson County, designed to report and certify the payment of excise taxes related to property transactions. This form is essential for ensuring compliance with local tax regulations and is typically required during the sale or transfer of real estate. By submitting this affidavit, property owners affirm that they have fulfilled their tax obligations, which can impact the transfer of ownership and the assessment of property taxes.

How to use the Jefferson County Excise Tax Affidavit Form

To use the Jefferson County Excise Tax Affidavit Form, individuals must first obtain the correct version of the form, which can usually be found on the county's official website or through local government offices. Once acquired, the form should be filled out with accurate information regarding the property and the involved parties. It is crucial to ensure that all sections are completed thoroughly to avoid delays in processing. After filling out the form, it must be signed and submitted according to the instructions provided, which may include online submission, mailing, or in-person delivery to the appropriate county office.

Steps to complete the Jefferson County Excise Tax Affidavit Form

Completing the Jefferson County Excise Tax Affidavit Form involves several important steps:

- Obtain the form from the official county website or local government office.

- Read the instructions carefully to understand the requirements.

- Fill in the property details, including the address and legal description.

- Provide information about the buyer and seller, ensuring accuracy.

- Calculate the excise tax owed based on the sale price of the property.

- Sign and date the form, ensuring all required signatures are included.

- Submit the completed form through the designated method.

Legal use of the Jefferson County Excise Tax Affidavit Form

The Jefferson County Excise Tax Affidavit Form serves a legal purpose by documenting the payment of excise taxes, which are mandated by local law. This form is often required by the county recorder's office before a property transaction can be finalized. Proper completion and submission of the form ensure that the transaction is legally recognized and that both parties are protected under local tax laws. Failure to submit the affidavit may result in penalties or delays in property transfer.

Key elements of the Jefferson County Excise Tax Affidavit Form

Several key elements must be included in the Jefferson County Excise Tax Affidavit Form to ensure its validity:

- Property Information: Address and legal description of the property.

- Parties Involved: Names and contact information of the buyer and seller.

- Tax Calculation: Total sale price and corresponding excise tax amount.

- Signatures: Required signatures from both parties to validate the affidavit.

- Date: The date of the transaction must be clearly indicated.

Form Submission Methods

The Jefferson County Excise Tax Affidavit Form can typically be submitted through various methods, depending on local regulations. Common submission options include:

- Online Submission: Many counties offer a digital platform for submitting forms electronically.

- Mail: The completed form can be mailed to the appropriate county office.

- In-Person: Individuals may also choose to deliver the form in person to ensure immediate processing.

Quick guide on how to complete jefferson county excise tax affidavit form

Complete Jefferson County Excise Tax Affidavit Form with ease on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and safely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Jefferson County Excise Tax Affidavit Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Jefferson County Excise Tax Affidavit Form effortlessly

- Find Jefferson County Excise Tax Affidavit Form and click Get Form to initiate.

- Make use of the tools we offer to complete your form.

- Identify important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Jefferson County Excise Tax Affidavit Form and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct jefferson county excise tax affidavit form

Create this form in 5 minutes!

How to create an eSignature for the jefferson county excise tax affidavit form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Jefferson County excise tax affidavit form?

The Jefferson County excise tax affidavit form is a document required for certain property transactions within Jefferson County. It helps track property sales and ensures that the applicable excise taxes are properly recorded. Utilizing airSlate SignNow, you can easily eSign this form online, streamlining your transaction process.

-

How can I access the Jefferson County excise tax affidavit form?

You can access the Jefferson County excise tax affidavit form through your local county office or online resources. With airSlate SignNow, you can upload this form and seamlessly eSign it, making it convenient to complete your obligations without the hassle of printing.

-

What are the benefits of using airSlate SignNow for the Jefferson County excise tax affidavit form?

Using airSlate SignNow for the Jefferson County excise tax affidavit form enhances efficiency, as you can sign and send documents electronically. This not only saves time but also reduces paperwork and facilitates quicker processing of your forms, ensuring compliance with local requirements.

-

Is there a cost associated with using airSlate SignNow for the Jefferson County excise tax affidavit form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses. Pricing plans offer various features tailored to your needs, allowing you to manage documents like the Jefferson County excise tax affidavit form effectively without overspending.

-

Can I integrate airSlate SignNow with other applications for the Jefferson County excise tax affidavit form?

Absolutely! AirSlate SignNow offers seamless integration with numerous applications, which allows you to manage the Jefferson County excise tax affidavit form alongside your other business processes. Integrating with platforms such as CRM or document management tools enhances your workflow and boosts productivity.

-

What features does airSlate SignNow provide for the Jefferson County excise tax affidavit form?

AirSlate SignNow provides essential features for the Jefferson County excise tax affidavit form, including easy eSigning, document sharing, and tracking capabilities. These functionalities help ensure that all parties involved can sign efficiently while maintaining clear records of each transaction.

-

How secure is the airSlate SignNow platform for the Jefferson County excise tax affidavit form?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption standards to protect your data, including the Jefferson County excise tax affidavit form. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Jefferson County Excise Tax Affidavit Form

Find out other Jefferson County Excise Tax Affidavit Form

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template