Schedule Ca 540 California Adjustments 2020

What is the Schedule CA 540 California Adjustments?

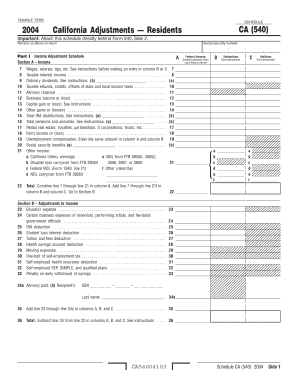

The Schedule CA 540 is a crucial form for California taxpayers, specifically designed to report adjustments to income and deductions. This form is used in conjunction with the California Form 540, which is the state's primary income tax return for residents. The Schedule CA 540 allows taxpayers to reconcile differences between federal and state tax laws, ensuring that all applicable adjustments are accurately reflected in their state tax filings. Understanding this form is essential for compliance and to maximize potential tax benefits.

Steps to Complete the Schedule CA 540 California Adjustments

Completing the Schedule CA 540 involves several key steps that help ensure accuracy and compliance. First, gather all necessary documentation, including your federal tax return and any relevant supporting documents. Next, identify the specific adjustments you need to report, such as differences in income or deductions between federal and state guidelines. Carefully fill out each section of the form, ensuring that all calculations are correct. After completing the form, review it thoroughly for any errors before submitting it with your California Form 540.

Legal Use of the Schedule CA 540 California Adjustments

The Schedule CA 540 is legally recognized as a valid document for reporting tax adjustments in California. To ensure its legal standing, it must be filled out accurately and submitted in accordance with state tax regulations. Compliance with the California Revenue and Taxation Code is essential, as any discrepancies could lead to penalties or audits. Utilizing a reliable eSignature solution can enhance the legal validity of your submitted documents, ensuring they meet all necessary requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule CA 540 are aligned with the general tax filing deadlines in California. Typically, the deadline for submitting your state income tax return, along with the Schedule CA 540, is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these dates, as timely submission is critical to avoid late fees and penalties.

Required Documents

To complete the Schedule CA 540, you will need several key documents. These include your federal tax return, W-2 forms, 1099 forms, and any other income statements. Additionally, gather documentation for any deductions or credits you plan to claim, such as mortgage interest statements or receipts for deductible expenses. Having all necessary documents on hand will streamline the completion process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Schedule CA 540 can be submitted through various methods, providing flexibility for taxpayers. You can file your form online using the California Franchise Tax Board's e-file system, which is a convenient option that allows for faster processing. Alternatively, you may choose to mail your completed form to the designated address provided by the state. In-person submission is also an option at certain tax offices, though this may require an appointment. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Examples of Using the Schedule CA 540 California Adjustments

Understanding how to use the Schedule CA 540 can be illustrated through practical examples. For instance, if a taxpayer has received a federal deduction for student loan interest, but California does not allow this deduction, they would report this adjustment on the Schedule CA 540. Another example includes reporting capital gains that are treated differently at the federal and state levels. These examples highlight the importance of accurately reflecting any discrepancies between federal and state tax regulations on the Schedule CA 540.

Quick guide on how to complete schedule ca 540 california adjustments

Effortlessly Prepare Schedule Ca 540 California Adjustments on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Schedule Ca 540 California Adjustments across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Modify and eSign Schedule Ca 540 California Adjustments Easily

- Find Schedule Ca 540 California Adjustments and click on Get Form to initiate the process.

- Utilize the features we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Schedule Ca 540 California Adjustments while ensuring seamless communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule ca 540 california adjustments

Create this form in 5 minutes!

People also ask

-

What are schedule ca 540 instructions?

Schedule CA 540 instructions provide detailed guidance for completing the California state tax form. These instructions help taxpayers accurately report their income and deductions. Understanding these instructions is essential for ensuring compliance and maximizing potential refunds.

-

How can airSlate SignNow assist with schedule ca 540 instructions?

airSlate SignNow simplifies the process of filling out and signing schedule ca 540 instructions. Our platform allows users to collaborate and finalize documents efficiently, reducing the time spent on tax preparation. This can be particularly beneficial during tax season.

-

Is there a cost associated with using airSlate SignNow for schedule ca 540 instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our pricing is competitive and designed to provide an effective solution for managing documents, including those related to schedule ca 540 instructions. You can choose a plan that best suits your needs.

-

What features does airSlate SignNow offer for schedule ca 540 instructions?

airSlate SignNow provides features such as electronic signatures, document templates, and secure storage, all of which facilitate the completion of schedule ca 540 instructions. These tools streamline the tax document process, making it easier to manage and submit forms accurately.

-

Can I integrate airSlate SignNow with other accounting software for schedule ca 540 instructions?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software and tools. This allows users to effortlessly manage their schedule ca 540 instructions alongside their financial records, enhancing overall efficiency in tax preparation.

-

What are the benefits of using airSlate SignNow for schedule ca 540 instructions?

Using airSlate SignNow for schedule ca 540 instructions provides a cost-effective and user-friendly solution for document management. The platform not only facilitates signature collection but also ensures your documents are secure and easily accessible. This enhances productivity during tax filing.

-

Is airSlate SignNow suitable for individuals or just businesses in handling schedule ca 540 instructions?

airSlate SignNow is suitable for both individuals and businesses when dealing with schedule ca 540 instructions. Whether you are a freelancer seeking to manage your own taxes or a business needing to handle employee tax documents, our platform can cater to all needs.

Get more for Schedule Ca 540 California Adjustments

- Order re sealing records of form

- Declare form

- Washington state juvenile non offender benchbook king form

- Full text of ampquotbreak ins at sanctuary churches and organizations form

- John alika kalii jr vs beth ann kalii 14 3 01646 7 form

- Order for change of judge form

- Mental health procedures maryland courts form

- Child abuse prevention efforts foster care review office form

Find out other Schedule Ca 540 California Adjustments

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast