Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents 2021

What is the Schedule CA 540 California Adjustments Residents?

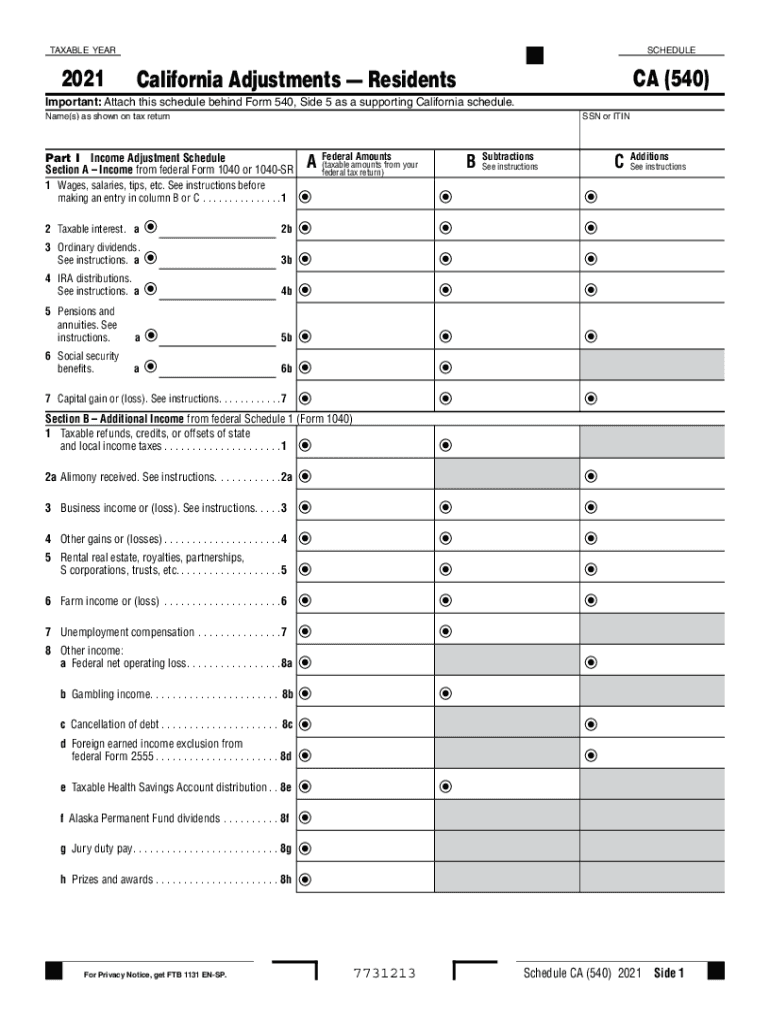

The Schedule CA 540 is a form used by California residents to report adjustments to their income when filing their state tax returns. This form is essential for individuals who need to make modifications to their federal adjusted gross income (AGI) to accurately reflect their California taxable income. It allows taxpayers to account for various state-specific deductions, credits, and adjustments that differ from federal tax regulations. Understanding this form is crucial for ensuring compliance with California tax laws and maximizing potential tax benefits.

How to use the Schedule CA 540 California Adjustments Residents

Using the Schedule CA 540 involves several steps to ensure accurate reporting of income adjustments. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any records of deductions or credits applicable to California. Once these documents are ready, individuals can begin filling out the form, ensuring they provide accurate figures for both federal and state income. Each section of the form corresponds to specific adjustments, such as state tax refunds, mortgage interest, and other deductions that may affect the final taxable income. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties.

Steps to complete the Schedule CA 540 California Adjustments Residents

Completing the Schedule CA 540 involves a systematic approach:

- Gather all relevant financial documents, including income statements and records of deductions.

- Begin filling out the form, starting with your federal adjusted gross income (AGI).

- Make necessary adjustments by following the specific instructions for each section of the form.

- Double-check all entries for accuracy, ensuring that all calculations are correct.

- Attach the completed Schedule CA 540 to your California tax return before submission.

Key elements of the Schedule CA 540 California Adjustments Residents

The Schedule CA 540 includes several key elements that taxpayers must understand:

- Federal AGI: The starting point for adjustments, representing your total income as reported on your federal tax return.

- Adjustments: Specific items that may increase or decrease your California income, such as state tax refunds or contributions to retirement accounts.

- Deductions: California-specific deductions that differ from federal allowances, which can impact your overall tax liability.

- Credits: Any applicable tax credits that can reduce your tax owed, which are also reported on this form.

Legal use of the Schedule CA 540 California Adjustments Residents

The Schedule CA 540 is legally recognized for use in California tax filings. To ensure that the form is valid, it must be completed accurately and submitted by the designated filing deadline. Compliance with California tax regulations is essential, as failure to file or inaccuracies can lead to penalties or audits. Additionally, using a reliable digital platform for completing and signing the form can enhance security and compliance with eSignature laws, ensuring that the document holds legal weight.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule CA 540 typically align with the federal tax deadlines. For most taxpayers, the deadline to file is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file. Keeping track of these important dates ensures compliance and avoids potential penalties for late submissions.

Quick guide on how to complete 2021 schedule ca 540 california adjustments residents 2021 schedule ca 540 california adjustments residents

Complete Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents on any device using the airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

The easiest way to modify and eSign Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents without hassle

- Obtain Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Modify and eSign Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule ca 540 california adjustments residents 2021 schedule ca 540 california adjustments residents

Create this form in 5 minutes!

People also ask

-

What is the purpose of the Schedule CA 540 California Adjustments Residents?

The Schedule CA 540 California Adjustments Residents is designed to help taxpayers adjust their federal adjusted gross income for California tax purposes. It provides a comprehensive way to report any additions or subtractions to ensure compliance with California tax laws.

-

How can I complete the Schedule CA 540 California Adjustments Residents using airSlate SignNow?

You can easily complete the Schedule CA 540 California Adjustments Residents using airSlate SignNow by uploading your documents, filling out the necessary sections, and securely eSigning them. The platform streamlines the process, making it cost-effective and user-friendly.

-

Are there any fees associated with using airSlate SignNow for Schedule CA 540 California Adjustments Residents?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs. You can choose a plan that provides you with features suited for processing the Schedule CA 540 California Adjustments Residents efficiently and at a competitive rate.

-

Can I integrate airSlate SignNow with other tools for managing my Schedule CA 540 California Adjustments Residents?

Absolutely! airSlate SignNow offers integrations with several popular software tools. This allows you to seamlessly manage your documents related to the Schedule CA 540 California Adjustments Residents along with your other business applications.

-

What are the key features of airSlate SignNow for filing Schedule CA 540 California Adjustments Residents?

Key features of airSlate SignNow include customizable templates, secure eSigning, cloud storage, and real-time collaboration. These features make it easier to handle the Schedule CA 540 California Adjustments Residents efficiently and securely.

-

Can airSlate SignNow help with other tax-related documents besides Schedule CA 540 California Adjustments Residents?

Yes, airSlate SignNow is versatile and supports a wide range of tax-related documents. Besides the Schedule CA 540 California Adjustments Residents, you can manage other forms, contracts, and agreements, making it a comprehensive solution for your documentation needs.

-

What benefits does airSlate SignNow offer for handling tax documents like Schedule CA 540 California Adjustments Residents?

Using airSlate SignNow for handling tax documents like the Schedule CA 540 California Adjustments Residents offers benefits such as time savings, reduced errors, and streamlined processes. The platform enhances productivity while ensuring compliance and security.

Get more for Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents

- Ohio as is form

- Construction contract cost plus or fixed fee ohio form

- Painting contract for contractor ohio form

- Trim carpenter contract for contractor ohio form

- Fencing contract for contractor ohio form

- Hvac contract for contractor ohio form

- Landscape contract for contractor ohio form

- Commercial construction contract form

Find out other Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself