Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents 2020

Understanding the Schedule CA 540 California Adjustments

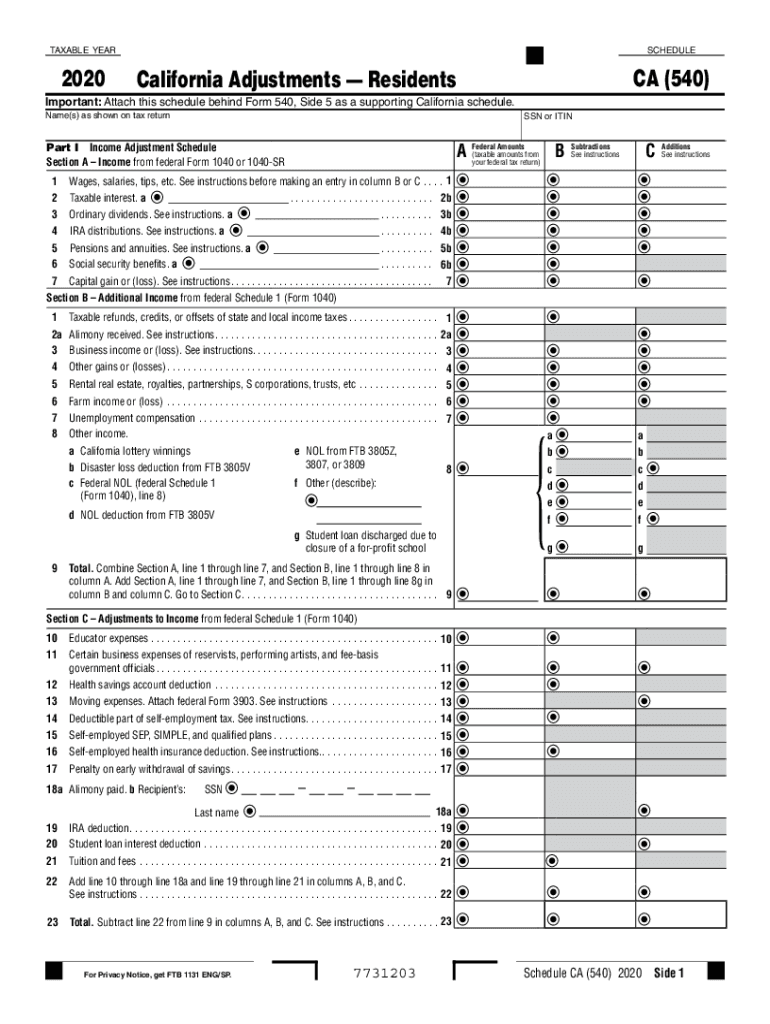

The Schedule CA 540 is a crucial form for California residents who need to make adjustments to their federal adjusted gross income when filing their state taxes. This form allows taxpayers to report various income adjustments, deductions, and credits that are specific to California tax laws. It is essential for ensuring that the income reported to the state reflects any necessary modifications based on California regulations.

Steps to Complete the Schedule CA 540

Completing the Schedule CA 540 involves several key steps to ensure accuracy and compliance with state tax laws:

- Gather all necessary documentation, including your federal tax return and any supporting documents for income adjustments.

- Begin by filling out your personal information at the top of the form, including your name, address, and Social Security number.

- Follow the instructions for each section, carefully entering any adjustments to your income, such as state tax refunds or unemployment compensation.

- Complete the adjustments section, where you will detail specific California adjustments, including deductions and credits that apply to your situation.

- Review the completed form for accuracy before submitting it along with your California state tax return.

Key Elements of the Schedule CA 540

Several key elements are essential for understanding the Schedule CA 540:

- Adjustments to Income: This section includes various adjustments that may increase or decrease your total income, such as student loan interest or contributions to retirement accounts.

- Deductions: Taxpayers can claim specific deductions that are allowable under California law, which may differ from federal deductions.

- Credits: The form also allows for the reporting of tax credits that can reduce your overall tax liability, such as the California Earned Income Tax Credit.

Legal Use of the Schedule CA 540

The Schedule CA 540 is legally recognized as a valid document for reporting state income tax adjustments. To ensure its legal validity, it must be completed accurately and submitted by the designated filing deadline. Electronic signatures are acceptable, provided they comply with California's eSignature laws, ensuring that the form is executed correctly and can withstand scrutiny from tax authorities.

Filing Deadlines for the Schedule CA 540

It is important to be aware of the filing deadlines associated with the Schedule CA 540. Typically, California residents must submit their state tax returns, including the Schedule CA 540, by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available for filing, which can provide additional time to complete their returns.

Obtaining the Schedule CA 540

The Schedule CA 540 can be obtained through various means to ensure accessibility for all California residents. It is available for download from the California Franchise Tax Board's website, where taxpayers can find the most current version of the form. Additionally, physical copies may be available at local tax offices or public libraries. Ensuring you have the correct form is vital for accurate tax reporting.

Quick guide on how to complete 2020 schedule ca 540 california adjustments residents 2020 schedule ca 540 california adjustments residents

Complete Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to obtain the correct format and safely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents swiftly without delays. Manage Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to alter and eSign Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents easily

- Find Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents and then click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize relevant parts of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method to send your form, either via email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule ca 540 california adjustments residents 2020 schedule ca 540 california adjustments residents

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule ca 540 california adjustments residents 2020 schedule ca 540 california adjustments residents

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

The way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the CA California form and how can airSlate SignNow assist with it?

The CA California form is a document required for various state-specific processes. airSlate SignNow simplifies the completion and signing of these forms, allowing you to eSign legally binding documents easily from anywhere.

-

How does airSlate SignNow ensure the security of my CA California form?

airSlate SignNow prioritizes security by employing advanced encryption and compliance standards to protect your CA California form data. With features like two-factor authentication, your documents remain safe throughout the signing process.

-

Are there any costs associated with sending a CA California form using airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include the ability to send CA California forms at an affordable rate. You can choose a plan that fits your business needs, with options for both individuals and teams.

-

Can I integrate airSlate SignNow with other platforms when working with CA California forms?

Yes! airSlate SignNow offers seamless integrations with various applications, such as Google Drive and Salesforce, making it easy to manage your CA California form in conjunction with other tools you already use.

-

What features make airSlate SignNow ideal for handling CA California forms?

airSlate SignNow includes features like smart fields, template creation, and automated reminders that streamline the handling of CA California forms. These tools enhance productivity and ensure timely completion of your documents.

-

Is it easy to track the status of my CA California form with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking capabilities for your CA California form. You can easily monitor who has signed, and who is still pending, ensuring you stay informed throughout the signing process.

-

Can I customize my CA California form when using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your CA California form to meet your specific needs. You can add branding elements, logos, and unique fields to tailor your documents, making them look professional and cohesive.

Get more for Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents

Find out other Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document