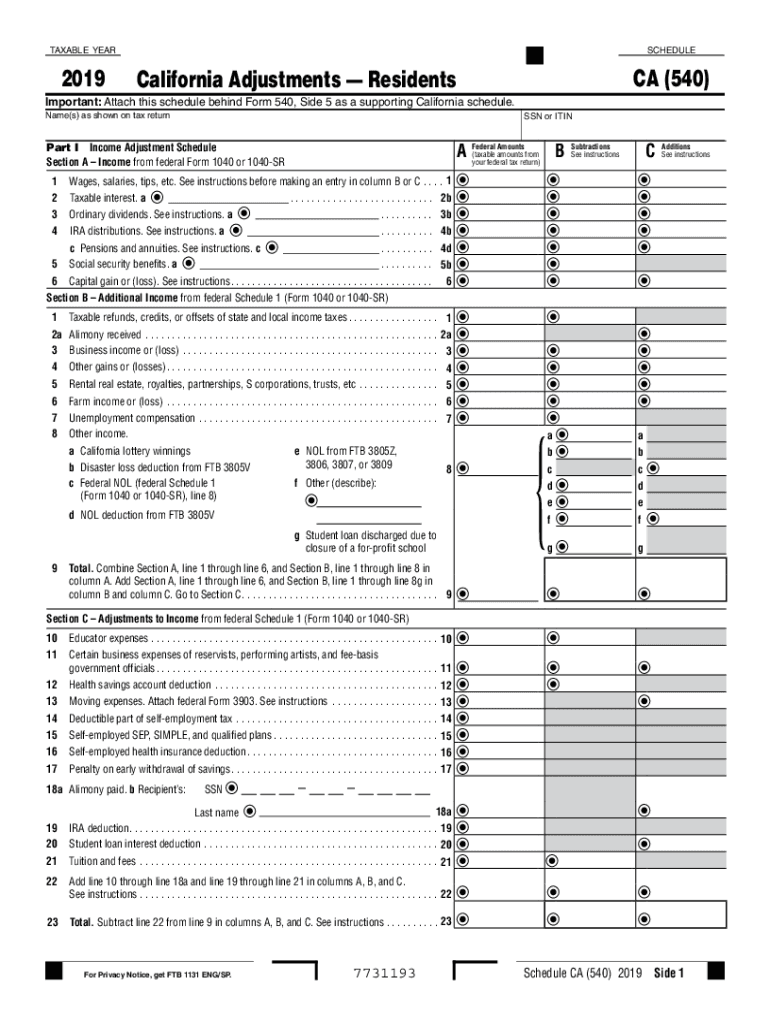

Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents 2019

What is the Schedule CA 540?

The Schedule CA 540 is a form used by California residents to report their state tax adjustments. This form is essential for individuals who need to reconcile their federal income with California-specific tax regulations. It allows taxpayers to make necessary adjustments for items such as state tax refunds, non-taxable income, and other deductions that differ from federal guidelines. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with California tax laws.

Steps to Complete the Schedule CA 540

Completing the Schedule CA 540 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including your federal tax return and any relevant income statements. Next, review the specific adjustments applicable to your situation, such as adjustments for state taxes paid or other California-specific deductions. Fill out the form carefully, ensuring that all entries reflect accurate figures. Finally, review your completed form for any errors before submission to ensure that it meets California's requirements.

Required Documents for Schedule CA 540

To accurately complete the Schedule CA 540, you will need several documents. These typically include:

- Your federal tax return (Form 1040)

- W-2 forms from your employers

- 1099 forms for any additional income

- Records of any state tax refunds received

- Documentation for any deductions or credits claimed on your federal return

Having these documents ready will streamline the process of filling out the Schedule CA 540 and help ensure that all necessary adjustments are accounted for.

Filing Deadlines for Schedule CA 540

The filing deadline for the Schedule CA 540 typically aligns with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to deadlines, especially in light of any special circumstances or extensions that may be announced by the California Franchise Tax Board. Timely filing is crucial to avoid penalties and ensure compliance with state tax laws.

Legal Use of the Schedule CA 540

The Schedule CA 540 is legally recognized as a valid document for reporting state tax adjustments. When completed accurately, it serves as an official record of your tax obligations to the state of California. To ensure its legal standing, it is essential to adhere to all instructions provided by the California Franchise Tax Board and to maintain compliance with state tax regulations. This form must be signed and submitted by the appropriate deadline to avoid any legal repercussions.

Digital vs. Paper Version of Schedule CA 540

Taxpayers have the option to file the Schedule CA 540 either digitally or on paper. The digital version offers several advantages, including faster processing times and the convenience of e-filing from home. Additionally, electronic submissions often reduce the risk of errors and provide immediate confirmation of receipt. Conversely, some taxpayers may prefer the traditional paper method for various reasons, including personal comfort or lack of access to technology. Regardless of the method chosen, it is important to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete 2019 schedule ca 540 california adjustments residents 2019 schedule ca 540 california adjustments residents

Effortlessly Prepare Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-oriented process today.

Easily Modify and eSign Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents Without Breaking a Sweat

- Locate Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize critical sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and click the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 schedule ca 540 california adjustments residents 2019 schedule ca 540 california adjustments residents

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule ca 540 california adjustments residents 2019 schedule ca 540 california adjustments residents

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the 2015 Schedule CA 540?

The 2015 Schedule CA 540 is a form used by California residents to report adjustments to their income and calculate their tax obligations. It is essential for assembling your tax return accurately and ensuring all credits and deductions are claimed. If you're preparing your taxes, understanding this schedule can help you maximize your refund or minimize your liability.

-

How can airSlate SignNow help with the 2015 Schedule CA 540?

airSlate SignNow provides an efficient way to eSign and send your 2015 Schedule CA 540, ensuring that your documents are handled securely and promptly. With our user-friendly interface, you can easily attach and send your completed tax forms for eSignature. This streamlines your filing process, allowing you to focus on what matters most.

-

Is there a cost associated with using airSlate SignNow for my 2015 Schedule CA 540?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. Our cost-effective solution provides you with unlimited eSigning capabilities, which can signNowly reduce the cost and time associated with handling the 2015 Schedule CA 540. We also offer a free trial for new users to explore our services.

-

What features does airSlate SignNow offer for the 2015 Schedule CA 540?

airSlate SignNow offers a range of features designed to simplify your document management, including templates, multi-user support, document tracking, and automated reminders. These features make it easy to manage your 2015 Schedule CA 540 and other essential tax documents efficiently. Our solution is also designed to ensure compliance and security throughout the signing process.

-

Can I integrate airSlate SignNow with other software for my 2015 Schedule CA 540?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and productivity software, making it easier to manage your filings, including the 2015 Schedule CA 540. These integrations ensure that your data is consistent across platforms, reducing the chance of errors and inefficiencies in your tax preparation process.

-

How secure is the signing process for the 2015 Schedule CA 540 with airSlate SignNow?

Security is a top priority for airSlate SignNow. We employ advanced encryption and industry-standard security protocols to ensure that your 2015 Schedule CA 540 and other sensitive documents are safe. Additionally, our platform offers features like access control and audit trails, giving you peace of mind about your eSigning process.

-

What are the benefits of using airSlate SignNow for my 2015 Schedule CA 540?

Using airSlate SignNow for your 2015 Schedule CA 540 offers numerous benefits, including increased efficiency, reduced paperwork, and a more streamlined eSigning process. You'll save time on document management and can ensure timely submissions. Our platform also enhances collaboration, allowing multiple parties to review and sign documents easily.

Get more for Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents

Find out other Schedule CA 540 California Adjustments Residents Schedule CA 540 California Adjustments Residents

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast

- How Can I eSign Hawaii LLC Operating Agreement

- eSign Indiana LLC Operating Agreement Fast

- eSign Michigan LLC Operating Agreement Fast

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy