Uk Council Tax People Form

What is the UK Council Tax People

The UK Council Tax People refers to the individuals or entities responsible for managing and administering council tax within the United Kingdom. Council tax is a local taxation system used to fund local services, including education, waste management, and public safety. It is typically levied on residential properties, with rates determined by local councils based on property value bands. Understanding the roles of the UK Council Tax People is essential for residents who need to navigate their obligations and rights regarding council tax payments.

How to Use the UK Council Tax People

Using the UK Council Tax People involves engaging with local council offices or online platforms to address various matters related to council tax. Residents can inquire about their tax band, apply for discounts, or report changes in their circumstances, such as moving to a new address or changes in occupancy. It is advisable to gather all necessary documentation, such as proof of residence and identification, before contacting the council to ensure a smooth process.

Steps to Complete the UK Council Tax People

Completing tasks related to the UK Council Tax People typically involves several key steps:

- Identify your local council and its contact information.

- Gather required documents, including proof of identity and residency.

- Visit the council's website or office to access the necessary forms.

- Fill out the forms accurately, providing all requested information.

- Submit the forms either online, by mail, or in person, depending on the council's options.

Legal Use of the UK Council Tax People

The legal use of the UK Council Tax People is governed by local laws and regulations that dictate how council tax is assessed, collected, and enforced. Residents have the right to appeal their council tax band if they believe it is incorrect. Additionally, certain groups, such as students or individuals with disabilities, may qualify for discounts or exemptions. Understanding these legal aspects helps residents ensure compliance and protect their rights.

Eligibility Criteria

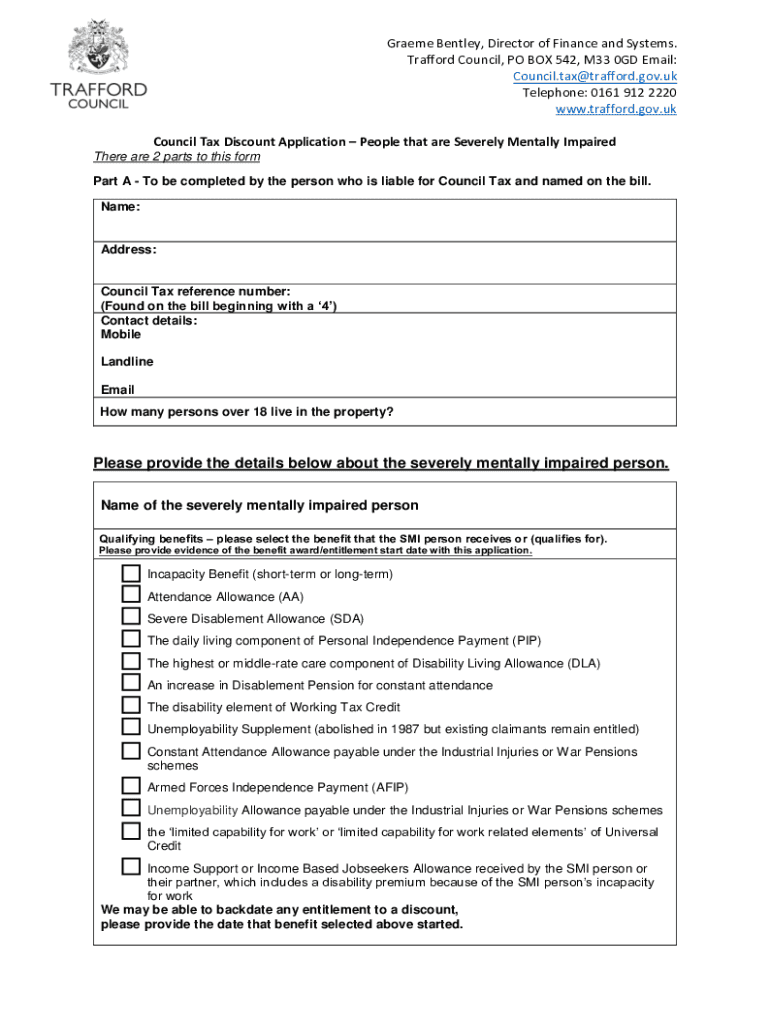

Eligibility for council tax discounts or exemptions under the UK Council Tax People framework varies based on specific circumstances. Common criteria include:

- Students and full-time education participants may be exempt.

- Individuals with severe mental impairments may qualify for reductions.

- Care leavers or those under the age of 25 may also be eligible for discounts.

Residents should check with their local council for specific eligibility requirements and application processes.

Required Documents

When dealing with the UK Council Tax People, certain documents are typically required to support applications or inquiries. These may include:

- Proof of identity, such as a driver's license or passport.

- Proof of residency, like a utility bill or lease agreement.

- Documentation supporting any claims for discounts or exemptions, such as medical certificates for severe mental impairment.

Having these documents ready can expedite the process and ensure compliance with local regulations.

Quick guide on how to complete uk council tax people

Accomplish Uk Council Tax People effortlessly on any gadget

Digital document management has become increasingly popular among businesses and users. It offers an ideal eco-friendly alternative to traditional printed and signed papers since you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you require to create, edit, and eSign your documents swiftly without any hold-ups. Manage Uk Council Tax People on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Uk Council Tax People with ease

- Obtain Uk Council Tax People and then click Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Highlight important parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, by email, SMS, invite link, or download it to your computer.

Leave behind concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Alter and eSign Uk Council Tax People and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for UK council tax people?

airSlate SignNow provides a variety of features tailored for UK council tax people, including secure eSigning, document templates, and automated workflows. These tools simplify the management of council tax documents, making it easier to handle paperwork efficiently. With a user-friendly interface, UK council tax people can quickly adopt these features.

-

How does airSlate SignNow benefit UK council tax people?

The primary benefit of using airSlate SignNow for UK council tax people is the ability to streamline document processes, reducing time spent on paper handling. This ultimately leads to improved accuracy and faster processing of council tax documentation. Additionally, the cost-effective solution helps organizations save money while enhancing service delivery.

-

What pricing plans does airSlate SignNow offer for UK council tax people?

airSlate SignNow offers flexible pricing plans suitable for UK council tax people, including a free trial and tiered subscriptions. These plans cater to different user needs, from small councils to larger municipal bodies. Providing value for money, the pricing ensures that everyone can access essential eSigning features.

-

Is airSlate SignNow secure for UK council tax people?

Yes, airSlate SignNow prioritizes security for UK council tax people by employing robust encryption and compliance measures. The platform adheres to industry standards to protect sensitive information throughout the eSigning process. This commitment to security provides peace of mind for both councils and taxpayers.

-

Can airSlate SignNow integrate with existing systems used by UK council tax people?

Absolutely! airSlate SignNow offers seamless integrations with popular software systems used by UK council tax people. Whether you use customer relationship management tools or document management systems, our platform can connect effortlessly, making it easier to incorporate eSigning into your existing workflows.

-

How does airSlate SignNow improve document turnaround times for UK council tax people?

airSlate SignNow signNowly improves document turnaround times for UK council tax people by allowing instant eSigning and real-time updates. This approach reduces the time spent waiting for physical signatures and accelerates the entire document delivery process. Consequently, councils can respond to taxpayer inquiries and needs much more promptly.

-

Are there any customer support options for UK council tax people using airSlate SignNow?

Yes, airSlate SignNow offers excellent customer support for UK council tax people through multiple channels, including live chat, email, and phone support. Our dedicated support team is available to assist with any questions or integration challenges. This ensures that your council can use our platform effectively and resolve issues quickly.

Get more for Uk Council Tax People

Find out other Uk Council Tax People

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free