Delaware Individual Resident Income Tax Return TaxFormFinder 2021

What is the Delaware Individual Resident Income Tax Return?

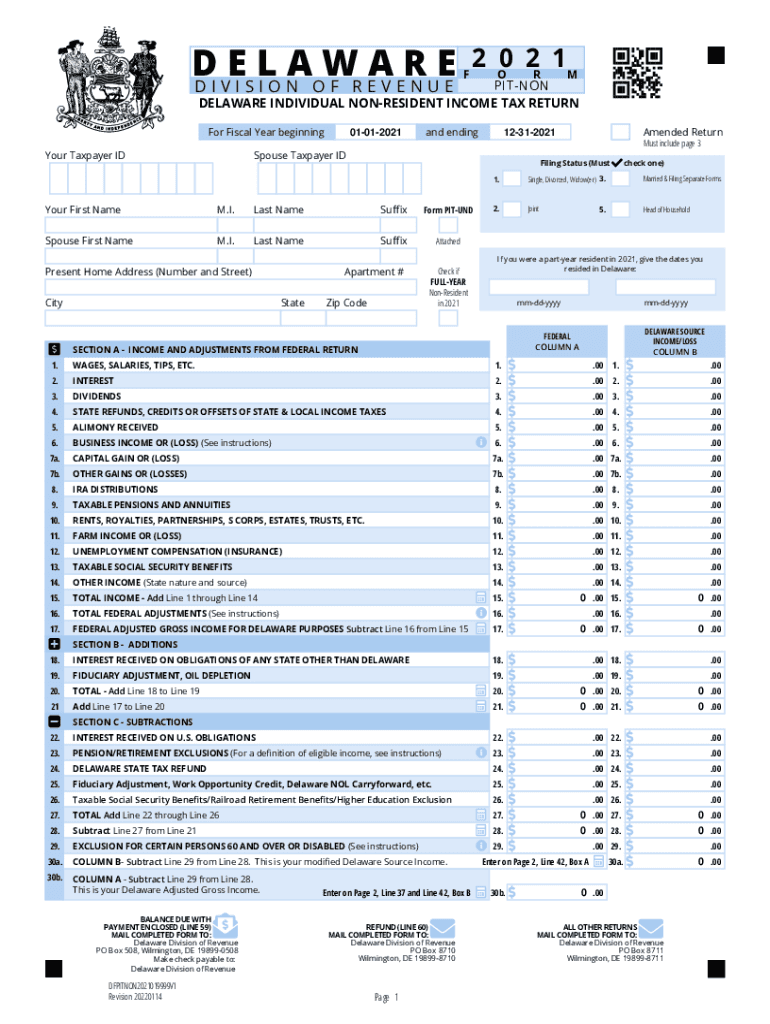

The Delaware Individual Resident Income Tax Return is a state-specific tax form used by residents of Delaware to report their income and calculate their tax liability. This form is essential for individual taxpayers who earn income within the state. It ensures compliance with Delaware tax laws and helps determine the amount of tax owed or any potential refund due. Understanding this form is crucial for accurate tax reporting and financial planning.

Steps to complete the Delaware Individual Resident Income Tax Return

Completing the Delaware Individual Resident Income Tax Return involves several key steps:

- Gather necessary documents: Collect all relevant income statements, such as W-2s and 1099s, along with any deductions or credits you plan to claim.

- Fill out the form: Enter your personal information, including your name, address, and Social Security number. Report your total income and applicable deductions.

- Calculate your tax: Use the tax tables provided with the form to determine your tax liability based on your taxable income.

- Review your entries: Double-check all information for accuracy to avoid errors that could lead to delays or penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the filing deadline.

Legal use of the Delaware Individual Resident Income Tax Return

The Delaware Individual Resident Income Tax Return is legally binding when completed and submitted according to state regulations. To ensure its validity, taxpayers must provide accurate information and adhere to the guidelines set forth by the Delaware Division of Revenue. E-signatures are accepted if they comply with the ESIGN and UETA regulations, which recognize electronic signatures as legally valid. This facilitates the efficient processing of tax returns while maintaining legal integrity.

Filing Deadlines / Important Dates

Timely filing of the Delaware Individual Resident Income Tax Return is crucial to avoid penalties. The standard deadline for submission is typically April fifteenth of each year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any extensions that may be available, as well as specific dates for estimated tax payments throughout the year.

Required Documents

To complete the Delaware Individual Resident Income Tax Return, taxpayers should gather the following documents:

- W-2 forms from employers

- 1099 forms for additional income

- Records of any deductions or credits, such as mortgage interest statements

- Proof of any estimated tax payments made during the year

- Social Security numbers for all dependents

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Delaware Individual Resident Income Tax Return:

- Online: Many taxpayers prefer to file electronically using approved software, which often simplifies the process and provides immediate confirmation.

- Mail: The form can be printed and sent via postal service to the appropriate address designated by the Delaware Division of Revenue.

- In-Person: Taxpayers may also choose to submit their forms in person at designated state offices, which can be beneficial for those requiring assistance.

Quick guide on how to complete delaware individual resident income tax return taxformfinder

Complete Delaware Individual Resident Income Tax Return TaxFormFinder effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can access the correct form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Delaware Individual Resident Income Tax Return TaxFormFinder on any platform using the airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

How to modify and eSign Delaware Individual Resident Income Tax Return TaxFormFinder without difficulty

- Obtain Delaware Individual Resident Income Tax Return TaxFormFinder and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive information with the tools airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to secure your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Delaware Individual Resident Income Tax Return TaxFormFinder to ensure outstanding communication during any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delaware individual resident income tax return taxformfinder

Create this form in 5 minutes!

People also ask

-

What is the Delaware Individual Resident Income Tax Return TaxFormFinder?

The Delaware Individual Resident Income Tax Return TaxFormFinder is a resource that helps residents of Delaware easily find and complete their income tax return forms. By utilizing this tool, taxpayers can ensure they are filling out the correct forms for efficient processing and compliance with state tax regulations.

-

How can I access the Delaware Individual Resident Income Tax Return TaxFormFinder?

You can access the Delaware Individual Resident Income Tax Return TaxFormFinder online through our website. Simply navigate to the relevant section, and you'll find easy-to-follow instructions to download or fill out your tax return forms digitally.

-

Is there a cost associated with using the Delaware Individual Resident Income Tax Return TaxFormFinder?

No, using the Delaware Individual Resident Income Tax Return TaxFormFinder is completely free of charge. We aim to provide efficient resources for individuals to complete their tax returns without any added financial burden.

-

What features does the Delaware Individual Resident Income Tax Return TaxFormFinder offer?

The Delaware Individual Resident Income Tax Return TaxFormFinder offers user-friendly interfaces, step-by-step guidance, and the ability to save and eSign your tax forms. These features ensure a smooth experience in preparing and filing your income tax returns.

-

Can I eSign my Delaware Individual Resident Income Tax Return using the TaxFormFinder?

Yes, the Delaware Individual Resident Income Tax Return TaxFormFinder integrates with airSlate SignNow to allow you to eSign your tax forms securely. This feature enhances convenience and ensures that your documents are legally binding and ready for submission.

-

How does using the Delaware Individual Resident Income Tax Return TaxFormFinder benefit me?

Using the Delaware Individual Resident Income Tax Return TaxFormFinder simplifies the tax filing process by providing accurate forms and guidance. It saves time and reduces the risk of errors, helping you avoid potential penalties from the state.

-

Is the Delaware Individual Resident Income Tax Return TaxFormFinder suitable for all residents?

Yes, the Delaware Individual Resident Income Tax Return TaxFormFinder is designed to accommodate all individual residents of Delaware. Regardless of your tax situation, this tool offers the necessary forms and resources to help ensure compliance with state tax laws.

Get more for Delaware Individual Resident Income Tax Return TaxFormFinder

- Warranty deed one individual to two individuals montana form

- Subcontractors request corporation or llc montana form

- Property intestate succession form

- Montana response form

- Montana quitclaim deed form

- Mt deed 497316112 form

- Quitclaim deed one individual to four individuals montana form

- Warranty deed three individuals to two individuals montana form

Find out other Delaware Individual Resident Income Tax Return TaxFormFinder

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors