If You Were a Part Year Resident in , Give the Dates You Resided 2020

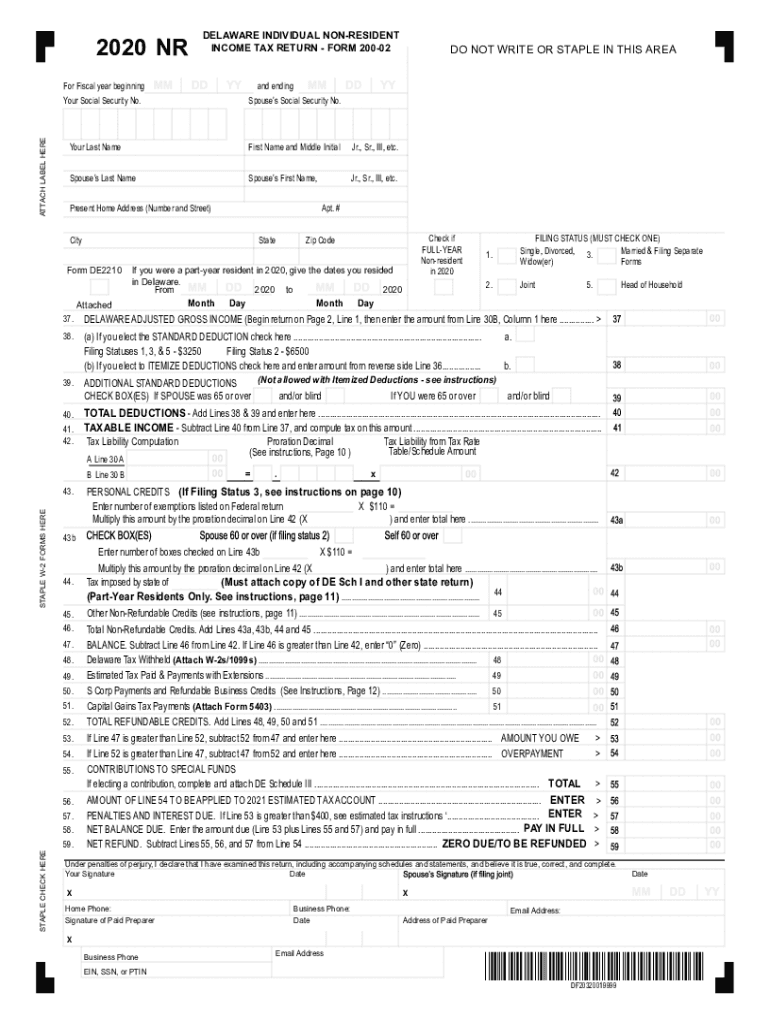

What is the 02 non resident form?

The 02 non resident form is a tax document used by individuals who are not residents of Delaware but have earned income within the state. This form helps determine the tax obligations for non-residents, ensuring compliance with Delaware tax laws. It is essential for accurately reporting income and calculating the appropriate tax liability.

Steps to complete the 02 non resident form

Completing the 02 non resident form involves several key steps:

- Gather all necessary documents, including income statements and proof of residency.

- Fill out personal information, including your name, address, and Social Security number.

- Report all income earned in Delaware during the tax year.

- Calculate your tax liability based on the income reported.

- Sign and date the form to certify the information provided is accurate.

Legal use of the 02 non resident form

The 02 non resident form is legally recognized in Delaware for tax purposes. It must be filled out accurately to avoid penalties or legal issues. The form serves as a formal declaration of income earned in the state and is essential for fulfilling tax obligations. Compliance with state laws regarding the use of this form is crucial for non-residents.

Filing deadlines for the 02 non resident form

It is important to be aware of filing deadlines for the 02 non resident form to avoid late fees and penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year in question. However, if you are unable to meet this deadline, you may be eligible for an extension, but you must still pay any taxes owed by the original deadline.

Required documents for the 02 non resident form

To complete the 02 non resident form, you will need several documents:

- W-2 forms or 1099 forms showing income earned in Delaware.

- Proof of residency in your home state.

- Any relevant tax documents from the previous year.

- Identification documents, such as a driver's license or Social Security card.

IRS guidelines for the 02 non resident form

The Internal Revenue Service (IRS) provides guidelines that can assist in completing the 02 non resident form. It is important to refer to IRS publications related to non-resident taxation, as they offer valuable insights into income reporting and tax obligations. Understanding these guidelines can help ensure that you comply with both federal and state tax laws.

Quick guide on how to complete if you were a part year resident in 2020 give the dates you resided

Effortlessly Prepare If You Were A Part year Resident In , Give The Dates You Resided on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly without any delays. Handle If You Were A Part year Resident In , Give The Dates You Resided on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign If You Were A Part year Resident In , Give The Dates You Resided with Ease

- Find If You Were A Part year Resident In , Give The Dates You Resided and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential portions of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to submit your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from your chosen device. Edit and eSign If You Were A Part year Resident In , Give The Dates You Resided to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct if you were a part year resident in 2020 give the dates you resided

Create this form in 5 minutes!

How to create an eSignature for the if you were a part year resident in 2020 give the dates you resided

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What does '02 non resident' refer to in airSlate SignNow?

The term '02 non resident' in airSlate SignNow typically refers to documents that require e-signatures from individuals or entities who are not residing in a specific jurisdiction. This feature ensures that businesses can seamlessly manage agreements with international clients or partners while complying with legal requirements.

-

How can airSlate SignNow assist non-residents with document signing?

airSlate SignNow provides a user-friendly platform that allows non-residents to electronically sign documents from anywhere. With just an internet connection, they can complete transactions swiftly and securely, making it an ideal solution for global business interactions involving '02 non resident' scenarios.

-

What are the pricing options for airSlate SignNow when dealing with 02 non resident documents?

airSlate SignNow offers competitive pricing plans that cater to businesses handling '02 non resident' documents. Each plan includes essential features such as unlimited e-signatures and document templates, allowing you to choose the best fit for your specific needs and budget.

-

Does airSlate SignNow support integrations for handling 02 non resident documents?

Yes, airSlate SignNow supports multiple integrations with popular tools and platforms to streamline the management of '02 non resident' documents. Whether you use CRM systems or cloud storage, our integrations enhance efficiency and ensure a smooth workflow.

-

What are the key features of airSlate SignNow for non-resident signers?

Key features of airSlate SignNow for non-resident signers include multi-language support, real-time tracking of document status, and secure storage. These features are designed to ensure that your documents are accessible and manageable for '02 non resident' individuals, no matter their location.

-

How does airSlate SignNow ensure the security of documents signed by non-residents?

airSlate SignNow prioritizes security with advanced encryption and authentication methods to protect documents signed by '02 non resident' users. This guarantees that sensitive information remains confidential and secure throughout the signing process.

-

Can I customize templates for 02 non resident documents in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize templates specifically for '02 non resident' documents. This feature saves time and ensures consistency across your agreements, making it easier to manage multiple signers from different jurisdictions.

Get more for If You Were A Part year Resident In , Give The Dates You Resided

Find out other If You Were A Part year Resident In , Give The Dates You Resided

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document