DIVISION of REVENUE 2022-2026

Understanding the Division of Revenue

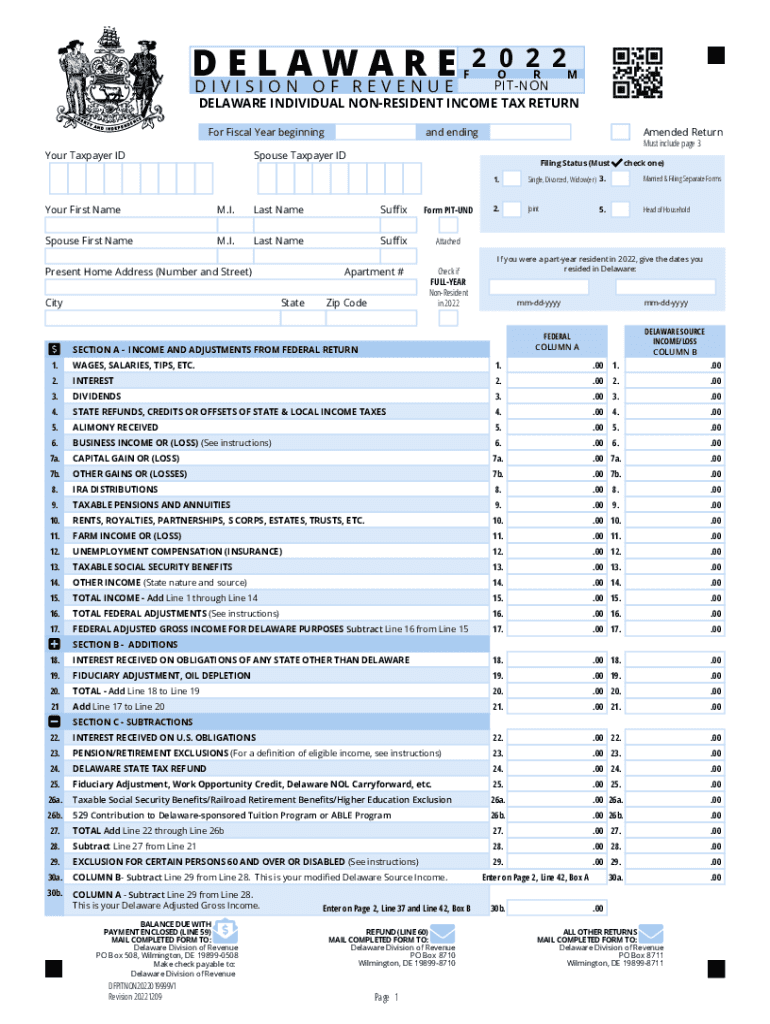

The Division of Revenue in Delaware is the state agency responsible for the administration of tax laws and the collection of taxes. This entity oversees the processing of various state tax forms, including the Delaware state tax form 2025. It plays a crucial role in ensuring compliance with state tax regulations and provides guidance to taxpayers on their obligations. Understanding the functions of the Division of Revenue can help you navigate the complexities of filing taxes in Delaware.

Steps to Complete the Delaware State Tax Form 2025

Completing the Delaware state tax form 2025 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including income statements, previous tax returns, and any relevant deductions. Next, carefully fill out the form, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form either electronically or by mail, depending on your preference and the guidelines provided by the Division of Revenue.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is essential for timely submission of the Delaware state tax form 2025. Typically, the deadline for filing individual income tax returns is April 30 of the tax year. If you require additional time, you may apply for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties. Keeping a calendar of these important dates can help you manage your tax responsibilities effectively.

Required Documents for Filing

When preparing to file the Delaware state tax form 2025, it is important to have all required documents on hand. This includes W-2 forms from employers, 1099 forms for any additional income, and documentation for deductions such as mortgage interest or educational expenses. Having these documents readily available will streamline the process and help ensure that your tax return is accurate and complete.

Form Submission Methods

The Delaware state tax form 2025 can be submitted through various methods, providing flexibility for taxpayers. You can choose to file electronically, which is often the fastest and most efficient method. Alternatively, you may opt to mail a paper version of the form to the Division of Revenue. If you prefer to file in person, some locations may allow for direct submission. Each method has its own guidelines and requirements, so it is advisable to review these before proceeding.

Penalties for Non-Compliance

Failure to comply with Delaware tax regulations can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action. It is important to understand the implications of non-compliance and to take proactive steps to meet your tax obligations. If you encounter difficulties in filing, seeking assistance from a tax professional can help mitigate risks associated with penalties.

Quick guide on how to complete division of revenue

Complete DIVISION OF REVENUE effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without any delays. Manage DIVISION OF REVENUE on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign DIVISION OF REVENUE seamlessly

- Obtain DIVISION OF REVENUE and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important parts of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form hunting, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign DIVISION OF REVENUE and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct division of revenue

Create this form in 5 minutes!

How to create an eSignature for the division of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of using airSlate SignNow for handling taxes in Delaware?

Using airSlate SignNow streamlines the process of handling documents related to taxes in Delaware. Our platform offers secure eSignature solutions that ensure compliance while facilitating faster transactions. This means businesses can efficiently manage their tax documentation without delays.

-

How does airSlate SignNow integrate with tax software for taxes in Delaware?

airSlate SignNow integrates seamlessly with various tax software, which makes managing taxes in Delaware much simpler. This integration allows users to import tax documents directly and send them for eSignature, reducing manual data entry and increasing accuracy.

-

Is airSlate SignNow cost-effective for managing taxes in Delaware?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing taxes in Delaware. Our pricing plans are straightforward, and users can choose the plan that best fits their business needs, often resulting in signNow savings on paper and postage expenses.

-

What features does airSlate SignNow offer for businesses dealing with taxes in Delaware?

airSlate SignNow offers a robust set of features tailored for businesses handling taxes in Delaware, including customizable templates, secure cloud storage, and automatic reminders for document completion. These features enhance efficiency and help ensure all tax-related documents are completed on time.

-

Can I use airSlate SignNow on mobile devices for tasks related to taxes in Delaware?

Absolutely! airSlate SignNow is fully optimized for mobile use, allowing you to manage taxes in Delaware on-the-go. Whether you're sending or signing documents, our mobile application ensures you have the flexibility to complete tasks anytime, anywhere.

-

What type of customer support does airSlate SignNow provide for tax-related inquiries in Delaware?

airSlate SignNow offers comprehensive customer support to assist users with tax-related inquiries in Delaware. Our dedicated team is available through various channels, including live chat and email, ensuring that you receive timely assistance when you need it.

-

Are there any security features in airSlate SignNow that ensure the safety of tax documents in Delaware?

Yes, airSlate SignNow prioritizes security with features that protect your tax documents in Delaware. We employ bank-level encryption, secure cloud storage, and compliance with legal standards, providing peace of mind that your sensitive information is safe.

Get more for DIVISION OF REVENUE

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant rhode island form

- Rhode island letter rent form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services rhode island form

- Temporary lease agreement to prospective buyer of residence prior to closing rhode island form

- Tenant notice eviction form

- Letter from landlord to tenant returning security deposit less deductions rhode island form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return rhode island form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return rhode island form

Find out other DIVISION OF REVENUE

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement