Azdor GovformsindividualResident Personal Income Tax Form Non Fillable Form AZDOR 2022

Understanding the Arizona Form 140 Tax Return

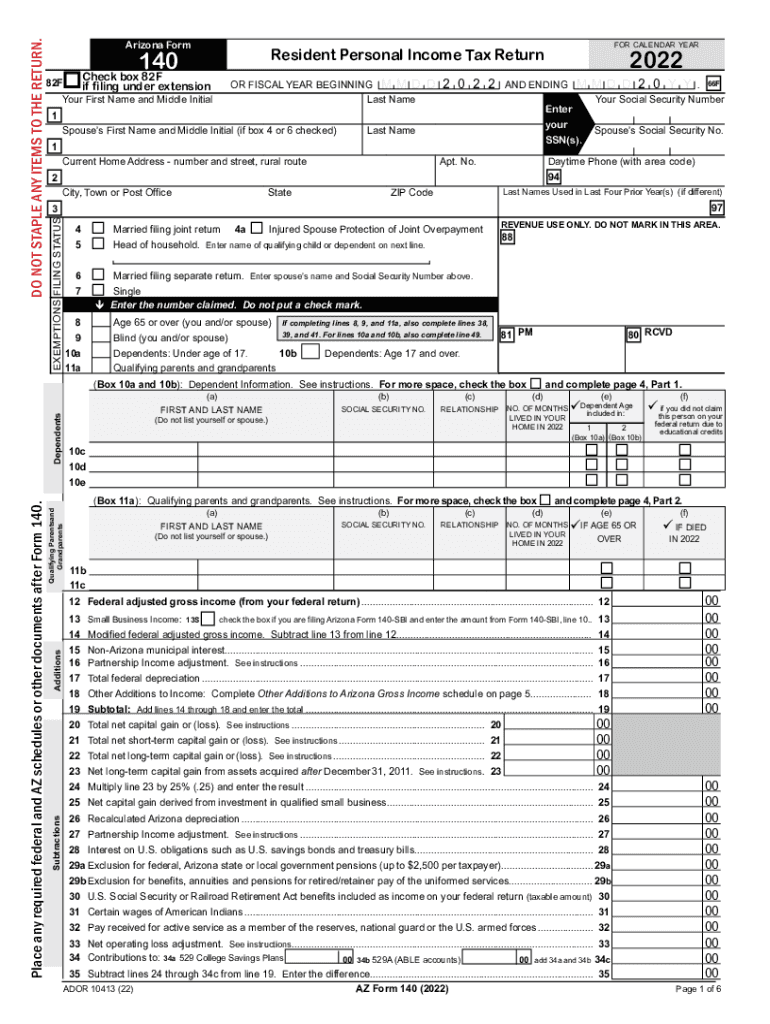

The Arizona Form 140 tax return is the official document used by residents to report their income and calculate their state tax obligations. This form is essential for individuals who earn income in Arizona and need to comply with state tax laws. It includes sections for reporting various types of income, deductions, and credits that can reduce the overall tax liability. Understanding the structure and purpose of this form is crucial for accurate filing and compliance with state regulations.

Steps to Complete the Arizona Form 140 Tax Return

Completing the Arizona Form 140 tax return involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and any other sources.

- Claim deductions and credits applicable to your situation, which may include standard deductions or itemized deductions.

- Calculate your tax liability based on the provided tax tables or tax rate schedules.

- Review the completed form for accuracy before submission.

Required Documents for the Arizona Form 140 Tax Return

When preparing to file the Arizona Form 140, you will need several key documents to ensure accurate reporting. These documents include:

- W-2 forms from employers to report wages and withheld taxes.

- 1099 forms for any freelance or contract work, reporting non-employee compensation.

- Records of any other income, such as rental income or investment earnings.

- Documentation for deductions, including mortgage interest statements and medical expenses.

Form Submission Methods for the Arizona Form 140 Tax Return

The Arizona Form 140 can be submitted through various methods, providing flexibility for taxpayers. These methods include:

- Online submission through the Arizona Department of Revenue's e-file system, which allows for quick processing.

- Mailing a paper form to the appropriate address listed on the form, ensuring it is postmarked by the filing deadline.

- In-person submission at designated Arizona Department of Revenue offices, where assistance may be available.

Filing Deadlines for the Arizona Form 140 Tax Return

It is important to be aware of the filing deadlines associated with the Arizona Form 140 tax return. Generally, the deadline for filing is the same as the federal tax return deadline, typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions they may file to avoid penalties.

Legal Use of the Arizona Form 140 Tax Return

The Arizona Form 140 tax return must be completed in accordance with state laws and regulations to be considered legally binding. This includes providing accurate information and ensuring all calculations are correct. Failure to comply with these requirements can result in penalties, audits, or other legal consequences. Utilizing a reliable eSignature tool can enhance the legal standing of the completed form, ensuring that it meets all necessary electronic signature laws.

Quick guide on how to complete azdorgovformsindividualresident personal income tax form non fillable form azdor

Effortlessly Manage Azdor govformsindividualResident Personal Income Tax Form Non fillable Form AZDOR on Any Device

Digital document handling has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Azdor govformsindividualResident Personal Income Tax Form Non fillable Form AZDOR on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to Modify and eSign Azdor govformsindividualResident Personal Income Tax Form Non fillable Form AZDOR with Ease

- Obtain Azdor govformsindividualResident Personal Income Tax Form Non fillable Form AZDOR and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify your information and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or a shared link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching through forms, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Alter and eSign Azdor govformsindividualResident Personal Income Tax Form Non fillable Form AZDOR to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct azdorgovformsindividualresident personal income tax form non fillable form azdor

Create this form in 5 minutes!

People also ask

-

What is the az form tax return and why is it important?

The az form tax return is a specific form required by the Arizona Department of Revenue for filing state income taxes. It is important because it ensures compliance with state tax laws and helps individuals correctly report their income, leading to potential refunds or avoiding penalties.

-

How can airSlate SignNow simplify the process of submitting an az form tax return?

airSlate SignNow streamlines the process of submitting an az form tax return by allowing users to eSign documents electronically, reducing the hassle of printing and mailing forms. With an intuitive interface, users can easily upload their tax documents and send them for signatures, ensuring a quick and efficient submission.

-

Is there a cost associated with using airSlate SignNow for my az form tax return?

Yes, there is a cost associated with using airSlate SignNow; however, it offers competitive pricing plans tailored to businesses of all sizes. The cost can be viewed as a valuable investment in simplifying your az form tax return process, saving time and reducing the chances of errors.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow provides features such as document templates, automatic reminders, and secure storage for managing tax-related documents. These features enhance the efficiency and accuracy of preparing your az form tax return, ensuring you have everything organized for a smooth filing experience.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow offers integrations with various accounting and tax preparation software, making it easier to manage your documents for your az form tax return. This flexibility allows you to synchronize your existing workflows seamlessly, enhancing overall productivity.

-

How secure is airSlate SignNow for handling my az form tax return?

airSlate SignNow prioritizes security, employing encryption and compliance measures to protect sensitive data associated with your az form tax return. This ensures that your information is safe while being processed and stored, providing peace of mind for users.

-

What benefits can I expect from using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents offers enhanced efficiency, reduced processing time, and increased accuracy when preparing your az form tax return. The ease of electronic signatures also speeds up the workflow, allowing for quicker submissions and better organization.

Get more for Azdor govformsindividualResident Personal Income Tax Form Non fillable Form AZDOR

- Drainage contractor package montana form

- Tax free exchange package montana form

- Landlord tenant sublease package montana form

- Buy sell agreement package montana form

- Option to purchase package montana form

- Amendment of lease package montana form

- Annual financial checkup package montana form

- Montana bill sale form

Find out other Azdor govformsindividualResident Personal Income Tax Form Non fillable Form AZDOR

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement