Income Tax FormsIndividuals & Families Colorado 2021

What is the Income Tax FormsIndividuals & Families Colorado

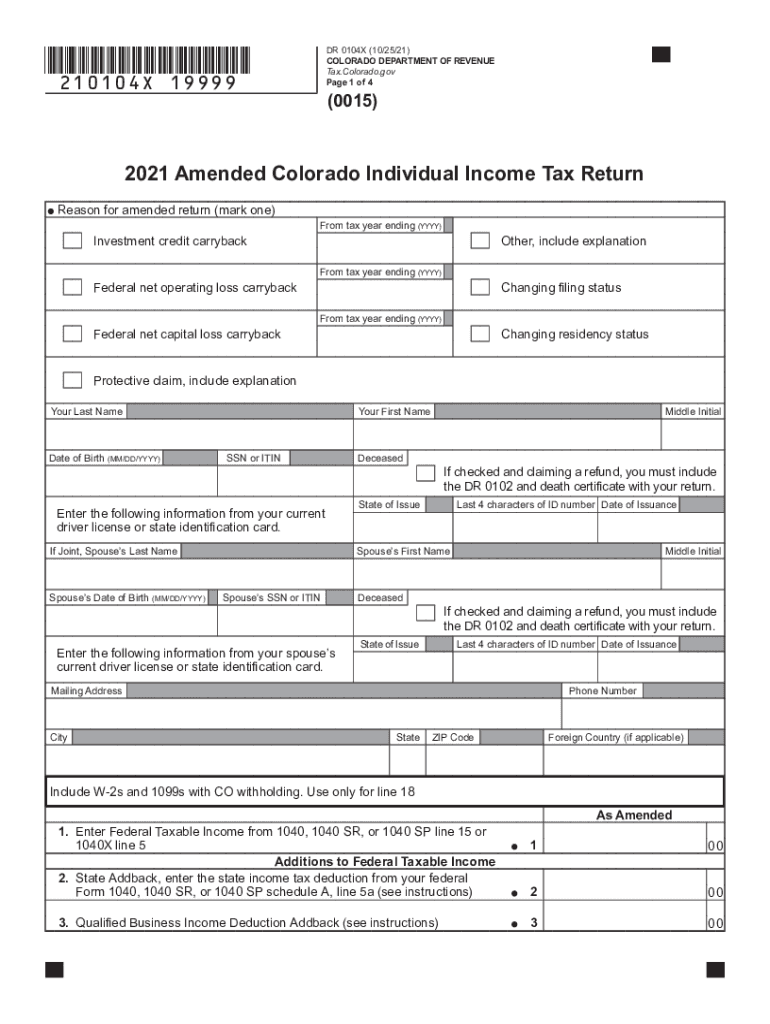

The Income Tax Forms for Individuals & Families in Colorado are essential documents used for reporting income and calculating tax obligations for residents of the state. These forms are designed to capture various income sources, deductions, and credits that taxpayers may qualify for. The primary form used is the Colorado Individual Income Tax Return, also known as Form 104, which is tailored to meet state-specific requirements. Understanding these forms is crucial for ensuring compliance with state tax laws and for maximizing potential tax benefits.

How to obtain the Income Tax FormsIndividuals & Families Colorado

To obtain the Income Tax Forms for Individuals & Families in Colorado, taxpayers can visit the Colorado Department of Revenue's official website. The forms are available for download in PDF format, allowing users to print and fill them out at their convenience. Additionally, physical copies of the forms can often be found at local government offices, libraries, and community centers. It is important to ensure that you are using the most current version of the form to avoid any issues during filing.

Steps to complete the Income Tax FormsIndividuals & Families Colorado

Completing the Income Tax Forms for Individuals & Families in Colorado involves several steps:

- Gather all necessary documents, including W-2s, 1099s, and any relevant receipts for deductions.

- Download or obtain the current Colorado Individual Income Tax Return form.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income accurately, ensuring that all figures match the documents provided.

- Claim any deductions and credits that apply to your situation, such as child tax credits or education deductions.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Sign and date the form before submission.

Legal use of the Income Tax FormsIndividuals & Families Colorado

The Income Tax Forms for Individuals & Families in Colorado are legally binding documents. When completed and submitted, they serve as formal declarations of income and tax liability. It is essential to provide accurate information, as any discrepancies can lead to penalties or audits. Utilizing a reliable electronic signature solution can enhance the legal validity of the forms, ensuring compliance with state regulations regarding eSignatures.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Forms for Individuals & Families in Colorado typically align with federal tax deadlines. Generally, the deadline for submitting your state income tax return is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply and keep track of important dates related to estimated tax payments and potential refunds.

Required Documents

When completing the Income Tax Forms for Individuals & Families in Colorado, it is important to have the following documents on hand:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses, such as medical costs or charitable contributions

- Records of any other income sources, including interest and dividends

- Previous year’s tax return for reference

Form Submission Methods (Online / Mail / In-Person)

Taxpayers in Colorado have several options for submitting their Income Tax Forms for Individuals & Families. The forms can be filed online through the Colorado Department of Revenue's e-filing system, which is a convenient and efficient method. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address listed on the form instructions. In-person submissions are also accepted at designated government offices, allowing for direct assistance if needed.

Quick guide on how to complete 2021 income tax formsindividuals ampamp families colorado

Complete Income Tax FormsIndividuals & Families Colorado effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, enabling you to access the correct form and securely save it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly and without delays. Manage Income Tax FormsIndividuals & Families Colorado on any device with the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

How to edit and eSign Income Tax FormsIndividuals & Families Colorado with ease

- Find Income Tax FormsIndividuals & Families Colorado and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to preserve your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Revise and eSign Income Tax FormsIndividuals & Families Colorado and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 income tax formsindividuals ampamp families colorado

Create this form in 5 minutes!

People also ask

-

What are Income Tax FormsIndividuals & Families Colorado?

Income Tax FormsIndividuals & Families Colorado refer to the specific tax documents needed by residents of Colorado for filing their annual income taxes. These forms help individuals and families report their income, claim deductions, and calculate their tax liability. Utilizing airSlate SignNow can simplify the process of managing these forms through electronic signatures and secure document handling.

-

How does airSlate SignNow help with Income Tax FormsIndividuals & Families Colorado?

airSlate SignNow enhances the management of Income Tax FormsIndividuals & Families Colorado by providing a user-friendly platform for document signing and sharing. Users can easily send their tax forms for signatures, making it faster to gather necessary approvals. The platform ensures all documents are securely stored and easily retrievable, simplifying your tax preparation process.

-

What features does airSlate SignNow offer for handling tax forms?

airSlate SignNow offers several features tailored for handling tax documents, including customizable templates for Income Tax FormsIndividuals & Families Colorado, in-app eSigning, and automated workflows. Users can track document statuses and send reminders to signers within the platform. These features streamline the filing process, ensuring compliance and preventing costly delays.

-

Is airSlate SignNow cost-effective for managing Income Tax FormsIndividuals & Families Colorado?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing Income Tax FormsIndividuals & Families Colorado. The platform offers flexible pricing plans that cater to different needs, ensuring individuals and families can find a suitable option. By reducing the time spent on document management, users can save money and focus on other important tax-related tasks.

-

Can I integrate airSlate SignNow with other accounting software for tax preparation?

Absolutely! airSlate SignNow can be integrated with a variety of accounting software programs that assist with Income Tax FormsIndividuals & Families Colorado. This integration allows for a seamless flow of tax documents between platforms, ensuring that all necessary forms are readily accessible for review and filing. Using integrated software enhances efficiency in tax preparation.

-

What are the benefits of using airSlate SignNow for my tax forms?

The benefits of using airSlate SignNow for Income Tax FormsIndividuals & Families Colorado include a streamlined signing process, enhanced security, and easy access to document history. With airSlate SignNow, you can sign and send documents from anywhere, anytime, making tax season a lot less stressful. Additionally, the platform ensures compliance with legal standards for electronic signatures.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security, making it a trusted choice for handling sensitive Income Tax FormsIndividuals & Families Colorado. The platform uses advanced encryption and security protocols to protect all documents and user data. This ensures that your personal and financial information remains confidential and secure throughout the signing and storage process.

Get more for Income Tax FormsIndividuals & Families Colorado

- Release property lien form

- North carolina deed 497316862 form

- North carolina deed 497316863 form

- Grant deed from husband and wife or two individuals to a limited liability company north carolina form

- North carolina quitclaim deed 497316865 form

- North carolina llc form

- Quitclaim deed llc 497316867 form

- North carolina satisfaction 497316868 form

Find out other Income Tax FormsIndividuals & Families Colorado

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney