DR 0104X Amended Individual Income Return Instructions 2024-2026

Understanding the DR 0104X Amended Individual Income Return Instructions

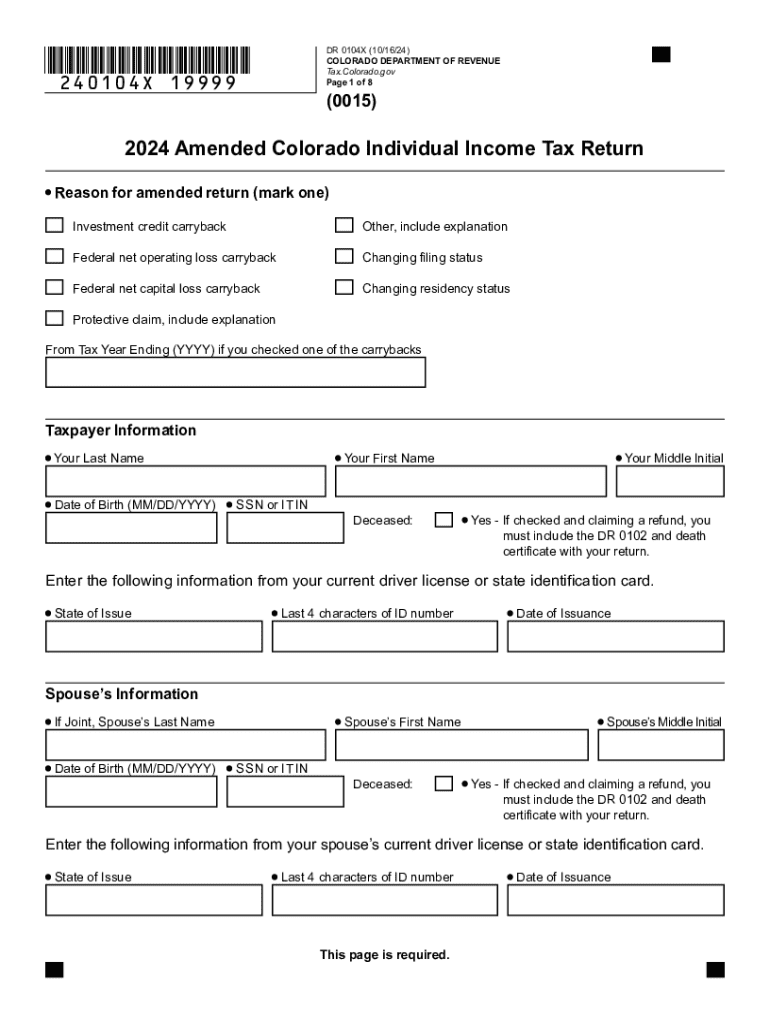

The DR 0104X Amended Individual Income Return Instructions are essential for taxpayers in the United States who need to correct or amend their previously filed individual income tax returns. This form allows individuals to update their tax information, whether due to errors, changes in income, or adjustments in deductions and credits. By following these instructions, taxpayers can ensure that their amended returns are processed accurately and efficiently.

Steps to Complete the DR 0104X Amended Individual Income Return Instructions

Completing the DR 0104X requires careful attention to detail. Here are the key steps involved:

- Gather all relevant documents, including your original tax return and any supporting documentation for the changes you are making.

- Fill out the DR 0104X form, ensuring that you provide accurate information in each section. Be sure to indicate the tax year you are amending.

- Clearly explain the reasons for your amendments in the designated area of the form.

- Double-check all entries for accuracy to avoid further complications.

- Sign and date the form before submission.

Obtaining the DR 0104X Amended Individual Income Return Instructions

Taxpayers can obtain the DR 0104X Amended Individual Income Return Instructions from the official state tax authority website or by visiting local tax offices. The form is typically available in both digital and printed formats, making it accessible for all users. Ensure that you have the most current version to avoid any compliance issues.

Filing Deadlines for the DR 0104X Amended Individual Income Return Instructions

It is crucial to be aware of the deadlines associated with filing the DR 0104X. Generally, amended returns must be filed within three years from the original filing date or within two years from the date the tax was paid, whichever is later. Adhering to these deadlines helps avoid penalties and ensures that any refunds due are processed promptly.

Required Documents for the DR 0104X Amended Individual Income Return Instructions

When completing the DR 0104X, certain documents are necessary to support your amendments. These may include:

- Your original tax return for the year being amended.

- Any W-2 forms or 1099 forms that reflect income changes.

- Documentation for any new deductions or credits being claimed.

- Proof of payment for any additional taxes owed.

Legal Use of the DR 0104X Amended Individual Income Return Instructions

The DR 0104X is legally recognized by the IRS and state tax authorities as the official method for amending individual income tax returns. Using this form correctly ensures compliance with tax laws and helps prevent issues such as audits or penalties. It is important to follow the instructions precisely to maintain legal standing.

Create this form in 5 minutes or less

Find and fill out the correct dr 0104x amended individual income return instructions

Create this form in 5 minutes!

How to create an eSignature for the dr 0104x amended individual income return instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the DR 0104X Amended Individual Income Return Instructions?

The DR 0104X Amended Individual Income Return Instructions provide detailed guidance on how to correctly complete and submit an amended tax return in Colorado. These instructions are essential for ensuring that any changes to your income or deductions are accurately reported to the state.

-

How can airSlate SignNow assist with the DR 0104X Amended Individual Income Return Instructions?

airSlate SignNow simplifies the process of completing and submitting the DR 0104X Amended Individual Income Return Instructions by allowing users to eSign documents securely and efficiently. Our platform ensures that your amended return is submitted correctly and on time, reducing the risk of errors.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow offers a range of features for managing tax documents, including customizable templates, secure eSigning, and document tracking. These features streamline the process of completing the DR 0104X Amended Individual Income Return Instructions, making it easier for users to stay organized and compliant.

-

Is there a cost associated with using airSlate SignNow for the DR 0104X Amended Individual Income Return Instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions ensure that you can efficiently manage your tax documents, including the DR 0104X Amended Individual Income Return Instructions, without breaking the bank.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your workflow. This integration allows you to easily access and manage the DR 0104X Amended Individual Income Return Instructions alongside your other financial documents.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. By utilizing our platform for the DR 0104X Amended Individual Income Return Instructions, you can ensure a smoother filing process and greater peace of mind.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and secure cloud storage. When handling sensitive information like the DR 0104X Amended Individual Income Return Instructions, you can trust that your data is protected against unauthorized access.

Get more for DR 0104X Amended Individual Income Return Instructions

- Cda form

- Hoja de siniestro vehicular form

- Great sandy national park map form

- Notary live scan form

- Church affiliation letter sample 351920601 form

- Customer refund request form immigration new zealand immigration govt

- Archaeological records check request for a cal fire project fire ca form

- Bilateral non disclosure agreement template form

Find out other DR 0104X Amended Individual Income Return Instructions

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy