Colorado Form 104PN Part YearNonresident Computation Colorado Form 104PN Part YearNonresident Computation Colorado Form 104CR Ta 2020

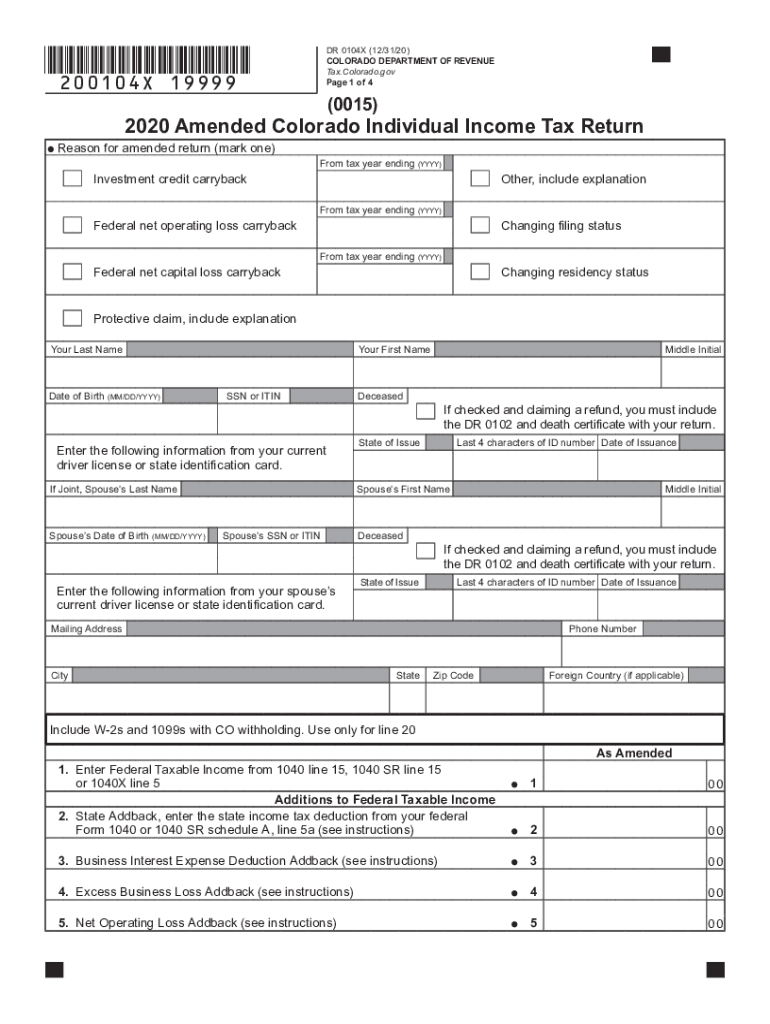

Understanding the Colorado Form 104X Amended Income Tax Return

The Colorado Form 104X is designed for taxpayers who need to amend their previously filed income tax returns. This form allows individuals to correct errors, claim additional deductions, or adjust their income. It is essential for ensuring that your tax records are accurate and up to date, which can prevent potential issues with the Colorado Department of Revenue.

Steps to Complete the Colorado Form 104X

Filling out the Colorado Form 104X involves several key steps:

- Begin by obtaining the correct version of the form, ensuring it corresponds to the tax year you are amending.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate the original amounts reported on your initial return and the corrected amounts you are now reporting.

- Clearly explain the reasons for the amendments in the designated section.

- Review the form for accuracy before submitting it to avoid further complications.

Legal Use of the Colorado Form 104X

The Colorado Form 104X is legally binding when completed correctly. To ensure its validity, you must adhere to the guidelines set forth by the Colorado Department of Revenue. This includes providing accurate information and signing the form. An amended return can affect your tax liability, so it is crucial to follow the legal requirements to avoid penalties or audits.

Filing Deadlines for the Colorado Form 104X

Timely submission of the Colorado Form 104X is critical. Generally, you must file the amended return within three years from the original filing date or within two years from the date you paid the tax, whichever is later. Keeping track of these deadlines helps ensure compliance and prevents unnecessary penalties.

Required Documents for Amending Your Tax Return

When submitting the Colorado Form 104X, you may need to include additional documentation to support your amendments. This can include:

- Copies of any relevant documents that substantiate the changes, such as W-2s or 1099s.

- Any previous tax returns that are being amended.

- Documentation for any new deductions or credits you are claiming.

Form Submission Methods for the Colorado Form 104X

You can submit the Colorado Form 104X through various methods. Options include:

- Online submission via the Colorado Department of Revenue's e-filing system, if applicable.

- Mailing the completed form to the appropriate address provided by the Department of Revenue.

- In-person submission at designated tax offices, which may offer assistance in completing the form.

Quick guide on how to complete colorado form 104pn part yearnonresident computation colorado form 104pn part yearnonresident computation colorado form 104cr

Complete Colorado Form 104PN Part YearNonresident Computation Colorado Form 104PN Part YearNonresident Computation Colorado Form 104CR Ta seamlessly on any device

Web-based document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Colorado Form 104PN Part YearNonresident Computation Colorado Form 104PN Part YearNonresident Computation Colorado Form 104CR Ta on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to adjust and eSign Colorado Form 104PN Part YearNonresident Computation Colorado Form 104PN Part YearNonresident Computation Colorado Form 104CR Ta effortlessly

- Obtain Colorado Form 104PN Part YearNonresident Computation Colorado Form 104PN Part YearNonresident Computation Colorado Form 104CR Ta and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Colorado Form 104PN Part YearNonresident Computation Colorado Form 104PN Part YearNonresident Computation Colorado Form 104CR Ta to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado form 104pn part yearnonresident computation colorado form 104pn part yearnonresident computation colorado form 104cr

Create this form in 5 minutes!

How to create an eSignature for the colorado form 104pn part yearnonresident computation colorado form 104pn part yearnonresident computation colorado form 104cr

The best way to generate an e-signature for your PDF document online

The best way to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is the colorado form 104x and how do I use it?

The colorado form 104x is a tax form used to amend your Colorado state income tax return. You can use this form to correct errors, update your filing status, or claim additional deductions. Ensure to follow the instructions carefully to file it accurately.

-

How does airSlate SignNow help with the colorado form 104x?

airSlate SignNow simplifies the process of electronically signing and sending the colorado form 104x. With our platform, you can quickly gather signatures from all necessary parties, ensuring your amendments are submitted promptly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the colorado form 104x?

airSlate SignNow offers competitive pricing options that allow you to eSign documents, including the colorado form 104x, affordably. You can choose from monthly or annual plans suitable for your business needs, ensuring you only pay for what you use.

-

What features does SignNow provide for handling the colorado form 104x?

SignNow offers various features tailored for the colorado form 104x, such as customizable templates, secure storage, and electronic signatures. These tools streamline your filing process and enhance compliance with state requirements.

-

Can I integrate airSlate SignNow with other applications to manage the colorado form 104x?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and more. This allows you to manage your documents, including the colorado form 104x, across different platforms, enhancing workflow efficiency.

-

What benefits can I expect when using airSlate SignNow for the colorado form 104x?

Using airSlate SignNow for the colorado form 104x offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security. These advantages help you focus on your business while ensuring your tax amendments are handled correctly.

-

Is electronic signing of the colorado form 104x legally binding?

Yes, electronic signatures on the colorado form 104x are considered legally binding, provided they meet state requirements. AirSlate SignNow complies with all necessary regulations, making your electronically signed forms valid for submission.

Get more for Colorado Form 104PN Part YearNonresident Computation Colorado Form 104PN Part YearNonresident Computation Colorado Form 104CR Ta

- Warning notice due to complaint from neighbors district of columbia form

- Lease subordination agreement district of columbia form

- Apartment rules and regulations district of columbia form

- Dc cancellation form

- Amendment of residential lease district of columbia form

- Agreement for payment of unpaid rent district of columbia form

- Commercial lease assignment from tenant to new tenant district of columbia form

- Tenant consent to background and reference check district of columbia form

Find out other Colorado Form 104PN Part YearNonresident Computation Colorado Form 104PN Part YearNonresident Computation Colorado Form 104CR Ta

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later