Amended Individual Income Return Instructions CDOR Colorado Gov 2022

Understanding the Amended Individual Income Return Instructions for Colorado

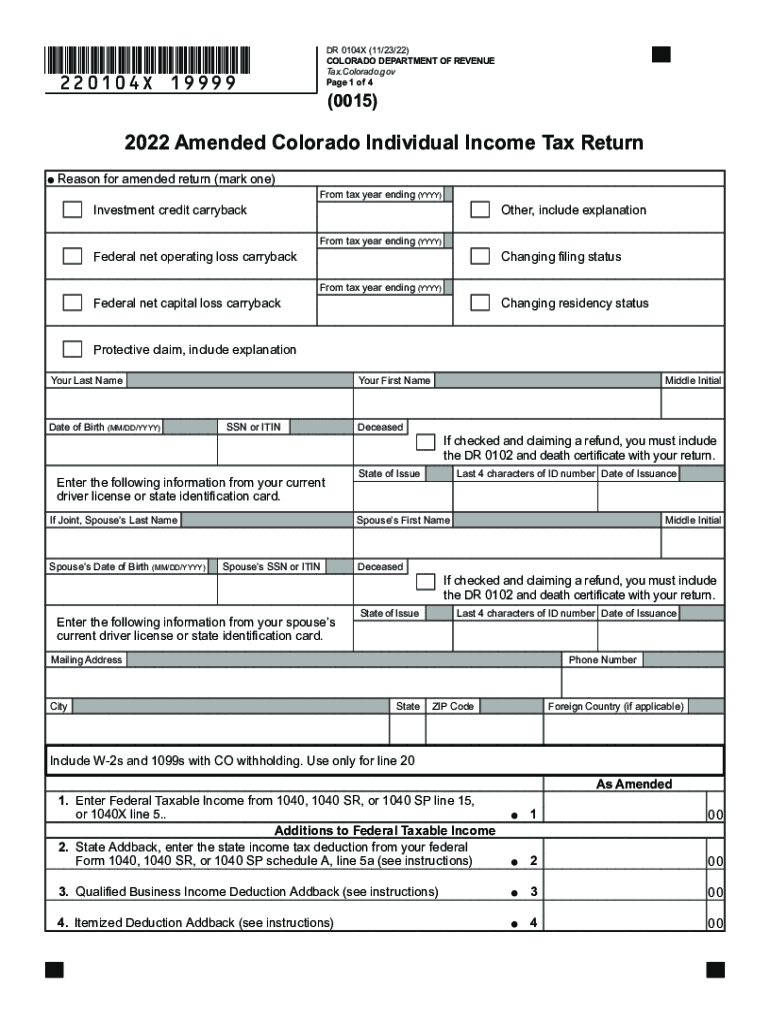

The Amended Individual Income Return Instructions provided by the Colorado Department of Revenue (CDOR) are essential for taxpayers who need to correct previously filed income tax returns. This document outlines the procedures and guidelines for making amendments, ensuring compliance with state tax regulations. It is crucial for taxpayers to understand the specific requirements and steps involved in the amendment process to avoid potential penalties and ensure accurate reporting of income.

Steps to Complete the Amended Individual Income Return Instructions

Completing the Amended Individual Income Return requires careful attention to detail. Here are the key steps to follow:

- Obtain the correct form: Use the Colorado Form 104X, which is specifically designed for amendments.

- Review your original return: Identify the errors or changes that need to be addressed.

- Fill out the 104X form: Provide accurate information reflecting the changes, including any additional income or deductions.

- Attach supporting documents: Include any necessary documentation that validates the changes made.

- Submit the amended return: File the 104X form with the Colorado Department of Revenue, either electronically or by mail.

Filing Deadlines and Important Dates

Timely filing of the amended return is crucial to avoid penalties. Generally, taxpayers have three years from the original filing date to submit an amended return. Important dates to keep in mind include:

- The original tax return due date.

- The date you filed your original return.

- The deadline for submitting the amended return, which is typically three years from the original filing date.

Required Documents for Amending Your Return

When amending your Colorado income tax return, certain documents are necessary to support your claims. These may include:

- Copy of the original tax return.

- Documentation for any additional income or deductions.

- Any correspondence from the Colorado Department of Revenue regarding your original return.

Penalties for Non-Compliance with Amended Returns

Failure to comply with the requirements for amending your Colorado income tax return can result in penalties. Common penalties include:

- Late filing penalties if the amended return is submitted after the deadline.

- Interest on any unpaid taxes due to errors in the original return.

- Potential audits if discrepancies are found between the original and amended returns.

Legal Use of the Amended Individual Income Return Instructions

The Amended Individual Income Return Instructions are legally binding documents that guide taxpayers in the amendment process. Compliance with these instructions ensures that the amended return is valid and recognized by the Colorado Department of Revenue. Understanding the legal implications of the amendment process is essential for maintaining compliance and avoiding future tax issues.

Quick guide on how to complete 2022 amended individual income return instructions cdorcoloradogov

Handle Amended Individual Income Return Instructions CDOR Colorado gov effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the right form and securely keep it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and electronically sign your documents without any holdups. Oversee Amended Individual Income Return Instructions CDOR Colorado gov on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The most efficient way to modify and electronically sign Amended Individual Income Return Instructions CDOR Colorado gov effortlessly

- Find Amended Individual Income Return Instructions CDOR Colorado gov and click on Obtain Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on Complete to save your modifications.

- Select your preferred method for sharing your form, via email, SMS, or a shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Amended Individual Income Return Instructions CDOR Colorado gov to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 amended individual income return instructions cdorcoloradogov

Create this form in 5 minutes!

How to create an eSignature for the 2022 amended individual income return instructions cdorcoloradogov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Colorado income tax?

airSlate SignNow is an eSignature platform that enables businesses to send and sign documents seamlessly. Understanding Colorado income tax forms is essential for businesses operating in the state, and our solution can help streamline the signing process for these important documents.

-

How can airSlate SignNow help me manage my Colorado income tax documentation?

With airSlate SignNow, you can easily create, manage, and sign Colorado income tax documents digitally. This simplifies the process and ensures that your tax forms are signed and filed promptly, reducing the risk of errors associated with traditional paper methods.

-

What features does airSlate SignNow offer for handling Colorado income tax forms?

airSlate SignNow includes features like templates, bulk sending, and automated reminders which can be particularly helpful for managing Colorado income tax forms. These tools ensure that you never miss a deadline and maintain compliance with state regulations.

-

Is airSlate SignNow cost-effective for small businesses dealing with Colorado income tax?

Yes, airSlate SignNow is designed to be cost-effective, making it accessible for small businesses managing Colorado income tax. Our pricing plans cater to various needs, allowing you to choose an option that fits your budget while enhancing your document management process.

-

Can I integrate airSlate SignNow with my accounting software for Colorado income tax?

Absolutely! airSlate SignNow offers integrations with several accounting software solutions. This feature allows you to send and receive electronically signed Colorado income tax documents directly within your existing tools, making your workflow more efficient.

-

What security measures does airSlate SignNow have for sensitive Colorado income tax documents?

airSlate SignNow employs top-tier security measures including encryption, secure servers, and audit trails to protect your Colorado income tax documents. Our commitment to data security ensures that your sensitive information remains confidential and secure during the signing process.

-

How quickly can I get started with airSlate SignNow for my Colorado income tax needs?

Getting started with airSlate SignNow is quick and easy. You can sign up in minutes and begin using our platform to manage your Colorado income tax documents right away, ensuring you are prepared for tax season without any delays.

Get more for Amended Individual Income Return Instructions CDOR Colorado gov

Find out other Amended Individual Income Return Instructions CDOR Colorado gov

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking