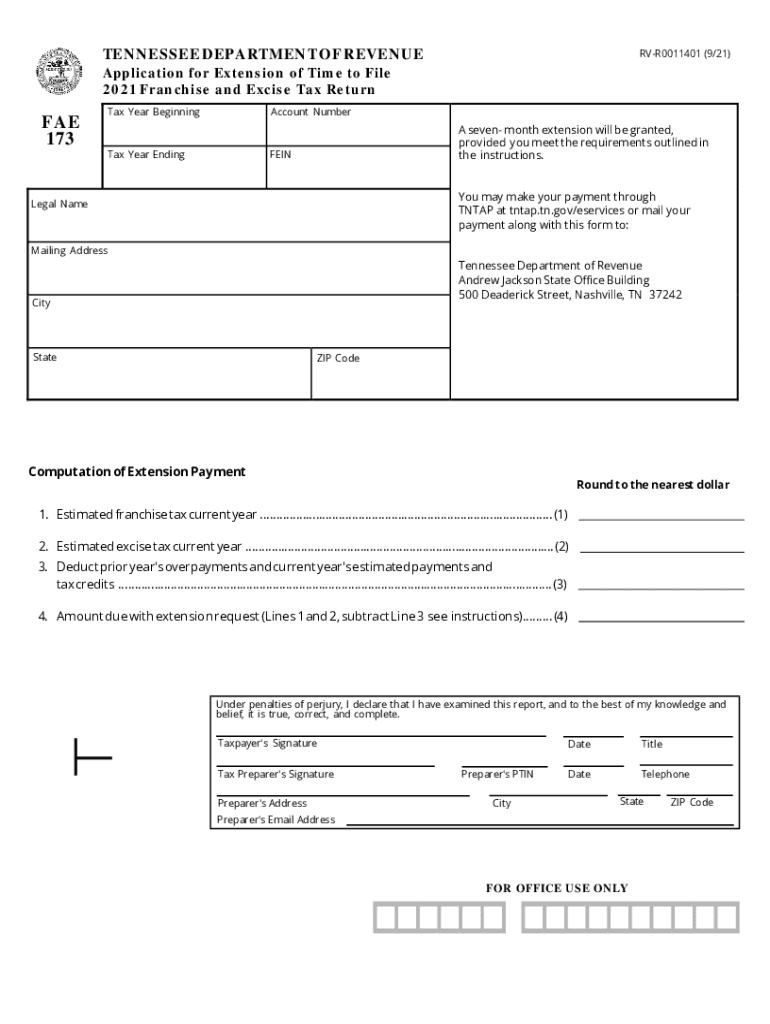

Fae173 FAE173 Application for Extension of Time to File Franchise Excise Tax Return 2021

Understanding the FAE 173 Application for Extension of Time

The FAE 173 is a crucial form for businesses in Tennessee seeking an extension to file their franchise excise tax return. This application allows taxpayers to request additional time beyond the standard filing deadline. It is essential for ensuring compliance with state tax regulations while providing flexibility for businesses that may need extra time to prepare their financial documents accurately.

Steps to Complete the FAE 173 Application

Completing the FAE 173 involves several important steps:

- Gather necessary financial information, including income statements and balance sheets.

- Fill out the FAE 173 form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Filing Deadlines and Important Dates

It is vital to be aware of the filing deadlines associated with the FAE 173. Typically, the application must be submitted before the original due date of the franchise excise tax return. Failing to file on time can result in penalties and interest on unpaid taxes. Keeping track of these dates ensures that businesses remain compliant with Tennessee tax laws.

Required Documents for the FAE 173 Application

When submitting the FAE 173, certain documents may be required to support the application. These may include:

- Previous year’s tax return for reference.

- Financial statements that reflect the current fiscal status.

- Any additional documentation that may support the request for an extension.

Legal Use of the FAE 173 Application

The FAE 173 is legally recognized as a valid request for an extension under Tennessee tax law. It provides businesses with the necessary time to prepare their tax returns without incurring penalties. Understanding the legal implications of this form ensures that businesses can navigate their tax obligations effectively while remaining compliant with state regulations.

Application Process and Approval Time

The application process for the FAE 173 is straightforward. Once the form is completed and submitted, businesses can typically expect a response from the Tennessee Department of Revenue within a few weeks. This allows businesses to plan accordingly and ensures they have the necessary time to file their tax returns accurately.

Quick guide on how to complete fae173 fae173 application for extension of time to file franchise excise tax return

Effortlessly Prepare Fae173 FAE173 Application For Extension Of Time To File Franchise Excise Tax Return on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, edit, and eSign your documents without delays. Handle Fae173 FAE173 Application For Extension Of Time To File Franchise Excise Tax Return on any platform using the airSlate SignNow apps for Android or iOS and enhance your document-centric processes today.

How to Edit and eSign Fae173 FAE173 Application For Extension Of Time To File Franchise Excise Tax Return with Ease

- Locate Fae173 FAE173 Application For Extension Of Time To File Franchise Excise Tax Return and click on Get Form to initiate.

- Utilize the available tools to complete your document.

- Emphasize essential paragraphs of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs within just a few clicks from your chosen device. Modify and eSign Fae173 FAE173 Application For Extension Of Time To File Franchise Excise Tax Return to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fae173 fae173 application for extension of time to file franchise excise tax return

Create this form in 5 minutes!

People also ask

-

What is the Tennessee franchise excise tax?

The Tennessee franchise excise tax is a state tax imposed on businesses operating in Tennessee. It is calculated based on the net worth of the business and its gross receipts. Companies need to comply with these taxes to avoid penalties and maintain good standing.

-

How does airSlate SignNow help with managing Tennessee franchise excise documentation?

airSlate SignNow streamlines the process of preparing and signing tax-related documents, including those required for the Tennessee franchise excise tax. Our platform allows for efficient collaboration and electronic signatures, ensuring that all forms are completed accurately and on time.

-

What are the pricing options for airSlate SignNow in relation to Tennessee franchise excise tax filings?

airSlate SignNow offers flexible pricing plans suited for different business sizes and needs, including those venturing into Tennessee franchise excise tax filings. You can select a plan that aligns with your filing requirements and budget, ensuring cost-effective solutions for your business.

-

What features does airSlate SignNow offer that can assist businesses with Tennessee franchise excise tax compliance?

airSlate SignNow includes features like document templates, automated workflows, and real-time collaboration tools that signNowly aid in Tennessee franchise excise tax compliance. These functionalities make it easier for businesses to prepare, sign, and store all necessary documents securely.

-

Can airSlate SignNow integrate with accounting software for Tennessee franchise excise tax purposes?

Yes, airSlate SignNow readily integrates with popular accounting software that can help manage Tennessee franchise excise tax calculations and filings. This seamless integration allows for a streamlined process, enabling businesses to maintain accurate financial records and file taxes efficiently.

-

What benefits does airSlate SignNow provide for businesses dealing with Tennessee franchise excise tax?

By using airSlate SignNow, businesses can enhance productivity, reduce paperwork, and improve compliance when dealing with Tennessee franchise excise tax. The platform's user-friendly interface makes it easy to manage documents, ensuring that all tax-related paperwork is processed swiftly and effectively.

-

Is airSlate SignNow suitable for small businesses dealing with Tennessee franchise excise tax?

Absolutely! airSlate SignNow is designed to accommodate businesses of all sizes, including small businesses handling Tennessee franchise excise tax filings. Our cost-effective solutions and easy-to-use features help small companies stay organized and compliant without overwhelming their resources.

Get more for Fae173 FAE173 Application For Extension Of Time To File Franchise Excise Tax Return

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497316956 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement north carolina form

- Letter agreement rent form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants north carolina form

- North carolina landlord 497316960 form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat north carolina form

- Nc waiver lien form

- Conditional waiver and release of lien upon final payment north carolina form

Find out other Fae173 FAE173 Application For Extension Of Time To File Franchise Excise Tax Return

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy