FAE173 Application for Extension of Time to File 2023-2026

What is the FAE173 Application for Extension of Time to File

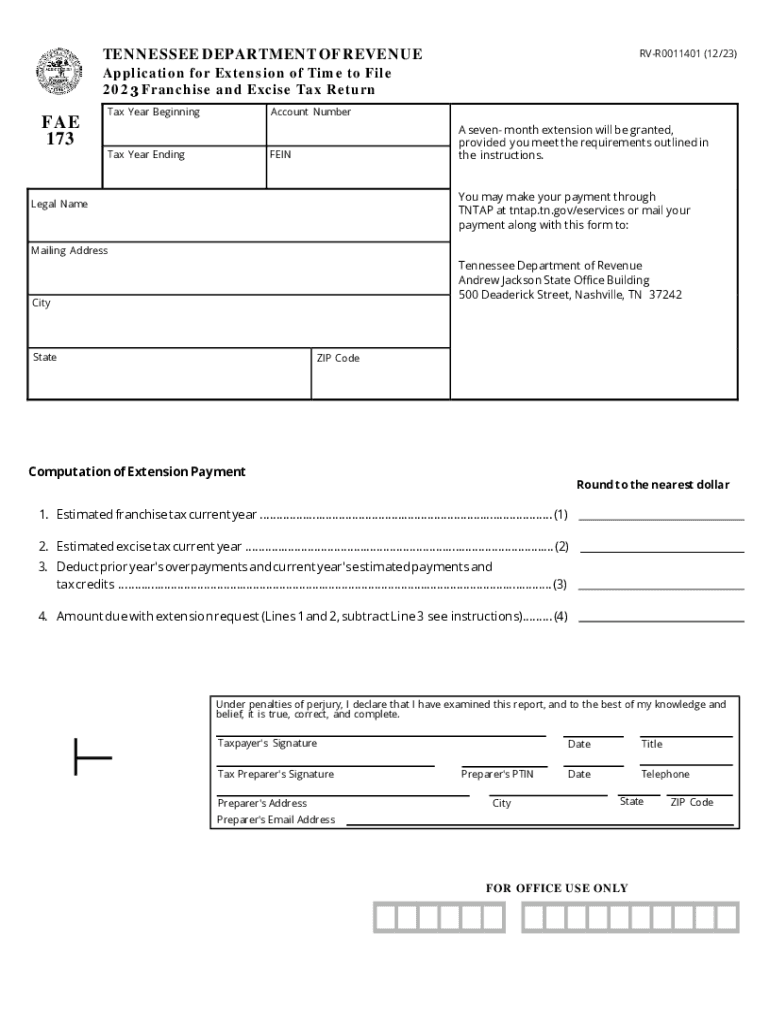

The FAE173 is a form used in Tennessee for requesting an extension of time to file certain tax documents. This application allows taxpayers to extend their filing deadline, providing additional time to gather necessary information and complete their tax returns without incurring immediate penalties. The form is specifically designed for individuals and businesses who need more time to prepare their taxes due to various circumstances, such as unexpected financial situations or the need for additional documentation.

How to Use the FAE173 Application for Extension of Time to File

To effectively use the FAE173, taxpayers must first ensure they meet the eligibility criteria for an extension. The application requires specific information, including taxpayer identification details and the type of tax return for which the extension is being requested. After filling out the form, it should be submitted to the appropriate Tennessee tax authority by the specified deadline. It is essential to keep a copy of the completed form for personal records and to confirm that the extension has been processed.

Steps to Complete the FAE173 Application for Extension of Time to File

Completing the FAE173 involves several key steps:

- Obtain the FAE173 form from the Tennessee Department of Revenue website or other official sources.

- Fill in your personal information, including your name, address, and Social Security number or Employer Identification Number.

- Indicate the type of tax return for which you are requesting an extension.

- Specify the reason for the extension, if required.

- Sign and date the form to validate your request.

- Submit the form by mail or electronically, as per the instructions provided.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the FAE173. Typically, the application must be submitted by the original due date of the tax return. For most taxpayers, this means the FAE173 should be filed by April 15 for individual tax returns. Failure to submit the application by this deadline may result in penalties and interest on any unpaid taxes. Always check the Tennessee Department of Revenue for any updates or changes to these deadlines.

Required Documents

When submitting the FAE173, certain documents may be required to support your request for an extension. These may include:

- Proof of income or any relevant financial documents that justify the need for an extension.

- Previous year's tax return, if applicable, to provide context for your current filing.

- Any additional forms or documentation as specified by the Tennessee Department of Revenue.

Gathering these documents in advance can facilitate a smoother application process.

Eligibility Criteria

To qualify for an extension using the FAE173, taxpayers must meet specific eligibility criteria. Generally, individuals and businesses must be in good standing with the Tennessee Department of Revenue and not have any outstanding tax liabilities. Additionally, the extension is typically granted for valid reasons, such as needing more time to prepare accurate returns or unforeseen circumstances affecting the taxpayer's ability to file on time. It is advisable to review the eligibility requirements thoroughly before applying.

Quick guide on how to complete fae173 application for extension of time to file

Complete FAE173 Application For Extension Of Time To File effortlessly on any gadget

Digital document management has become widely accepted among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without any delays. Manage FAE173 Application For Extension Of Time To File on any gadget using airSlate SignNow apps for Android or iOS and enhance any document-driven workflow today.

How to modify and eSign FAE173 Application For Extension Of Time To File without hassle

- Locate FAE173 Application For Extension Of Time To File and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tiresome form searching, or errors that necessitate reprinting document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign FAE173 Application For Extension Of Time To File and ensure effective communication at any point in your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fae173 application for extension of time to file

Create this form in 5 minutes!

How to create an eSignature for the fae173 application for extension of time to file

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fae 173 extension and how does it work?

The fae 173 extension is a powerful tool offered by airSlate SignNow that enhances document management and electronic signatures. By integrating this extension, users can streamline their document workflows and eSigning processes, making it easier to handle contracts and agreements efficiently. It automates document tracking and provides a seamless signing experience.

-

What are the key features of the fae 173 extension?

The fae 173 extension includes features such as customizable templates, in-person signing options, and secure cloud storage integration. It also offers advanced tracking capabilities and supports multiple file formats, ensuring that all your document needs are met in one place. These features help enhance efficiency and improve the user experience.

-

How much does the fae 173 extension cost?

The pricing for the fae 173 extension is competitive, with flexible plans designed to cater to different business sizes and needs. Users can choose from monthly or annual subscriptions, allowing them to select a plan that fits their budget. Additionally, airSlate SignNow often provides promotional offers for new users, making it even more affordable.

-

What are the benefits of using the fae 173 extension?

Using the fae 173 extension can signNowly reduce the time and effort needed to manage documents. It allows for quick eSigning processes, minimizes paper waste, and enhances overall productivity. The user-friendly interface ensures that even those unfamiliar with technology can adopt it quickly.

-

Can the fae 173 extension be integrated with other tools?

Yes, the fae 173 extension is designed for seamless integration with various business applications and platforms. This includes CRM systems, project management tools, and cloud storage services, allowing users to incorporate eSigning capabilities into their existing workflows efficiently. This flexibility enhances productivity by connecting different software solutions.

-

Is the fae 173 extension secure for sensitive documents?

Absolutely, the fae 173 extension prioritizes security and complies with industry regulations to safeguard sensitive information. It uses advanced encryption and authentication mechanisms to protect documents during transmission and while stored in the cloud. Users can confidently manage their confidential documents with airSlate SignNow.

-

How can I get support for the fae 173 extension?

airSlate SignNow offers comprehensive customer support for the fae 173 extension through various channels, including email, live chat, and phone support. Users can access a detailed knowledge base with tutorials and FAQs to troubleshoot common issues. The dedicated support team is also available to assist with any technical inquiries or installation questions.

Get more for FAE173 Application For Extension Of Time To File

- Percentage shopping enter lease agreementfree legal form

- 66 22 107 form of certificate of acknowledgment 2016

- To be used to pay their creditors form

- For and in consideration of the sum of dollars form

- County of state of tennessee hereinafter seller whether one or more form

- 12th biennial judge joe lee bankruptcy institute uknowledge form

- Form c 22 tngov

- Fillable online form c 28 fax email print pdffiller

Find out other FAE173 Application For Extension Of Time To File

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form