Form Fae 173 2017

What is the Form FAE 173?

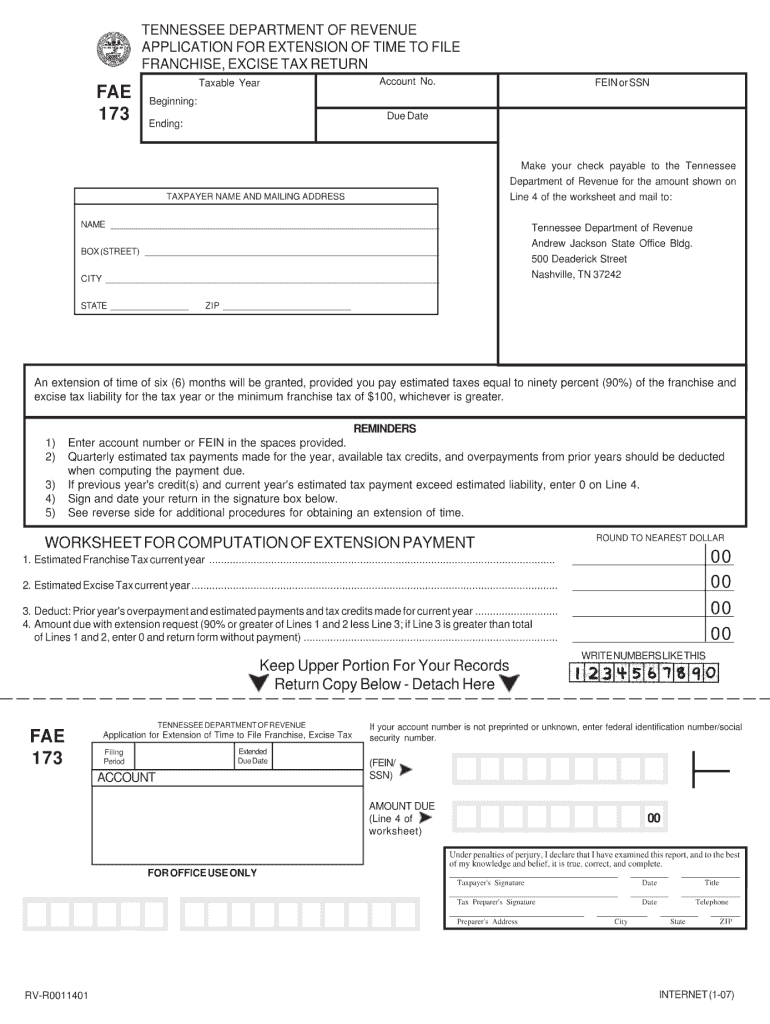

The Form FAE 173 is an extension franchise excise form used by businesses in Tennessee to request an extension for filing their franchise and excise tax returns. This form allows taxpayers to extend the deadline for filing their returns, providing additional time to prepare the necessary documentation and calculations. Understanding the purpose and requirements of the FAE 173 is essential for compliance with state tax regulations.

Steps to Complete the Form FAE 173

Completing the Form FAE 173 involves several key steps:

- Begin by entering your business's name, address, and federal employer identification number (FEIN).

- Indicate the tax year for which you are requesting an extension.

- Calculate the estimated tax due for the period, which is crucial for determining if any payment is required with the extension request.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form by the original due date of your franchise and excise tax return.

Following these steps ensures that your extension request is processed smoothly and complies with state requirements.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form FAE 173. Generally, the form must be submitted by the original due date of the franchise and excise tax return. For most businesses, this date falls on the 15th day of the fourth month following the end of their fiscal year. Missing this deadline may result in penalties or interest on unpaid taxes.

Legal Use of the Form FAE 173

The Form FAE 173 is legally recognized by the state of Tennessee as a valid request for an extension of time to file franchise and excise tax returns. To ensure the form's legal standing, it is essential to complete it accurately and submit it on time. Compliance with the relevant tax laws and regulations is necessary to avoid any legal complications.

Required Documents

When submitting the Form FAE 173, certain documents may be required to support your extension request. These may include:

- Your business's federal tax return, if applicable.

- Documentation of any estimated tax payments made for the current tax year.

- Any prior year tax returns that may be relevant to your extension request.

Having these documents ready can facilitate a smoother filing process and ensure compliance with state requirements.

Who Issues the Form

The Form FAE 173 is issued by the Tennessee Department of Revenue. This department is responsible for administering tax laws and ensuring compliance among businesses operating within the state. For any questions regarding the form or the extension process, taxpayers can contact the Department of Revenue for assistance.

Quick guide on how to complete form fae 173 2007

Effortlessly prepare Form Fae 173 on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can easily acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents promptly without delays. Manage Form Fae 173 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to alter and eSign Form Fae 173 with ease

- Retrieve Form Fae 173 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize crucial sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Put aside worries about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Form Fae 173 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form fae 173 2007

Create this form in 5 minutes!

How to create an eSignature for the form fae 173 2007

The way to generate an electronic signature for a PDF in the online mode

The way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

The best way to make an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the extension franchise excise tax?

The extension franchise excise tax is a specific fee imposed on businesses for the privilege of operating as a franchise in a certain state. Understanding this tax can help businesses plan their finances better and ensure compliance while using digital tools like airSlate SignNow to manage documents efficiently.

-

How can airSlate SignNow help with managing extension franchise excise documentation?

airSlate SignNow provides a streamlined platform to send and eSign important documentation related to extension franchise excise tax. This feature reduces paperwork and helps businesses organize files, ensuring that all necessary forms are completed accurately and efficiently.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers various pricing plans catering to different business needs, making it affordable to manage extension franchise excise documentation. With flexible monthly and annual subscription options, businesses can choose the best plan that fits their requirements without breaking the bank.

-

Does airSlate SignNow integrate with other software relevant to extension franchise excise management?

Yes, airSlate SignNow seamlessly integrates with a variety of software tools that businesses commonly use for accounting and tax management, which can simplify the process of handling extension franchise excise tasks. Integrations enhance productivity, allowing users to focus on their core operations.

-

What are the main benefits of using airSlate SignNow for extension franchise excise documents?

By utilizing airSlate SignNow for extension franchise excise documents, businesses enjoy faster processing speeds, enhanced compliance, and reduced risk of errors. The platform’s intuitive interface makes managing important paperwork, including tax-related documents, hassle-free and efficient.

-

Is there a mobile app for managing extension franchise excise documents?

Yes, airSlate SignNow offers a mobile app that allows users to manage their extension franchise excise documents on the go. This convenience ensures that business owners and managers can sign and send documents anytime, anywhere, which is crucial for timely compliance.

-

How secure is airSlate SignNow when handling extension franchise excise documents?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your extension franchise excise documents. Users can rest assured that their sensitive information is safeguarded against unauthorized access while using the platform.

Get more for Form Fae 173

Find out other Form Fae 173

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney