FAE173 Application for Extension of Time to File FAE173 Application for Extension of Time to File 2022

Understanding the FAE173 Application for Extension of Time to File

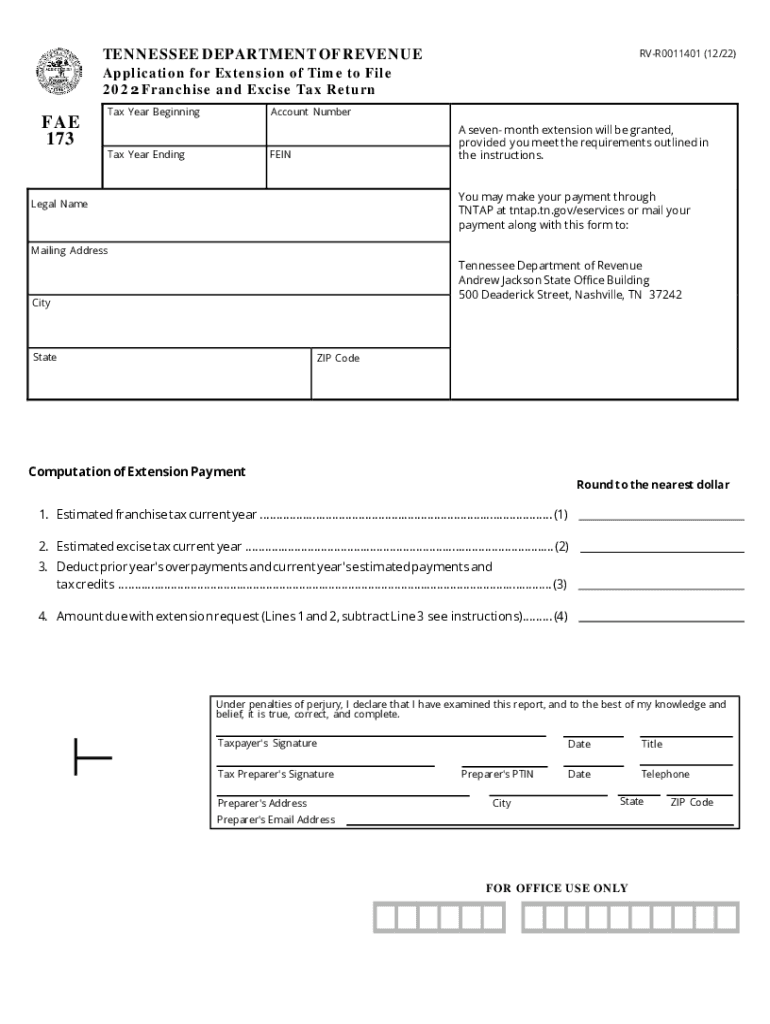

The Tennessee Franchise Excise Form, commonly referred to as the FAE173, is a crucial document for businesses seeking an extension on their franchise and excise tax filing. This application allows entities to request additional time to file their tax returns without incurring penalties. The FAE173 is specifically designed for corporations, partnerships, and limited liability companies operating in Tennessee, ensuring they adhere to state tax regulations while managing their filing deadlines effectively.

Steps to Complete the FAE173 Application

Completing the FAE173 requires careful attention to detail to ensure compliance with Tennessee tax laws. Here are the steps to follow:

- Gather necessary information, including your business name, address, and taxpayer identification number.

- Indicate the reason for the extension request clearly on the form.

- Provide the estimated amount of tax owed, if applicable, to avoid penalties.

- Sign and date the application to validate it.

- Submit the completed form to the Tennessee Department of Revenue by the due date.

Legal Use of the FAE173 Application

The FAE173 serves as a legal request for an extension, ensuring that businesses can file their tax returns without facing immediate penalties. It is essential that the application is filled out accurately and submitted on time to maintain its legal standing. The Tennessee Department of Revenue recognizes eSignatures as valid, allowing businesses to complete and submit the FAE173 electronically, provided they comply with the necessary legal frameworks.

Filing Deadlines and Important Dates

Timely submission of the FAE173 is critical to avoid penalties. The application must be filed by the original due date of the franchise and excise tax return. Typically, this is the fifteenth day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the FAE173 must be submitted by April 15. Keeping track of these deadlines helps ensure compliance and avoids unnecessary fees.

Required Documents for the FAE173 Application

To successfully complete the FAE173, certain documents may be necessary. These include:

- Previous year’s tax return for reference.

- Financial statements to estimate tax liability.

- Any correspondence from the Tennessee Department of Revenue related to your business.

Having these documents ready will streamline the process and help ensure that all information provided is accurate.

Form Submission Methods

The FAE173 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the Tennessee Department of Revenue’s e-file system.

- Mailing a hard copy of the completed form to the appropriate department.

- In-person submission at a local Department of Revenue office.

Choosing the right method depends on your business's needs and resources, but electronic submission often provides the quickest confirmation.

Quick guide on how to complete fae173 application for extension of time to file fae173 application for extension of time to file

Complete FAE173 Application For Extension Of Time To File FAE173 Application For Extension Of Time To File seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and eSign your documents swiftly without interruptions. Manage FAE173 Application For Extension Of Time To File FAE173 Application For Extension Of Time To File on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign FAE173 Application For Extension Of Time To File FAE173 Application For Extension Of Time To File effortlessly

- Find FAE173 Application For Extension Of Time To File FAE173 Application For Extension Of Time To File and click Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all details and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Modify and eSign FAE173 Application For Extension Of Time To File FAE173 Application For Extension Of Time To File and ensure excellent communication at any point in your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fae173 application for extension of time to file fae173 application for extension of time to file

Create this form in 5 minutes!

How to create an eSignature for the fae173 application for extension of time to file fae173 application for extension of time to file

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Tennessee franchise excise form?

The Tennessee franchise excise form is a tax document required for certain businesses operating in Tennessee. It helps determine the excise tax owed based on the profit of the business. Understanding how to complete and submit the Tennessee franchise excise form can ensure compliance and avoid penalties.

-

How can airSlate SignNow help with the Tennessee franchise excise form?

airSlate SignNow simplifies the process of completing and submitting the Tennessee franchise excise form by providing an intuitive eSign platform. Users can easily fill out the necessary details and electronically sign the document, making compliance seamless and efficient. This can save time and reduce errors in the submission process.

-

What are the benefits of using airSlate SignNow for the Tennessee franchise excise form?

Using airSlate SignNow for your Tennessee franchise excise form offers numerous benefits including quick document preparation, secure eSignatures, and easy cloud storage. This solution ensures that your tax documents are handled efficiently and safely, which is crucial for maintaining compliance with Tennessee tax regulations.

-

Is airSlate SignNow cost-effective for filing the Tennessee franchise excise form?

Yes, airSlate SignNow is a cost-effective solution for filing the Tennessee franchise excise form. With affordable pricing plans, businesses can streamline their documentation process without incurring high costs. The platform not only saves money but also enhances productivity when handling important tax-related forms.

-

Can I integrate airSlate SignNow with my accounting software for the Tennessee franchise excise form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your Tennessee franchise excise form efficiently. This integration helps maintain accurate records and simplifies the tracking of submissions, making your overall financial management smoother.

-

What features should I look for when choosing a tool for the Tennessee franchise excise form?

When selecting a tool for the Tennessee franchise excise form, look for features such as easy document creation, eSigning capabilities, compliance checks, and secure cloud storage. airSlate SignNow provides all these features to ensure that you can handle your tax documents effectively and efficiently.

-

How secure is my information when using airSlate SignNow for the Tennessee franchise excise form?

The security of your data is a top priority for airSlate SignNow. The platform employs advanced encryption and security measures to safeguard your information while completing the Tennessee franchise excise form. You can have peace of mind knowing that your sensitive data is protected throughout the process.

Get more for FAE173 Application For Extension Of Time To File FAE173 Application For Extension Of Time To File

- Warranty deed one individual to two individuals south dakota form

- Notice of nonliability by corporation or llc south dakota form

- Renunciation and disclaimer of property received by intestate succession south dakota form

- South dakota form 497326119

- Quitclaim deed from individual to individual south dakota form

- Warranty deed from individual to individual south dakota form

- Special warranty deed south dakota form

- Warranty deed to child reserving a life estate in the parents south dakota form

Find out other FAE173 Application For Extension Of Time To File FAE173 Application For Extension Of Time To File

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed