5089, Concessionaire's Sales Tax Return and Payment 2022

What is the 5089, Concessionaire's Sales Tax Return And Payment

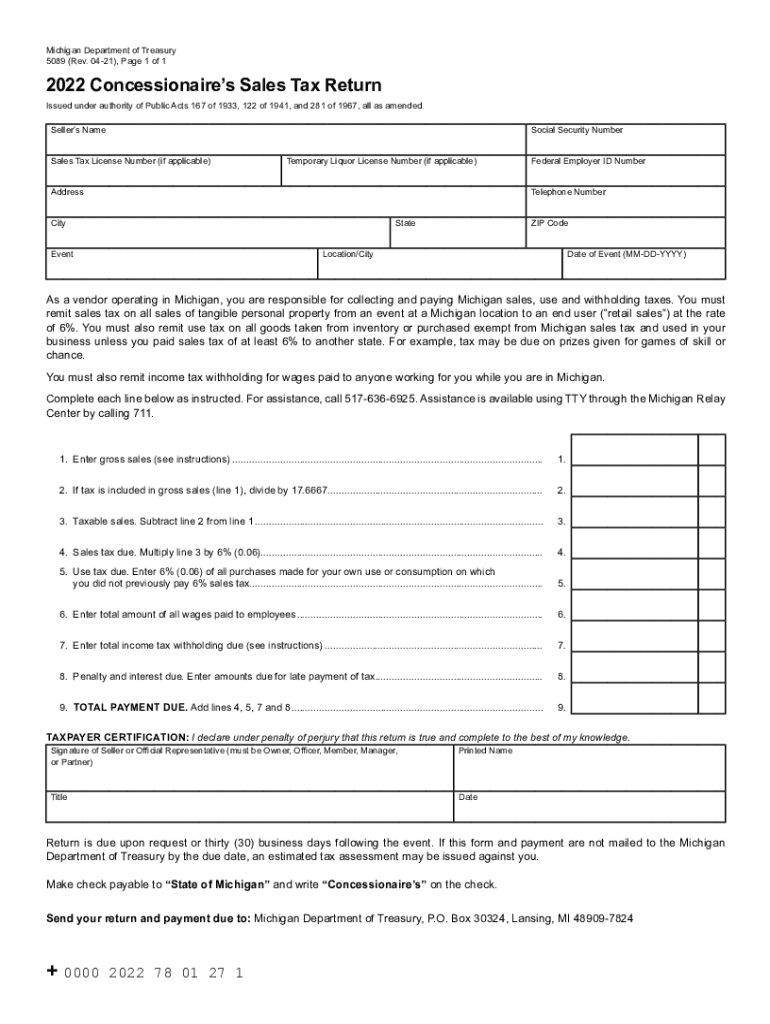

The state of Michigan form 5089 is officially known as the Concessionaire's Sales Tax Return and Payment. This form is specifically designed for businesses that operate as concessionaires, allowing them to report and remit sales tax collected from their sales activities. The form captures essential information regarding gross sales, taxable sales, and the amount of sales tax due. It is crucial for ensuring compliance with Michigan's sales tax regulations and for maintaining accurate financial records.

Steps to complete the 5089, Concessionaire's Sales Tax Return And Payment

Completing the 5089 form involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect all sales records, including gross sales and any exemptions that may apply.

- Fill out the form: Enter the required information, including total gross sales, taxable sales, and the sales tax collected.

- Calculate the tax due: Use the appropriate sales tax rate for your location to determine the total tax owed.

- Review for accuracy: Double-check all entries for correctness to avoid errors that could lead to penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

How to use the 5089, Concessionaire's Sales Tax Return And Payment

Using the 5089 form effectively requires understanding its purpose and the information it collects. Businesses must accurately report their sales activities and remit the appropriate sales tax to the state. The form can be filled out digitally, making it easier to track and manage sales tax obligations. When using the form, ensure that all sales data is up-to-date and reflective of the reporting period to maintain compliance with state regulations.

Legal use of the 5089, Concessionaire's Sales Tax Return And Payment

The 5089 form is legally binding when completed correctly and submitted on time. Compliance with Michigan's sales tax laws is essential to avoid penalties and interest on unpaid taxes. Businesses must ensure they are familiar with the legal requirements surrounding the form, including deadlines for submission and record-keeping practices. Using a reliable electronic signature tool can enhance the legal validity of the submitted document.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 5089 form is critical for concessionaires. Typically, the form must be submitted on a monthly or quarterly basis, depending on the volume of sales. It is important to check the specific due dates for each reporting period to avoid late fees. Keeping a calendar of these dates can help ensure timely submissions and compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The 5089 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission: Many businesses prefer to file electronically for convenience and speed.

- Mail: Completed forms can be printed and mailed to the appropriate state tax office.

- In-person: Businesses may also choose to deliver the form directly to their local tax office.

Quick guide on how to complete 5089 concessionaires sales tax return and payment

Complete 5089, Concessionaire's Sales Tax Return And Payment with ease on any platform

Managing documents online has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage 5089, Concessionaire's Sales Tax Return And Payment on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign 5089, Concessionaire's Sales Tax Return And Payment effortlessly

- Obtain 5089, Concessionaire's Sales Tax Return And Payment and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of the documents or obscure sensitive details with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and eSign 5089, Concessionaire's Sales Tax Return And Payment to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 5089 concessionaires sales tax return and payment

Create this form in 5 minutes!

People also ask

-

What are state of michigan forms 5089 used for?

State of Michigan forms 5089 are typically used for administrative purposes within various state agencies. They help in facilitating the processing of claims, benefits, or other legal obligations. Understanding how to complete and submit these forms correctly is essential for compliance.

-

How can I fill out state of michigan forms 5089 using airSlate SignNow?

AirSlate SignNow offers an intuitive platform where you can easily fill out state of michigan forms 5089 electronically. The platform allows you to input necessary information directly into the forms, making the process more efficient. This reduces errors and speeds up submission timelines.

-

Are there any costs associated with using airSlate SignNow for state of michigan forms 5089?

Yes, there are subscription plans available for using airSlate SignNow. However, the pricing is competitive and designed to provide value for businesses processing state of michigan forms 5089. You can choose a plan that fits your needs based on the volume of documents you handle.

-

What are the benefits of using airSlate SignNow for state of michigan forms 5089?

Using airSlate SignNow to handle state of michigan forms 5089 offers numerous benefits, including increased efficiency, enhanced security, and better tracking of document status. You can reduce the time spent on paperwork, allowing you to focus on your core business activities.

-

Can airSlate SignNow integrate with other tools for processing state of michigan forms 5089?

Absolutely! airSlate SignNow seamlessly integrates with various applications and tools, helping streamline the management of state of michigan forms 5089. This integration capability enhances workflow efficiency and minimizes the chances of data entry errors.

-

Is electronic signing of state of michigan forms 5089 legally binding?

Yes, electronic signing of state of michigan forms 5089 through airSlate SignNow is legally binding. The platform complies with electronic signature laws, ensuring that your signed documents are valid and enforceable in a court of law.

-

How can I ensure the security of my state of michigan forms 5089 when using airSlate SignNow?

AirSlate SignNow prioritizes the security of your documents, including state of michigan forms 5089, using advanced encryption and data protection policies. This ensures your sensitive information remains confidential and secure throughout the signing process.

Get more for 5089, Concessionaire's Sales Tax Return And Payment

- Nc will testament 497317328 form

- Legal last will and testament form for married person with minor children north carolina

- Nc will form

- Legal last will and testament form for married person with adult and minor children from prior marriage north carolina

- Legal last will and testament form for married person with adult and minor children north carolina

- Mutual wills package with last wills and testaments for married couple with adult and minor children north carolina form

- North carolina widow form

- Legal last will and testament form for widow or widower with minor children north carolina

Find out other 5089, Concessionaire's Sales Tax Return And Payment

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online