Concessionaires Sales Tax Return 2023-2026

What is the Concessionaires Sales Tax Return

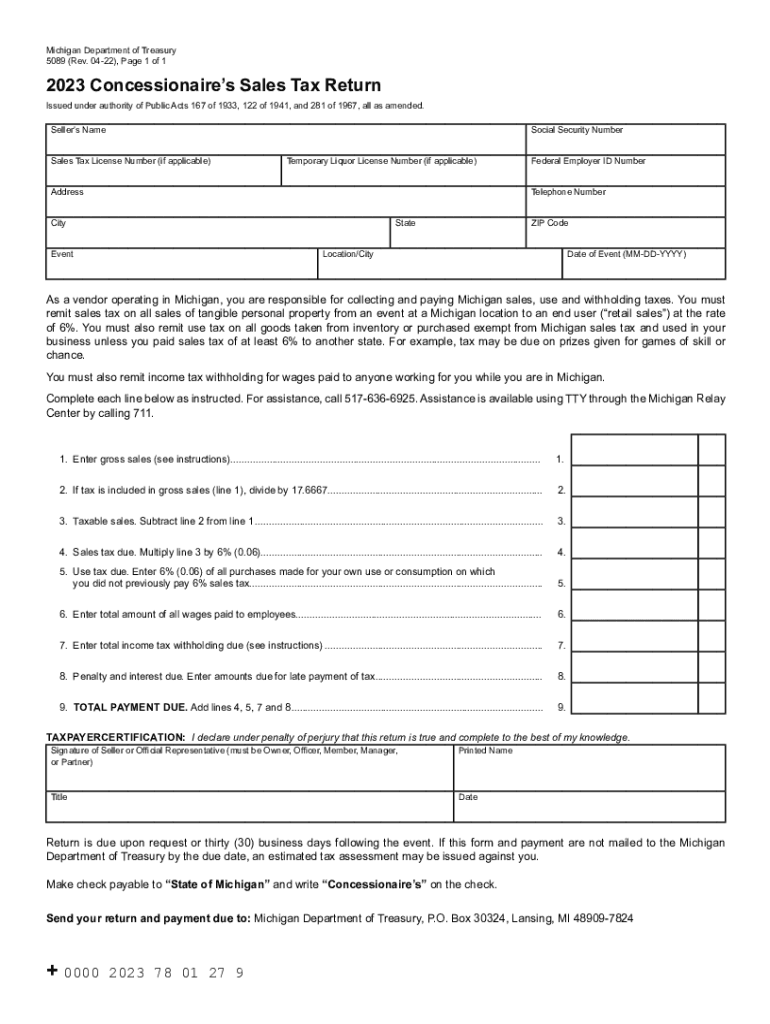

The Concessionaires Sales Tax Return is a specific form used by businesses in Michigan that sell tangible personal property at events or locations where they do not have a permanent establishment. This form, known as the Michigan Sales Tax Form 2271, allows concessionaires to report and pay sales tax collected from customers. It is essential for compliance with Michigan tax laws and ensures that businesses fulfill their tax obligations accurately.

Steps to complete the Concessionaires Sales Tax Return

Completing the Michigan Sales Tax Return (Form 2271) involves several key steps:

- Gather Sales Information: Collect all sales data for the reporting period, including total sales and sales tax collected.

- Fill Out the Form: Enter your business information, including your name, address, and sales tax identification number. Input the total sales and the sales tax amount on the form.

- Calculate Tax Due: Ensure that the sales tax amount is calculated correctly based on the total sales reported.

- Review for Accuracy: Double-check all entries for accuracy to avoid errors that could lead to penalties.

- Submit the Form: Choose your submission method—online, by mail, or in person—and ensure it is sent by the deadline.

How to obtain the Concessionaires Sales Tax Return

The Michigan Sales Tax Form 2271 can be obtained through several methods:

- Online: Visit the Michigan Department of Treasury's website to download a printable version of the form.

- In-Person: You can also visit local tax offices or government buildings to request a physical copy of the form.

- Request by Mail: If you prefer, you can request that a copy be mailed to you by contacting the Michigan Department of Treasury directly.

Filing Deadlines / Important Dates

It is crucial for concessionaires to be aware of the filing deadlines for the Michigan Sales Tax Return. Typically, the return is due on the 20th day of the month following the end of the reporting period. For example, if the reporting period ends on December 31, the return must be filed by January 20. Staying informed about these deadlines helps avoid late fees and penalties.

Required Documents

To successfully complete the Michigan Sales Tax Return, you will need several documents:

- Sales Records: Detailed records of all sales made during the reporting period.

- Sales Tax Collected: Documentation showing the total sales tax collected from customers.

- Business Identification: Your sales tax identification number and business information.

Penalties for Non-Compliance

Failing to file the Michigan Sales Tax Return or submitting inaccurate information can result in significant penalties. These may include:

- Late Fees: A percentage of the unpaid tax may be charged for each month the return is late.

- Interest Charges: Interest may accrue on any unpaid tax amounts, increasing the total due.

- Legal Action: Continued non-compliance can lead to legal actions by the state, including liens or other enforcement measures.

Quick guide on how to complete concessionaires sales tax return

Effortlessly Prepare Concessionaires Sales Tax Return on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Manage Concessionaires Sales Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to Edit and eSign Concessionaires Sales Tax Return Effortlessly

- Obtain Concessionaires Sales Tax Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from your chosen device. Edit and eSign Concessionaires Sales Tax Return and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct concessionaires sales tax return

Create this form in 5 minutes!

How to create an eSignature for the concessionaires sales tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Michigan sales tax return, and why is it important?

A Michigan sales tax return is a document businesses must file to report sales tax collected from customers to the state. It's essential for compliance with state tax regulations, helping businesses avoid penalties and legal issues. Plus, filing accurately can maintain a good standing with the Michigan Department of Treasury.

-

How can airSlate SignNow assist with filing a Michigan sales tax return?

airSlate SignNow streamlines the process of preparing and signing your Michigan sales tax return. Its user-friendly platform allows you to easily send, eSign, and store your tax documents securely. This efficiency can save you time and reduce the risk of errors in your filing.

-

Are there any fees associated with using airSlate SignNow for Michigan sales tax return?

Yes, airSlate SignNow offers various pricing plans, depending on your business needs. These plans provide a cost-effective solution for eSigning and managing your Michigan sales tax return and other documents. By evaluating your usage, you can select a plan that offers the best value for your business.

-

What features does airSlate SignNow offer for managing a Michigan sales tax return?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time collaboration. These tools help you prepare and manage your Michigan sales tax return efficiently. Additionally, the platform supports various file formats, making it versatile for your tax needs.

-

Can I integrate airSlate SignNow with other accounting software for my Michigan sales tax return?

Yes, airSlate SignNow offers integrations with popular accounting and financial software. This allows for seamless data transfer when preparing your Michigan sales tax return, minimizing manual entry. Such integrations can enhance your workflow, ensuring accuracy and saving time.

-

Is airSlate SignNow secure for handling sensitive information like Michigan sales tax returns?

Absolutely! airSlate SignNow prioritizes security with features like encryption, secure storage, and compliance with industry standards. This ensures that your Michigan sales tax return and other sensitive documents are protected from unauthorized access.

-

What are the benefits of using airSlate SignNow for my Michigan sales tax return?

Using airSlate SignNow offers numerous benefits, including increased efficiency, reduced costs, and enhanced document security. It simplifies the preparation and signing process of your Michigan sales tax return. Moreover, it allows you to focus on your business while maintaining compliance.

Get more for Concessionaires Sales Tax Return

- Notice of motor vehicle tow form

- Acknowledged before me this date form

- Department of revenue division of motor coloradogov form

- Change of financial institution address andor fein change form

- X cdlps yes no ctgov form

- 8 15 13 villager combo by weekly register call issuu form

- Information and instructions for prequalification of bidders

- State form 20070 r5 5 21

Find out other Concessionaires Sales Tax Return

- eSign Hawaii High Tech Claim Later

- How To eSign Hawaii High Tech Confidentiality Agreement

- How Do I eSign Hawaii High Tech Business Letter Template

- Can I eSign Hawaii High Tech Memorandum Of Understanding

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy