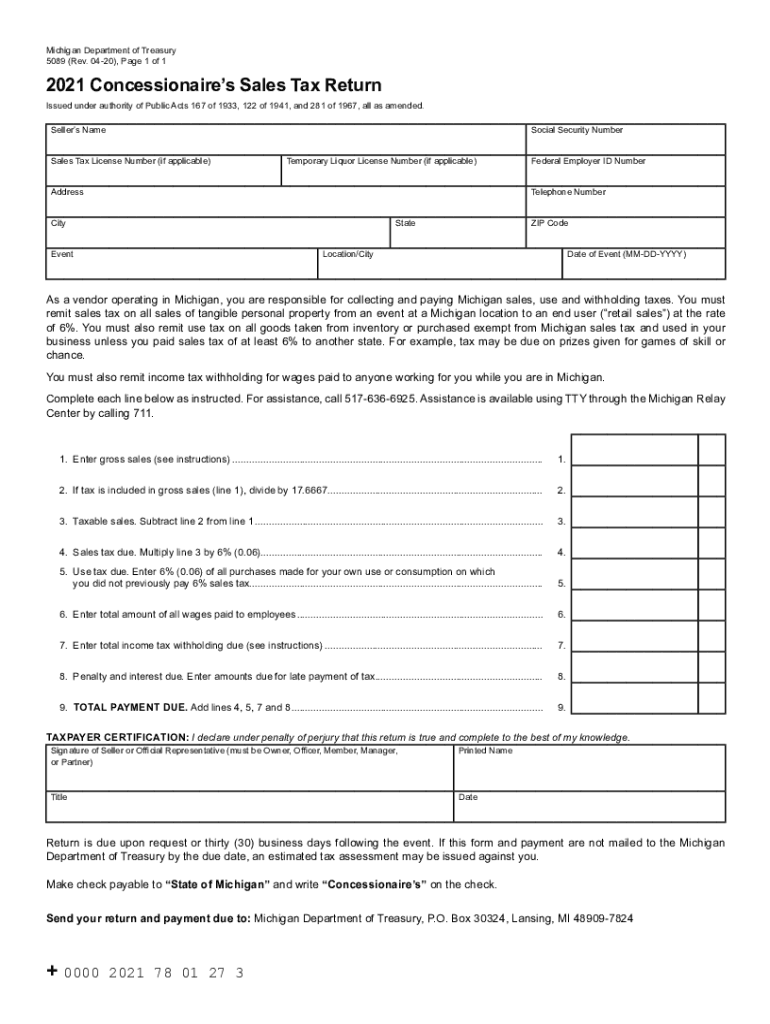

Concessionaires Sales Tax Return 2021

What is the Concessionaires Sales Tax Return

The Concessionaires Sales Tax Return, commonly referred to as HFC Form 2271, is a specific tax form used by concessionaires to report sales tax collected on taxable sales. This form is essential for businesses operating in the food and beverage industry, particularly those selling at events, fairs, or other temporary venues. It ensures compliance with state tax regulations by accurately documenting sales and the corresponding tax obligations.

Steps to complete the Concessionaires Sales Tax Return

Completing the HFC Form 2271 involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records, including receipts and invoices, to determine the total sales amount. Next, calculate the total sales tax collected during the reporting period. Then, fill out the form by entering your business information, total sales, and the calculated sales tax. Finally, review the form for any errors before submitting it to the appropriate state agency.

Legal use of the Concessionaires Sales Tax Return

The HFC Form 2271 is legally binding when completed accurately and submitted on time. It must comply with the relevant state laws regarding sales tax reporting. To ensure legal use, businesses should maintain accurate records of all sales and taxes collected, as these may be required for audits or reviews by tax authorities. Additionally, using a reliable eSignature solution can enhance the legal standing of submitted forms by providing proof of submission and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Concessionaires Sales Tax Return vary by state, but it is crucial to submit the form on time to avoid penalties. Typically, the return is due on a quarterly or monthly basis, depending on the volume of sales. Businesses should keep track of these dates and set reminders to ensure timely submission. Late filings may incur additional fees or interest on unpaid taxes, making adherence to deadlines essential for compliance.

Required Documents

When filing the HFC Form 2271, several documents are required to support the reported figures. These include sales records, receipts, and any documentation related to tax-exempt sales. Additionally, businesses should have their tax identification number and any previous tax returns available for reference. Having these documents organized and readily accessible will streamline the filing process and help ensure accuracy.

Who Issues the Form

The HFC Form 2271 is issued by the state tax authority responsible for sales tax collection and enforcement. This agency provides the necessary forms and guidelines for businesses to comply with state tax laws. It is important for concessionaires to stay informed about any updates or changes to the form or filing requirements by regularly checking the state tax authority's website or contacting them directly.

Penalties for Non-Compliance

Failure to file the HFC Form 2271 on time or inaccuracies in the submitted information can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action from the state tax authority. To avoid these consequences, it is essential for businesses to adhere to filing deadlines, maintain accurate records, and ensure that all information provided on the form is correct and complete.

Quick guide on how to complete 2021 concessionaires sales tax return

Complete Concessionaires Sales Tax Return smoothly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Concessionaires Sales Tax Return on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric task today.

The easiest method to modify and eSign Concessionaires Sales Tax Return effortlessly

- Obtain Concessionaires Sales Tax Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark key sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Concessionaires Sales Tax Return and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 concessionaires sales tax return

Create this form in 5 minutes!

How to create an eSignature for the 2021 concessionaires sales tax return

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an e-signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the hfc form 2271 and why is it important?

The hfc form 2271 is a critical document used by businesses to ensure compliance with specific regulations. Understanding its requirements can help avoid potential fines and streamline the documentation process. Utilizing airSlate SignNow for managing the hfc form 2271 makes the signing and submission process efficient and secure.

-

Can airSlate SignNow help with eSigning the hfc form 2271?

Yes, airSlate SignNow allows users to easily eSign the hfc form 2271 electronically. This eliminates the need for physical signatures and speeds up the process, allowing your business to remain agile. With our platform, users can securely send and track the hfc form 2271 with ease.

-

What features does airSlate SignNow offer for managing the hfc form 2271?

airSlate SignNow offers features such as customizable templates, in-app collaboration tools, and automated reminders to enhance the management of the hfc form 2271. These features help facilitate better communication and organization, ensuring that all aspects of the form are completed effectively. Automated workflows reduce errors and streamline the signing process.

-

What are the pricing options for using airSlate SignNow with the hfc form 2271?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for using the hfc form 2271. The pricing is designed to be cost-effective while providing robust features. Prospective customers can choose the plan that best fits their needs and budget.

-

How does airSlate SignNow ensure the security of the hfc form 2271?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the hfc form 2271. Our platform uses encryption protocols and secure cloud storage to protect your signed documents. We also offer features such as access controls and audit trails to monitor who accesses the form.

-

Is it easy to integrate airSlate SignNow with existing systems for the hfc form 2271?

Yes, airSlate SignNow is designed for seamless integration with various systems that your business may already use. This includes CRM, ERP, and document management systems, which can enhance the efficiency of processing the hfc form 2271. Such integrations allow for a smooth workflow.

-

What are the benefits of using airSlate SignNow for the hfc form 2271?

Using airSlate SignNow for the hfc form 2271 provides several benefits, including increased efficiency, time savings, and reduced manual errors. Our platform simplifies the eSigning process, enabling quick and secure document handling. This can lead to faster business operations and improved compliance.

Get more for Concessionaires Sales Tax Return

Find out other Concessionaires Sales Tax Return

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe