Section 205 30 Michigan Legislature State of Michigan 2017

What is the Section 205 30 Michigan Legislature State Of Michigan

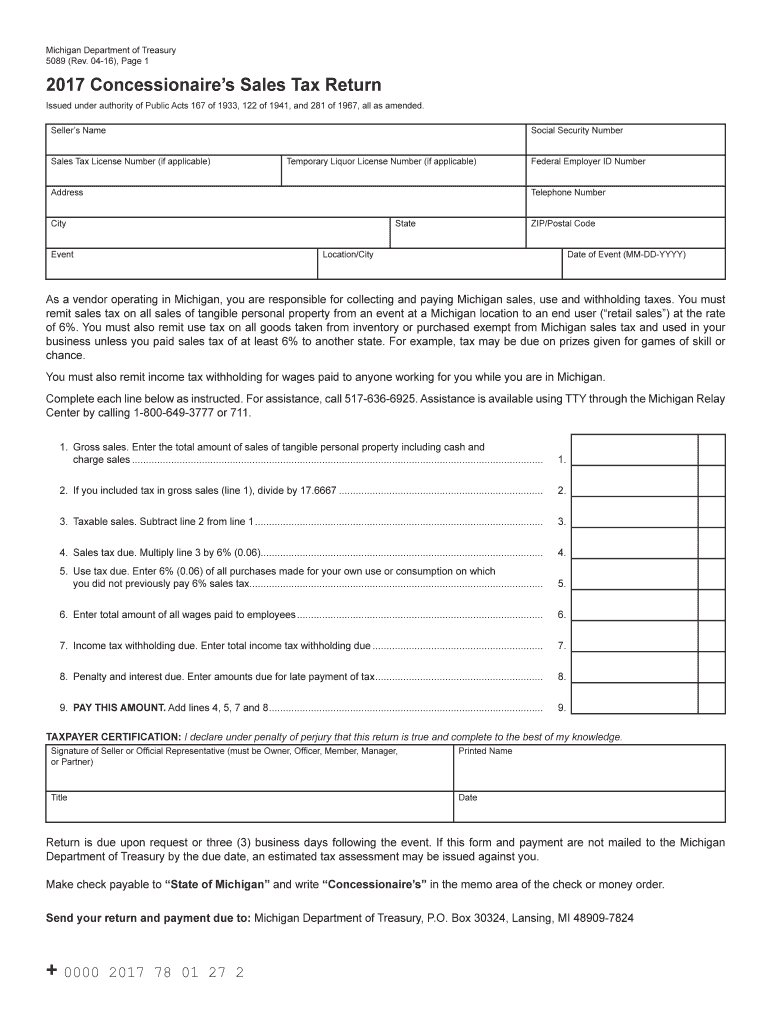

The Section 205 30 Michigan Legislature State Of Michigan form is a specific document used primarily for tax reporting purposes within the state of Michigan. This form is designed to assist individuals and businesses in accurately reporting their income and ensuring compliance with state tax regulations. It contains fillable fields where users can input necessary information, making it easier to complete online. The form adheres to the requirements set forth by the Michigan Department of Treasury, ensuring that all submissions are valid and recognized by state authorities.

Steps to complete the Section 205 30 Michigan Legislature State Of Michigan

Completing the Section 205 30 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and previous tax returns. Next, access the form through a secure online platform, where you can fill in the required fields. Carefully enter your information, double-checking for accuracy to avoid errors. Once completed, review the form for any missing information or discrepancies. Finally, use a reliable eSignature solution to sign the document digitally, ensuring it meets all legal requirements before submission.

Legal use of the Section 205 30 Michigan Legislature State Of Michigan

The legal use of the Section 205 30 form is governed by state tax laws and regulations. It is essential for taxpayers to understand that this form must be filled out accurately to avoid potential legal issues. The Michigan Department of Treasury recognizes electronically signed forms as valid, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. This allows taxpayers to submit their forms digitally, streamlining the process while maintaining legal integrity.

Form Submission Methods (Online / Mail / In-Person)

The Section 205 30 form can be submitted through various methods, providing flexibility for users. The most efficient way is to complete and submit the form online, which allows for immediate processing. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate state office. In-person submissions are also accepted at designated tax offices. Each method has its own processing times, so users should consider their preferences and deadlines when choosing how to submit their forms.

Key elements of the Section 205 30 Michigan Legislature State Of Michigan

Key elements of the Section 205 30 form include personal identification details, income reporting sections, and signature fields. Users must provide their name, address, and Social Security number or Employer Identification Number (EIN). The income reporting sections require detailed information about various income sources, including wages, dividends, and interest. Additionally, the form includes a section for deductions and credits, which can significantly affect the overall tax liability. Finally, the signature field, which can be completed electronically, is crucial for validating the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Section 205 30 form are critical for compliance with Michigan tax laws. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April 15. However, taxpayers should be aware of any extensions or specific state deadlines that may apply. It is advisable to stay informed about any changes in tax legislation that could impact filing dates, ensuring timely submissions to avoid penalties.

Quick guide on how to complete section 20530 michigan legislature state of michigan

Your assistance manual on how to prepare your Section 205 30 Michigan Legislature State Of Michigan

If you’re curious about how to finalize and present your Section 205 30 Michigan Legislature State Of Michigan, here are some brief instructions on how to simplify tax filing signNowly.

To initiate, you just need to set up your airSlate SignNow account to revolutionize your document handling online. airSlate SignNow is an incredibly user-friendly and powerful document management solution that enables you to modify, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and electronic signatures, and revert to amend information as necessary. Enhance your tax administration with sophisticated PDF editing, eSigning features, and user-friendly sharing options.

Follow the directions below to complete your Section 205 30 Michigan Legislature State Of Michigan in just a few minutes:

- Create your account and start managing PDFs within moments.

- Utilize our library to obtain any IRS tax form; search through versions and schedules.

- Click Obtain form to access your Section 205 30 Michigan Legislature State Of Michigan in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-recognized eSignature (if required).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting on paper may increase return errors and delay reimbursements. Furthermore, prior to e-filing your taxes, check the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct section 20530 michigan legislature state of michigan

FAQs

-

Could an expert tell me how an out of state executor from Washington can legally transfer pistols and rifles which are located in Michigan and to be sold in Michigan?

I am not an expert on Michigan law, but i can read the instructions. I suggest the executor begin by going to the Michigan State Police web site, MSP - Firearmswhere there is a link to a compilation of firearms laws. http://www.legislature.mi.gov/do...Page 8 of that says:8) This section does not prevent the transfer of ownership of pistols to an heir or devisee, whether by testamentary bequest or by the laws of intestacy regardless of whether the pistol is registered with this state. An individual who has inherited a pistol shall obtain a license as required in this section within 30 days of taking physical possession of the pistol. The license may be signed by a next of kin of the decedent or the person authorized to dispose of property under the estates and protected individuals code, 1998 PA 386, MCL 700.1101 to 700.8206, including when the next of kin is the individual inheriting the pistol. If the heir or devisee is not qualified for a license under this section, the heir or devisee may direct the next of kin or person authorized to dispose of property under the estates and protected individuals code, 1998 PA 386, MCL 700.1101 to 700.8206, to dispose of the pistol in any manner that is lawful and the heir or devisee considers appropriate. The person authorized to dispose of property under the estates and protected individuals code, 1998 PA 386, MCL 700.1101 to 700.8206, is not required to obtain a license under this section if he or she takes temporary lawful possession of the pistol in the process of disposing of the pistol pursuant to the decedent’s testamentary bequest or the laws ofand so on.If the executor is still nervous I suggest he or she get advice from a member of the Michigan bar.

-

Some in California want to secede from the state and form the new state of California. According to Article 4 Section 3 of the US Constitution, permission to secede must be sought from the state legislature. How did W Virginia secede from Virginia?

West Virginia became a separate state the same way California would have to split into separate states. The people of West Virginia wanted to separate from Virginia, and Congress wanted them to. In the case of West Virginia it didn’t hurt that the State of Virginia was in rebellion and as far as Congress was concerned didn’t have a legitimate legislature to block separation.Splitting a state into smaller states or joining small states into one larger state are possible as long as Congress and the state legislatures involved agree. Don’t hold your breath.

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

Create this form in 5 minutes!

How to create an eSignature for the section 20530 michigan legislature state of michigan

How to create an eSignature for the Section 20530 Michigan Legislature State Of Michigan online

How to create an eSignature for the Section 20530 Michigan Legislature State Of Michigan in Google Chrome

How to generate an eSignature for signing the Section 20530 Michigan Legislature State Of Michigan in Gmail

How to generate an eSignature for the Section 20530 Michigan Legislature State Of Michigan right from your smartphone

How to create an eSignature for the Section 20530 Michigan Legislature State Of Michigan on iOS devices

How to create an eSignature for the Section 20530 Michigan Legislature State Of Michigan on Android

People also ask

-

What is Section 205 30 Michigan Legislature State Of Michigan?

Section 205 30 Michigan Legislature State Of Michigan refers to specific legislative provisions regarding electronic signatures and transactions in the state. This section outlines the legal framework that validates electronic signatures, ensuring they hold the same weight as traditional signatures. Understanding this legislation is crucial for businesses looking to adopt eSignature solutions like airSlate SignNow.

-

How can airSlate SignNow help me comply with Section 205 30 Michigan Legislature State Of Michigan?

airSlate SignNow is designed to comply with the Section 205 30 Michigan Legislature State Of Michigan by providing legally binding electronic signatures. Our platform adheres to the legal standards set forth in this legislation, ensuring that all signed documents are valid and enforceable. This compliance helps businesses operate confidently in Michigan's legal landscape.

-

What features does airSlate SignNow offer that align with Section 205 30 Michigan Legislature State Of Michigan?

airSlate SignNow offers a range of features that align with Section 205 30 Michigan Legislature State Of Michigan, including secure document storage, audit trails, and customizable signing workflows. These features ensure that all electronic signatures are tracked and recorded, enhancing the legal integrity of your documents. By using airSlate SignNow, you can streamline your signing process while remaining compliant with Michigan law.

-

Is airSlate SignNow a cost-effective solution for businesses in Michigan?

Yes, airSlate SignNow is a cost-effective solution for businesses in Michigan looking to comply with Section 205 30 Michigan Legislature State Of Michigan. Our pricing plans are designed to accommodate businesses of all sizes, offering flexible options that fit your budget. By choosing our platform, you not only save on paper and postage but also enhance your workflow efficiency.

-

Can I integrate airSlate SignNow with other applications for better workflow management?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance workflow management while complying with Section 205 30 Michigan Legislature State Of Michigan. You can connect it with tools like Google Drive, Salesforce, and Slack, allowing for a more streamlined document management process. This integration capability ensures that all your business operations remain efficient and compliant.

-

What are the benefits of using airSlate SignNow for electronic signatures in Michigan?

Using airSlate SignNow for electronic signatures offers numerous benefits for businesses in Michigan, particularly in light of Section 205 30 Michigan Legislature State Of Michigan. You can enjoy faster turnaround times, reduced paper usage, and improved document tracking. These advantages not only enhance productivity but also help you maintain compliance with state legislation.

-

How secure is airSlate SignNow when it comes to signing documents in Michigan?

airSlate SignNow prioritizes security, ensuring that all electronic signatures are protected in accordance with Section 205 30 Michigan Legislature State Of Michigan. Our platform utilizes industry-standard encryption and security protocols to safeguard your documents. This commitment to security means you can trust that your sensitive information remains confidential and secure.

Get more for Section 205 30 Michigan Legislature State Of Michigan

- Printable humana inpatient authorization form

- Volleyball assessment pe central form

- Permission cum admission form

- Dons dorganes et de tissus aprs dcs dans le cadre de l form

- Crash data and statisticsdpshighway safety form

- Form itd3823 certification of no employer identification

- Proof of immunization compliance form

- Church endorsement form

Find out other Section 205 30 Michigan Legislature State Of Michigan

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien