L8 Request for Income Tax Clearance City of Detroit 2018-2026

What is the L8 Request For Income Tax Clearance City Of Detroit

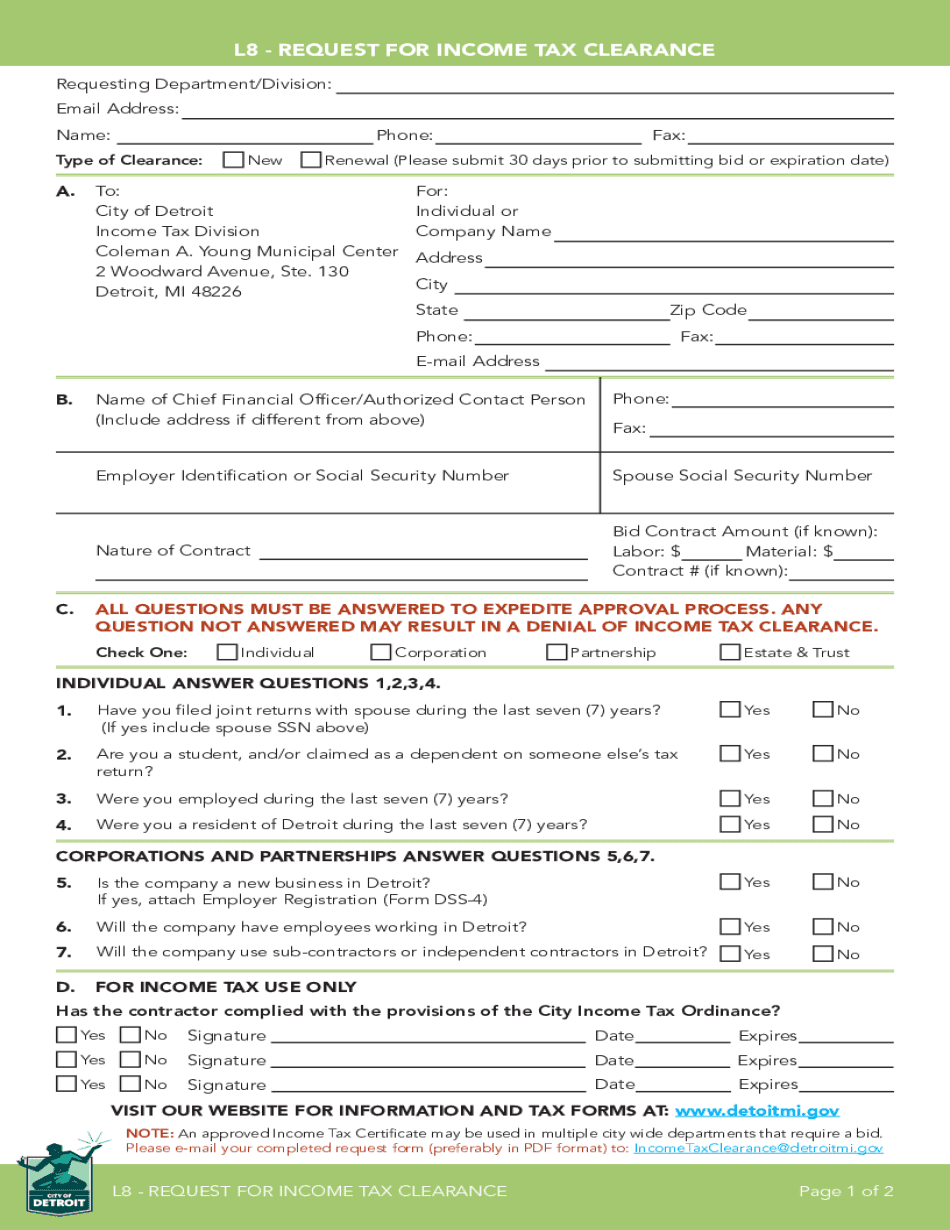

The L8 Request for Income Tax Clearance is a crucial document for individuals and businesses in Detroit seeking to confirm their tax compliance status. This form is often required when applying for various permits, licenses, or during the sale of property. It serves as proof that all income taxes owed to the City of Detroit have been paid or that a payment plan is in place. Understanding the purpose of this form is essential for anyone navigating tax obligations in the city.

Steps to complete the L8 Request For Income Tax Clearance City Of Detroit

Completing the L8 Request for Income Tax Clearance involves several key steps:

- Gather necessary information, including your Social Security number or Employer Identification Number, and any relevant tax documents.

- Visit the official City of Detroit website or the appropriate office to obtain the L8 form.

- Fill out the form accurately, ensuring all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the completed form either online, by mail, or in person, depending on the available options.

Required Documents

When submitting the L8 Request for Income Tax Clearance, you may need to provide several supporting documents to verify your tax status. These documents typically include:

- Proof of identity, such as a driver's license or state ID.

- Recent tax returns or W-2 forms to demonstrate income history.

- Any correspondence from the City of Detroit regarding your tax status.

Having these documents ready can streamline the process and help ensure your request is processed without unnecessary delays.

Form Submission Methods (Online / Mail / In-Person)

The L8 Request for Income Tax Clearance can be submitted through various methods, providing flexibility for users:

- Online: Many users prefer to submit their requests electronically through the City of Detroit's official portal, which often allows for faster processing.

- Mail: If you choose to submit the form by mail, ensure it is sent to the correct department and consider using a trackable delivery method.

- In-Person: For those who prefer face-to-face interaction, visiting the local tax office can be beneficial for immediate assistance and clarification.

Eligibility Criteria

To qualify for the L8 Request for Income Tax Clearance, applicants must meet specific eligibility criteria. Generally, individuals and businesses must:

- Be current with all income tax payments owed to the City of Detroit.

- Have filed all required tax returns for the applicable years.

- Not have any outstanding tax liabilities or unresolved issues with the tax authority.

Meeting these criteria is essential for a successful application and to avoid potential penalties.

Legal use of the L8 Request For Income Tax Clearance City Of Detroit

The L8 Request for Income Tax Clearance holds legal significance as it serves as an official declaration of tax compliance. This document can be requested by various entities, including:

- Property buyers needing proof of tax status before closing a sale.

- Businesses applying for licenses or permits that require verification of tax compliance.

- Individuals seeking to resolve any disputes regarding their tax obligations.

Understanding the legal implications of this form can help ensure that it is used appropriately and effectively in various transactions.

Quick guide on how to complete l8 request for income tax clearance city of detroit

Complete L8 Request For Income Tax Clearance City Of Detroit effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to find the right template and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle L8 Request For Income Tax Clearance City Of Detroit on any platform using airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

How to modify and eSign L8 Request For Income Tax Clearance City Of Detroit with ease

- Find L8 Request For Income Tax Clearance City Of Detroit and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your method of delivering your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign L8 Request For Income Tax Clearance City Of Detroit to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct l8 request for income tax clearance city of detroit

Create this form in 5 minutes!

People also ask

-

What is the city of Detroit tax clearance process?

The city of Detroit tax clearance process is essential for businesses to ensure they are compliant with local tax regulations. It involves obtaining a clearance certificate from the City of Detroit, which verifies that all tax obligations have been met. Using airSlate SignNow can simplify this process, allowing for secure electronic signatures and document management.

-

How does airSlate SignNow help with city of Detroit tax clearance?

airSlate SignNow provides an easy-to-use platform for managing the documentation needed for the city of Detroit tax clearance. With its secure eSigning feature, businesses can quickly sign and send necessary forms. This efficiency helps streamline the tax clearance process, saving time and reducing administrative burdens.

-

Is there a cost associated with the city of Detroit tax clearance using airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for the city of Detroit tax clearance, but it is generally more cost-effective than traditional methods. The pricing plans are designed to fit various business sizes and needs, ensuring that you get the best value for your investment. The efficiencies gained can often justify the expense.

-

What features does airSlate SignNow offer for the city of Detroit tax clearance?

airSlate SignNow offers a range of features specifically useful for the city of Detroit tax clearance, including electronic signatures, document templates, and audit trails. These features enhance the reliability and security of your documents, ensuring that your tax clearance process is smooth and compliant. Additionally, you can manage all your documents in one user-friendly interface.

-

Are there integrations available for managing city of Detroit tax clearance?

Yes, airSlate SignNow integrates with various third-party applications, allowing for seamless management of documents related to the city of Detroit tax clearance. Integration with tools such as CRM systems or file storage solutions enhances workflow and keeps all related documents organized. This flexibility makes it easier to handle the tax clearance process efficiently.

-

What are the benefits of using airSlate SignNow for city of Detroit tax clearance?

The primary benefits of using airSlate SignNow for city of Detroit tax clearance include increased efficiency, reduced paperwork, and enhanced compliance. With features like real-time tracking and reminders, you can ensure that your documents are processed on time. This not only saves valuable resources but also helps prevent potential penalties due to overlooked paperwork.

-

How can I get started with airSlate SignNow for city of Detroit tax clearance?

Getting started with airSlate SignNow for city of Detroit tax clearance is simple. You can sign up for a free trial on our website to explore our features and see how they can benefit your tax clearance process. After that, choose a pricing plan that fits your business needs and start streamlining your document management today.

Get more for L8 Request For Income Tax Clearance City Of Detroit

- Essential legal life documents for newlyweds north dakota form

- North dakota legal 497317758 form

- Essential legal life documents for new parents north dakota form

- General power of attorney for care and custody of child or children north dakota form

- North dakota business nd form

- Company employment policies and procedures package north dakota form

- Nd power attorney form

- Newly divorced individuals package north dakota form

Find out other L8 Request For Income Tax Clearance City Of Detroit

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast