State of Iowa TaxesIowa Department of RevenueIowa Individual Tax InformationIowa Department of RevenueState of Iowa TaxesIowa De 2021

Understanding Iowa Taxes and the Department of Revenue

The State of Iowa taxes are administered by the Iowa Department of Revenue, which provides essential information for individuals and businesses regarding their tax obligations. This includes guidelines on income tax, sales tax, and property tax. The Iowa Department of Revenue also offers resources for understanding tax credits and deductions available to residents. For individuals, the Iowa Individual Tax Information section is particularly useful as it outlines how to file taxes, available forms, and deadlines.

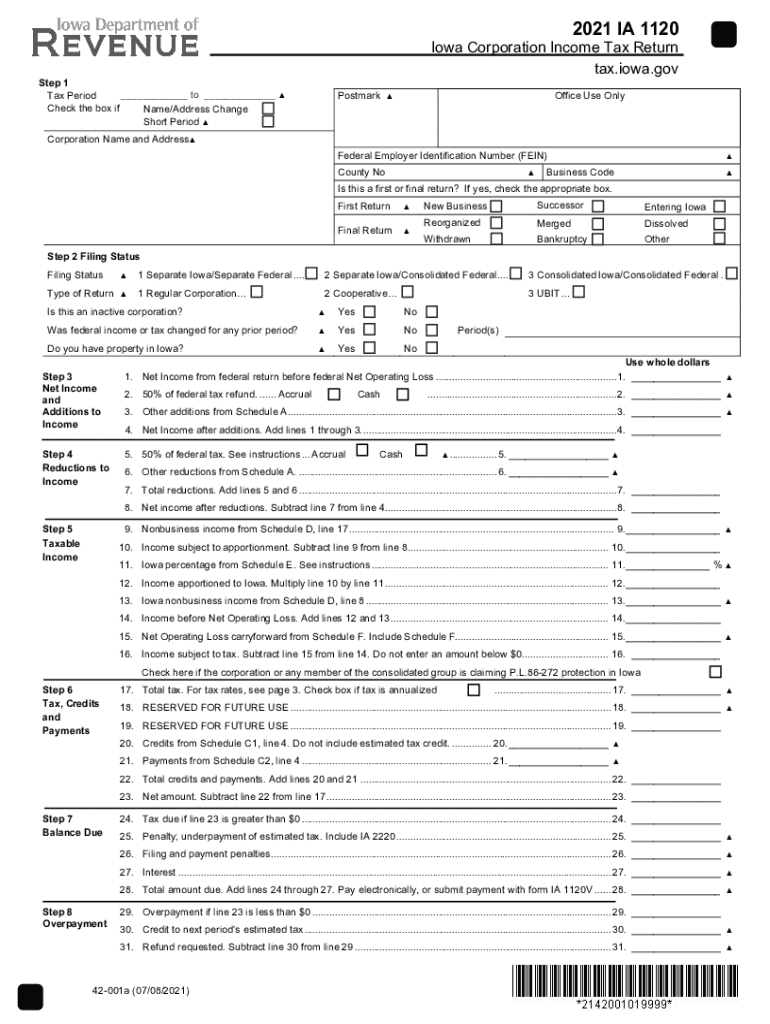

Steps to Complete the IA 1120S S Corporations Return

Completing the IA 1120S S Corporations Return requires careful attention to detail. Start by gathering all necessary financial documents, including income statements and expense reports. Next, download the IA 1120S form from the Iowa Department of Revenue website. Fill out the form with accurate information regarding your corporation's income, deductions, and credits. Ensure that all calculations are correct to avoid penalties. Once completed, review the form for accuracy before submission.

Filing Deadlines for Iowa Taxes

It is crucial to be aware of the filing deadlines for Iowa taxes to avoid penalties. The standard deadline for filing individual income tax returns is typically April 30th of each year. For S Corporations filing the IA 1120S, the deadline aligns with the federal tax deadline, which is usually March 15th. Extensions may be available, but it is important to file for an extension before the original deadline to ensure compliance.

Required Documents for Iowa Tax Filing

When filing Iowa taxes, specific documents are required to support your claims. These may include:

- W-2 forms from employers

- 1099 forms for other income

- Receipts for deductible expenses

- Previous year's tax return for reference

- Any relevant schedules or additional forms required by the Iowa Department of Revenue

Having these documents organized will facilitate a smoother filing process.

Legal Use of Iowa Tax Forms

The IA 1120S S Corporations Return and other Iowa tax forms are legally binding documents. To ensure their validity, they must be completed accurately and submitted on time. Electronic signatures are accepted, provided they comply with the relevant eSignature laws. Using a trusted platform for eSigning can enhance the security and legality of your submissions.

State-Specific Rules for Iowa Taxes

Iowa has specific rules that govern its tax system, which may differ from federal regulations. For instance, Iowa allows certain tax credits that can reduce your overall tax liability. Additionally, the state has unique rules regarding the treatment of business income and deductions. It is important to familiarize yourself with these rules to ensure compliance and optimize your tax situation.

Quick guide on how to complete state of iowa taxesiowa department of revenueiowa individual tax informationiowa department of revenuestate of iowa taxesiowa

Prepare State Of Iowa TaxesIowa Department Of RevenueIowa Individual Tax InformationIowa Department Of RevenueState Of Iowa TaxesIowa De easily on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can locate the correct form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle State Of Iowa TaxesIowa Department Of RevenueIowa Individual Tax InformationIowa Department Of RevenueState Of Iowa TaxesIowa De on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign State Of Iowa TaxesIowa Department Of RevenueIowa Individual Tax InformationIowa Department Of RevenueState Of Iowa TaxesIowa De effortlessly

- Find State Of Iowa TaxesIowa Department Of RevenueIowa Individual Tax InformationIowa Department Of RevenueState Of Iowa TaxesIowa De and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your alterations.

- Select how you would like to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and electronically sign State Of Iowa TaxesIowa Department Of RevenueIowa Individual Tax InformationIowa Department Of RevenueState Of Iowa TaxesIowa De and ensure exceptional communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of iowa taxesiowa department of revenueiowa individual tax informationiowa department of revenuestate of iowa taxesiowa

Create this form in 5 minutes!

People also ask

-

What are the primary features of airSlate SignNow related to State Of Iowa Taxes?

airSlate SignNow offers a user-friendly platform that simplifies document management and eSignature processes, essential for handling State Of Iowa Taxes. Users can easily create, send, and sign tax documents digitally, ensuring compliance with Iowa Department Of Revenue regulations.

-

How does airSlate SignNow help with Iowa Individual Tax Information?

With airSlate SignNow, managing Iowa Individual Tax Information becomes seamless. Our platform allows for easy document tracking and secure storage, making it simpler to access your tax information when dealing with the Iowa Department Of Revenue.

-

Can airSlate SignNow assist with IA 1120S S Corporations Return Instructions?

Yes, airSlate SignNow facilitates the process of completing IA 1120S S Corporations Return Instructions, 42 005, by providing templates and tools to ensure accuracy. Our platform streamlines the gathering of necessary signatures and data, which is essential for timely filing.

-

What is the pricing structure for airSlate SignNow's services regarding State Of Iowa Taxes?

airSlate SignNow offers flexible pricing plans designed to fit various business needs. Our affordable solutions cater to tasks related to State Of Iowa Taxes, ensuring that you can efficiently manage your documents without breaking the bank.

-

How does airSlate SignNow enhance compliance with the Iowa Department Of Revenue?

By utilizing airSlate SignNow, businesses can enhance compliance with the Iowa Department Of Revenue through automated reminders and secure document storage. This ensures that all necessary tax documents are up-to-date and accessible for tax seasons.

-

Does airSlate SignNow integrate with other accounting software for Iowa tax processes?

Absolutely, airSlate SignNow integrates seamlessly with many accounting software solutions, enhancing the efficiency of managing Iowa taxes. This integration facilitates automatic population of tax forms and quick access to Iowa Individual Tax Information.

-

What benefits does airSlate SignNow provide for filing State of Iowa Taxes?

airSlate SignNow offers numerous benefits for filing State Of Iowa Taxes, such as saving time and reducing paperwork. Our solution ensures that documents are sent and signed electronically, minimizing the risk of errors and delays.

Get more for State Of Iowa TaxesIowa Department Of RevenueIowa Individual Tax InformationIowa Department Of RevenueState Of Iowa TaxesIowa De

- Satisfaction release or cancellation of mortgage by corporation north dakota form

- Satisfaction release or cancellation of mortgage by individual north dakota form

- Partial release of property from mortgage for corporation north dakota form

- Partial release of property from mortgage by individual holder north dakota form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy north dakota form

- Warranty deed for parents to child with reservation of life estate north dakota form

- Warranty deed for separate or joint property to joint tenancy north dakota form

- Warranty deed to separate property of one spouse to both spouses as joint tenants north dakota form

Find out other State Of Iowa TaxesIowa Department Of RevenueIowa Individual Tax InformationIowa Department Of RevenueState Of Iowa TaxesIowa De

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now