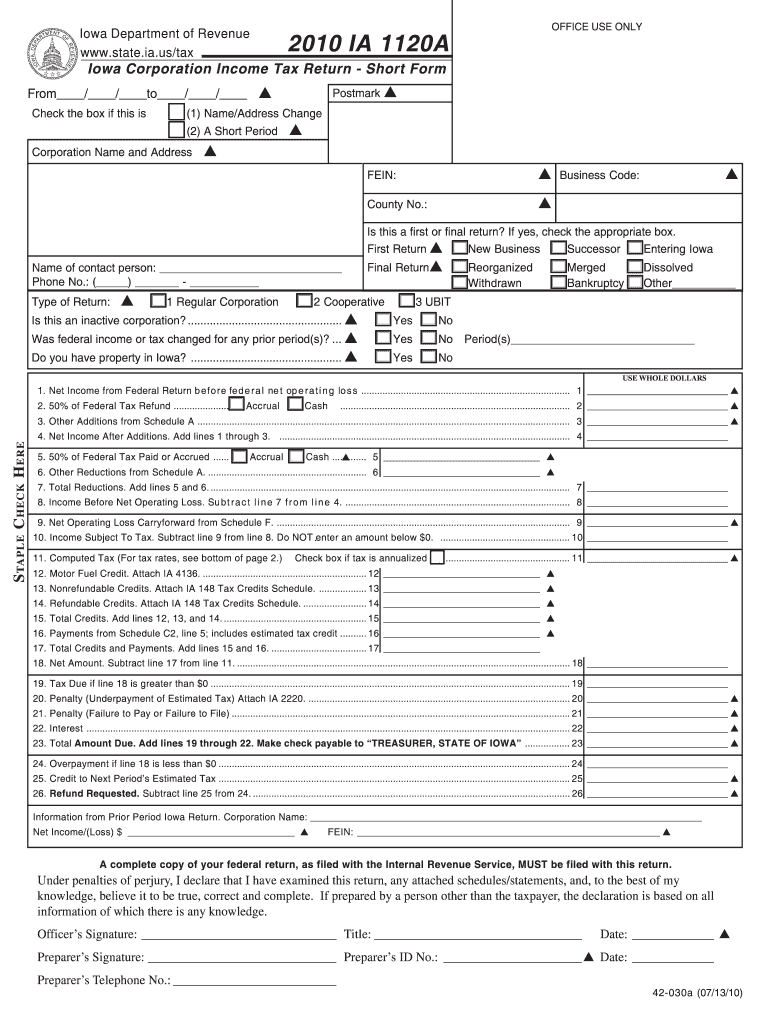

Iowa Corporation Short Form Income Tax Return State of Iowa 2010

What is the Iowa Corporation Short Form Income Tax Return State Of Iowa

The Iowa Corporation Short Form Income Tax Return is a specific tax form used by corporations operating in Iowa to report their income and calculate their tax liability. This form is designed for corporations that meet certain criteria, allowing them to file a simplified return. It streamlines the reporting process for eligible corporations, making it easier to comply with state tax regulations.

Steps to complete the Iowa Corporation Short Form Income Tax Return State Of Iowa

Completing the Iowa Corporation Short Form Income Tax Return involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Access the form online or obtain a physical copy from the Iowa Department of Revenue.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the completed form by the designated deadline, ensuring you retain a copy for your records.

How to obtain the Iowa Corporation Short Form Income Tax Return State Of Iowa

The Iowa Corporation Short Form Income Tax Return can be obtained through the Iowa Department of Revenue's website. Users can download a digital copy or request a paper form to be mailed. It is essential to ensure that you are using the most current version of the form to comply with state regulations.

Legal use of the Iowa Corporation Short Form Income Tax Return State Of Iowa

The Iowa Corporation Short Form Income Tax Return is legally binding when completed and submitted in accordance with state laws. Corporations must ensure that the information provided is accurate and truthful to avoid penalties. The form must be signed by an authorized representative of the corporation, which validates its legal standing.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Iowa Corporation Short Form Income Tax Return. Typically, the return is due on the first day of the fourth month following the end of the corporation's fiscal year. It is crucial to stay informed about any changes to these deadlines to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The Iowa Corporation Short Form Income Tax Return can be submitted through various methods:

- Online: Corporations can file electronically through the Iowa Department of Revenue's e-filing system.

- Mail: Completed forms can be mailed to the appropriate address provided by the Iowa Department of Revenue.

- In-Person: Corporations may also choose to deliver their forms directly to a local Department of Revenue office.

Quick guide on how to complete iowa corporation short form income tax return state of iowa

Your assistance manual on how to prepare your Iowa Corporation Short Form Income Tax Return State Of Iowa

If you’re wondering how to complete and submit your Iowa Corporation Short Form Income Tax Return State Of Iowa, here are some concise instructions to simplify the tax declaration process.

To begin, you just need to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to edit, draft, and finalize your tax forms with ease. With its editor, you can alternate between text, check boxes, and electronic signatures and revert to modify details as necessary. Enhance your tax administration with sophisticated PDF editing, electronic signing, and easy sharing options.

Adhere to the steps below to fulfill your Iowa Corporation Short Form Income Tax Return State Of Iowa in just a few minutes:

- Create your account and start working on PDFs almost instantly.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Iowa Corporation Short Form Income Tax Return State Of Iowa in our editor.

- Complete the required fillable sections with your details (text, numbers, check marks).

- Use the Sign Tool to add your legally-recognized electronic signature (if needed).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically using airSlate SignNow. Keep in mind that paper filing may lead to errors on returns and delay refunds. Before e-filing your taxes, be sure to review the IRS website for declaration guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct iowa corporation short form income tax return state of iowa

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

Create this form in 5 minutes!

How to create an eSignature for the iowa corporation short form income tax return state of iowa

How to make an electronic signature for your Iowa Corporation Short Form Income Tax Return State Of Iowa in the online mode

How to make an electronic signature for your Iowa Corporation Short Form Income Tax Return State Of Iowa in Google Chrome

How to make an electronic signature for signing the Iowa Corporation Short Form Income Tax Return State Of Iowa in Gmail

How to create an eSignature for the Iowa Corporation Short Form Income Tax Return State Of Iowa from your mobile device

How to create an eSignature for the Iowa Corporation Short Form Income Tax Return State Of Iowa on iOS

How to create an electronic signature for the Iowa Corporation Short Form Income Tax Return State Of Iowa on Android OS

People also ask

-

What is the Iowa Corporation Short Form Income Tax Return State Of Iowa?

The Iowa Corporation Short Form Income Tax Return State Of Iowa is a simplified tax return option designed for eligible corporations operating in Iowa. This form allows corporations to report income and calculate their tax liability more efficiently. By using this short form, businesses can streamline their filing process and ensure compliance with state tax regulations.

-

Who is eligible to file the Iowa Corporation Short Form Income Tax Return State Of Iowa?

Eligibility for the Iowa Corporation Short Form Income Tax Return State Of Iowa typically includes small corporations with a certain level of income and specific operational criteria. Corporations must meet the revenue threshold and comply with Iowa tax laws to qualify for this simplified filing option. To determine eligibility, it’s advisable to consult with a tax professional or review state guidelines.

-

What are the benefits of using the Iowa Corporation Short Form Income Tax Return State Of Iowa?

Using the Iowa Corporation Short Form Income Tax Return State Of Iowa provides several benefits, including a quicker filing process and reduced paperwork. This form is designed to minimize the complexity of tax preparation, allowing businesses to focus more on their operations rather than on extensive tax filing. Additionally, it can lead to faster processing times and refunds.

-

How can airSlate SignNow help with the Iowa Corporation Short Form Income Tax Return State Of Iowa?

airSlate SignNow offers a user-friendly platform for businesses to securely send and eSign the Iowa Corporation Short Form Income Tax Return State Of Iowa. By utilizing our electronic signature solutions, you can streamline the document signing process, ensuring that your tax returns are filed promptly and efficiently. Our service simplifies compliance and improves document management.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides essential features for tax document management, including electronic signatures, document templates, and real-time tracking. These features enable businesses to efficiently handle the Iowa Corporation Short Form Income Tax Return State Of Iowa and other important documents. With easy access to templates, you can quickly prepare and send your tax returns for signature.

-

Is airSlate SignNow cost-effective for filing Iowa Corporation Short Form Income Tax Return State Of Iowa?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to file the Iowa Corporation Short Form Income Tax Return State Of Iowa. Our pricing plans are designed to accommodate varying business needs, ensuring you have access to essential features without overspending. This affordability, combined with our efficiency, makes us a great choice for tax document management.

-

Can airSlate SignNow integrate with my existing accounting software for tax filing?

Absolutely! airSlate SignNow can integrate with various accounting software solutions to enhance your filing process for the Iowa Corporation Short Form Income Tax Return State Of Iowa. This integration allows for seamless data transfer and document management, ensuring that all your financial information is accurately reflected in your tax returns.

Get more for Iowa Corporation Short Form Income Tax Return State Of Iowa

- Construction contract invitation for bids for form

- Cook services contract form

- Kk car insurance onlinesave money when you compare form

- Independent contractor breeder agreement form

- Number 18 pages 4361 4540 new jersey state library form

- Specifications department of administrative services ctgov form

- Independent contractor psychic services contract form

- Independent contractor technical writer agreement form

Find out other Iowa Corporation Short Form Income Tax Return State Of Iowa

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter