Iowa Fidicuary Return 2011

What is the Iowa Fiduciary Return

The Iowa Fiduciary Return is a tax form used by fiduciaries to report the income, deductions, and tax liabilities of estates and trusts in the state of Iowa. This form is essential for ensuring compliance with state tax laws and is designed to provide the Iowa Department of Revenue with a clear picture of the financial activities of the estate or trust. Fiduciaries, such as executors or trustees, are responsible for managing the assets of the estate or trust and must file this return annually to report any income generated during the tax year.

Steps to Complete the Iowa Fiduciary Return

Completing the Iowa Fiduciary Return involves several key steps:

- Gather Required Information: Collect all necessary financial documents, including income statements, expense records, and prior year tax returns.

- Complete the Form: Fill out the Iowa Fiduciary Return, ensuring all income and deductions are accurately reported. Pay special attention to the sections regarding distributions to beneficiaries.

- Review for Accuracy: Double-check all entries for accuracy and completeness to avoid errors that could lead to penalties or delays.

- Sign and Date: The fiduciary must sign and date the return, affirming that the information provided is true and correct.

- Submit the Return: File the completed form with the Iowa Department of Revenue by the designated deadline, either online or via mail.

Legal Use of the Iowa Fiduciary Return

The Iowa Fiduciary Return serves a legal purpose by ensuring that estates and trusts comply with state tax regulations. It is crucial for fiduciaries to understand the legal implications of this form, as failure to file or inaccuracies can result in penalties. The return must be filed in accordance with Iowa law, and fiduciaries are legally obligated to report all income and distributions accurately. This form not only helps in tax compliance but also protects the fiduciary from potential legal repercussions associated with mismanagement of the estate or trust.

Filing Deadlines / Important Dates

Filing deadlines for the Iowa Fiduciary Return are critical for compliance. Typically, the return is due on the first day of the fourth month following the end of the tax year. For most estates and trusts that operate on a calendar year, this means the return is due by April 30. Fiduciaries should be aware of any extensions available and the process for requesting them, as timely filing is essential to avoid penalties.

Required Documents

To complete the Iowa Fiduciary Return, several documents are necessary:

- Income statements for the estate or trust, including interest, dividends, and capital gains.

- Records of any deductions, such as administrative expenses and distributions to beneficiaries.

- Prior year tax returns, if applicable, to ensure consistency and accuracy in reporting.

- Any supporting documentation that verifies income and expenses claimed on the return.

Form Submission Methods

The Iowa Fiduciary Return can be submitted through various methods to accommodate different preferences:

- Online Submission: Fiduciaries can file electronically through the Iowa Department of Revenue's online portal, which offers a streamlined process.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Iowa Department of Revenue.

- In-Person: Fiduciaries may also choose to submit the form in person at designated state offices, although this option may vary by location.

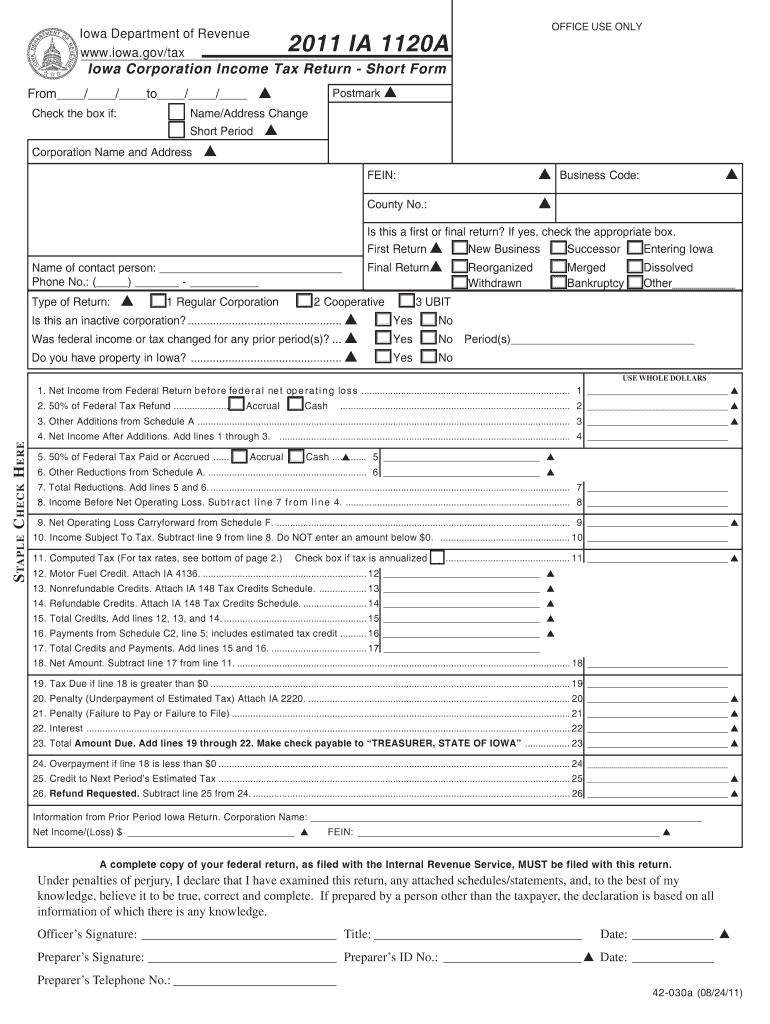

Quick guide on how to complete iowa corporation short form income tax return state of iowa iowa

Your assistance manual on how to prepare your Iowa Fidicuary Return

If you’re curious about how to generate and dispatch your Iowa Fidicuary Return, here are some concise instructions on how to facilitate tax processing signNowly.

To commence, you simply need to sign up for your airSlate SignNow account to revolutionize your document handling online. airSlate SignNow is a very intuitive and robust document solution that enables you to modify, create, and complete your income tax documents with ease. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and revisit to modify details as necessary. Streamline your tax management with enhanced PDF editing, eSigning, and user-friendly sharing.

Adhere to the steps below to finalize your Iowa Fidicuary Return within a few moments:

- Create your account and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax document; browse through versions and schedules.

- Click Get form to access your Iowa Fidicuary Return in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if needed).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can increase return errors and delay reimbursements. Additionally, prior to e-filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct iowa corporation short form income tax return state of iowa iowa

FAQs

-

How can rural states with sparse and spread out populations like Dakotas, Iowa have commute times of only 16 to 20 minutes?

Most people are probably within 15 miles of their place of work. In rural Minnesota where I live (or Iowa or the Dakotas) you can go 15 miles in 15–20 minutes. If you count farmers, and there a lots of farmers here, the commute from home to his field is not more than a mile. A lot of farmers rent land.

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the iowa corporation short form income tax return state of iowa iowa

How to make an electronic signature for your Iowa Corporation Short Form Income Tax Return State Of Iowa Iowa online

How to make an electronic signature for the Iowa Corporation Short Form Income Tax Return State Of Iowa Iowa in Google Chrome

How to make an eSignature for putting it on the Iowa Corporation Short Form Income Tax Return State Of Iowa Iowa in Gmail

How to create an eSignature for the Iowa Corporation Short Form Income Tax Return State Of Iowa Iowa from your smart phone

How to create an eSignature for the Iowa Corporation Short Form Income Tax Return State Of Iowa Iowa on iOS

How to create an electronic signature for the Iowa Corporation Short Form Income Tax Return State Of Iowa Iowa on Android OS

People also ask

-

What is the iowa short form, and how can it be used with airSlate SignNow?

The iowa short form is a streamlined document used to collect essential information quickly. With airSlate SignNow, you can easily create, send, and eSign the iowa short form, ensuring that you capture the necessary details without additional hassle.

-

What are the pricing options for using the iowa short form on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that make it cost-effective to use the iowa short form. You can choose from various subscription options based on your business needs, with each plan granting access to features designed to maximize efficiency in document management.

-

Can I customize the iowa short form templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the iowa short form templates to suit your unique requirements. You can easily add your branding, adjust fields, and modify the layout to ensure that it fits your organization's workflow perfectly.

-

What are the main benefits of using airSlate SignNow for the iowa short form?

Using airSlate SignNow for the iowa short form offers numerous benefits, including enhanced efficiency, quick turnaround times, and improved accuracy in data collection. The platform simplifies the signing process, making it easier for both you and your clients to manage documents seamlessly.

-

How can I integrate the iowa short form with other applications using airSlate SignNow?

airSlate SignNow supports various integrations with popular business applications, allowing you to seamlessly use the iowa short form alongside your existing tools. This capability ensures that your document management processes are streamlined and efficient across different software platforms.

-

Is it secure to send and eSign the iowa short form through airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and complies with industry standards to protect your sensitive information. When you send or eSign the iowa short form, you can trust that your data is secure and only accessible by authorized users.

-

How quickly can I send out the iowa short form with airSlate SignNow?

You can send out the iowa short form within minutes using airSlate SignNow. The platform's user-friendly interface facilitates fast document preparation and delivery, allowing you to address your clients' needs promptly and efficiently.

Get more for Iowa Fidicuary Return

Find out other Iowa Fidicuary Return

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word