Wisconsin Homestead Credit Form 2022

What is the Wisconsin Homestead Credit Form

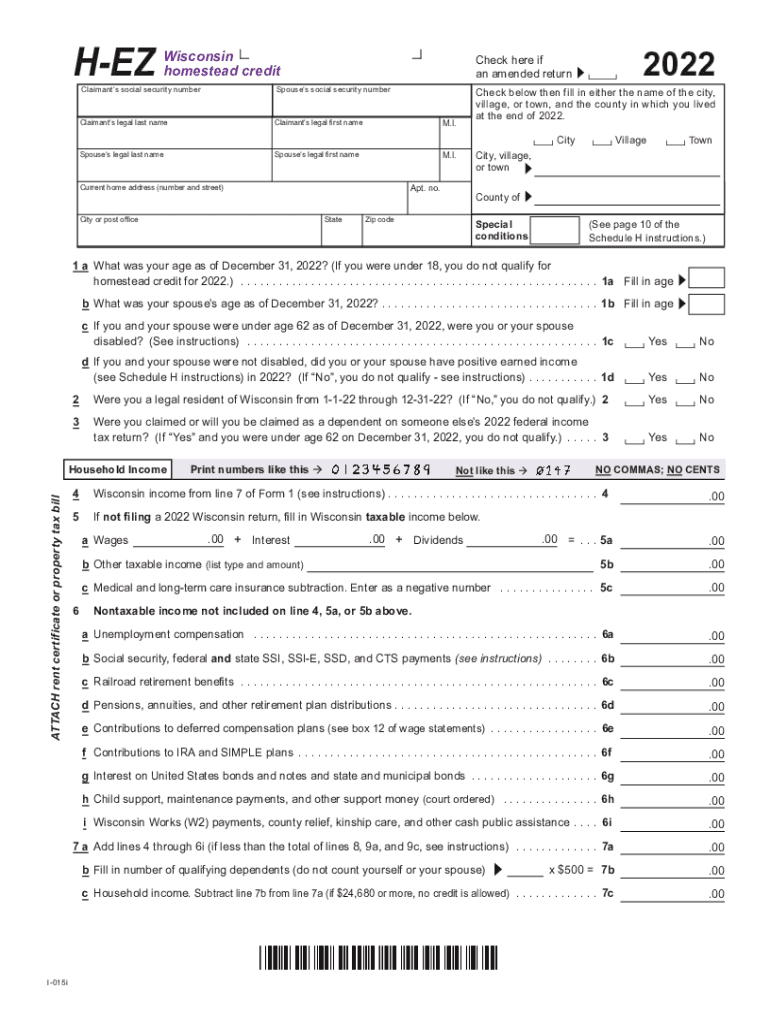

The Wisconsin Homestead Credit Form is a tax document that allows eligible homeowners to receive a property tax credit based on their income and property taxes paid. This program is designed to assist low-income residents, particularly those who are elderly or disabled, by reducing their property tax burden. The credit is available to both renters and homeowners, making it an essential form for many Wisconsin residents seeking financial relief.

Eligibility Criteria

To qualify for the Wisconsin Homestead Credit, applicants must meet specific eligibility requirements. These include:

- Being a resident of Wisconsin for the entire tax year.

- Owning or renting a home in Wisconsin.

- Meeting income limits, which are adjusted annually.

- Being at least eighteen years old or having a qualifying dependent.

It is crucial to review the latest eligibility criteria for the 2023 homestead form to ensure compliance and maximize potential benefits.

Steps to Complete the Wisconsin Homestead Credit Form

Completing the Wisconsin Homestead Credit Form involves several steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary documents, including proof of income and property tax information.

- Obtain the Wisconsin Homestead Credit Form 2023, which can be downloaded or printed from official sources.

- Fill out the form carefully, providing all required personal and financial information.

- Review the completed form for accuracy and ensure all necessary signatures are included.

- Submit the form by the designated deadline, either online or via mail.

Following these steps will help ensure that your application is processed smoothly and efficiently.

How to Obtain the Wisconsin Homestead Credit Form

The Wisconsin Homestead Credit Form can be obtained through several methods:

- Visit the Wisconsin Department of Revenue website to download the form directly.

- Request a printed version from local government offices or tax assistance centers.

- Access the form through tax preparation software that includes state forms.

It is advisable to obtain the most current version of the form to ensure compliance with any updates or changes for the 2023 tax year.

Form Submission Methods

Once the Wisconsin Homestead Credit Form is completed, there are multiple submission methods available:

- Online: Submit the form electronically through the Wisconsin Department of Revenue's online portal, if available.

- Mail: Send the completed form to the appropriate address provided on the form.

- In-Person: Deliver the form directly to a local Department of Revenue office.

Choosing the right submission method can help ensure timely processing and receipt of any applicable credits.

Key Elements of the Wisconsin Homestead Credit Form

Understanding the key elements of the Wisconsin Homestead Credit Form is essential for accurate completion. Important sections typically include:

- Personal information, such as name, address, and Social Security number.

- Income details, including wages, pensions, and other sources of income.

- Property tax information, outlining taxes paid on the residence.

- Signature section to validate the information provided.

Carefully reviewing these elements can help prevent errors that may delay processing or affect eligibility.

Quick guide on how to complete wisconsin homestead credit form 2021

Prepare Wisconsin Homestead Credit Form seamlessly on any device

Digital document management has gained prominence among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Manage Wisconsin Homestead Credit Form on any device using airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

The easiest way to modify and eSign Wisconsin Homestead Credit Form effortlessly

- Obtain Wisconsin Homestead Credit Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal weight as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Wisconsin Homestead Credit Form and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin homestead credit form 2021

Create this form in 5 minutes!

People also ask

-

What is the Wisconsin homestead credit form 2023?

The Wisconsin homestead credit form 2023 is a state-issued document designed to help eligible homeowners reduce their property taxes. This form allows residents to claim benefits based on their income and property taxes paid, ultimately providing financial relief to homeowners. If you're a Wisconsin resident and think you qualify, it's essential to fill out the form accurately.

-

Who is eligible to file the Wisconsin homestead credit form 2023?

To be eligible for the Wisconsin homestead credit form 2023, you must meet specific criteria, including being a resident of Wisconsin, owning or renting your primary home, and having a household income below a certain threshold. Additionally, you must be at least 18 years old. It's important to review the eligibility requirements carefully to ensure you can claim the credit.

-

What documents do I need to complete the Wisconsin homestead credit form 2023?

When completing the Wisconsin homestead credit form 2023, you'll need to gather essential documents such as proof of income, property tax bills, and any supporting documentation for your residency. This information helps substantiate your claims on the form and ensures a smoother process. Be organized to expedite the form submission and approval.

-

How do I submit the Wisconsin homestead credit form 2023?

You can submit the Wisconsin homestead credit form 2023 either by mailing it directly to your local municipality or, in some cases, electronically through state-approved platforms. Ensure you check the submission deadlines to avoid missing out on potential credits. Proper submission is key to securing your benefits.

-

When is the deadline for filing the Wisconsin homestead credit form 2023?

The deadline for filing the Wisconsin homestead credit form 2023 typically falls on July 15th of the year. It is crucial to complete and submit the form before this deadline to be eligible for the credit for the tax year you're claiming. Make sure to mark your calendar and submit your application on time.

-

Can I amend my Wisconsin homestead credit form 2023 after submission?

Yes, if you realize there are errors or omissions in your filing of the Wisconsin homestead credit form 2023, you can amend your submission. You'll need to complete a new form, indicating any changes, and resubmit it to your local municipality. Promptly addressing mistakes can help you secure the proper benefits.

-

What are the benefits of filing the Wisconsin homestead credit form 2023?

Filing the Wisconsin homestead credit form 2023 allows eligible homeowners to reduce their property taxes, offering signNow financial relief. By claiming this credit, residents can maintain affordable living expenses, ultimately leading to a more sustainable financial situation. Maximizing the benefits of this program is essential for homeowners.

Get more for Wisconsin Homestead Credit Form

- Mutual wills or last will and testaments for unmarried persons living together with minor children nebraska form

- Non marital cohabitation living together agreement nebraska form

- Ne paternity form

- Bill of sale in connection with sale of business by individual or corporate seller nebraska form

- Office lease agreement nebraska form

- Commercial sublease nebraska form

- Residential lease renewal agreement nebraska form

- Notice to lessor exercising option to purchase nebraska form

Find out other Wisconsin Homestead Credit Form

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement