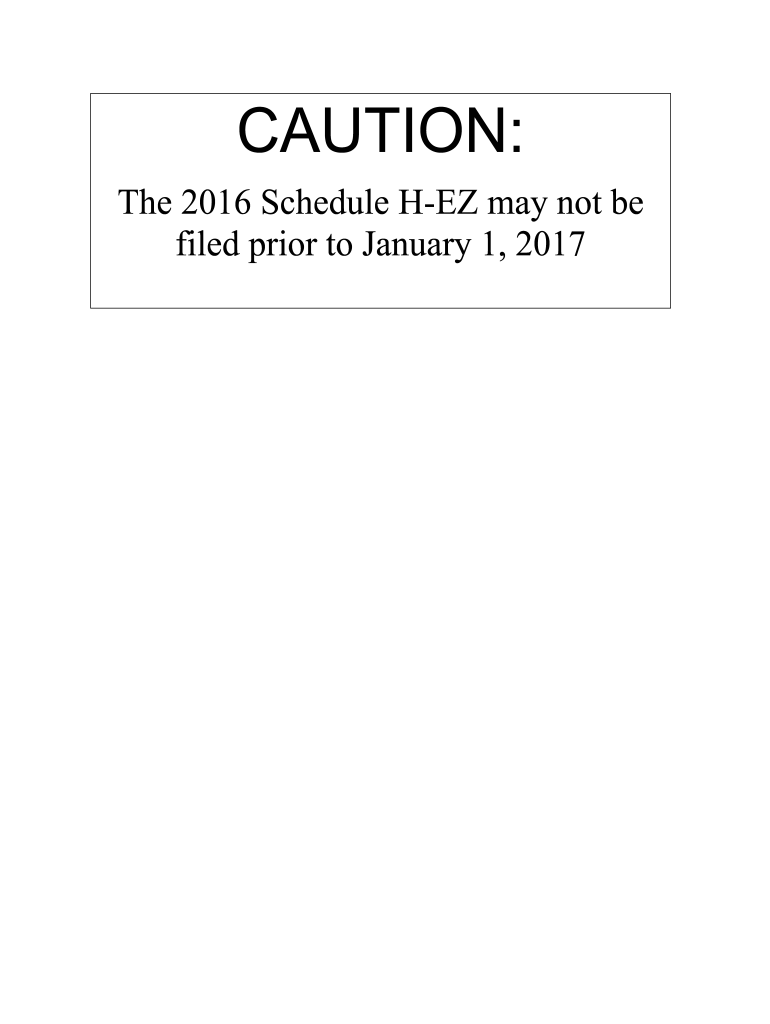

Wisconsin H Ez Homestead Credit Form 2016

What is the Wisconsin H Ez Homestead Credit Form

The Wisconsin H Ez Homestead Credit Form is a tax document used by eligible homeowners in Wisconsin to claim a property tax credit. This form is specifically designed for individuals who meet certain income and residency requirements. The credit aims to provide financial relief to low-income homeowners by reducing their property tax burden, thereby making homeownership more affordable. Understanding the purpose of this form is essential for those looking to benefit from the homestead credit.

Eligibility Criteria

To qualify for the Wisconsin H Ez Homestead Credit, applicants must meet specific criteria, including:

- Being a resident of Wisconsin for the entire year.

- Owning a home that is your primary residence.

- Meeting income limits set by the state.

- Being at least eighteen years old by the end of the year for which the credit is claimed.

It is important for applicants to review these criteria thoroughly to ensure they qualify before completing the form.

Steps to Complete the Wisconsin H Ez Homestead Credit Form

Filling out the Wisconsin H Ez Homestead Credit Form involves several key steps:

- Gather necessary documentation, including proof of income and property ownership.

- Download the form from the official state website or obtain a physical copy.

- Complete the form by providing accurate information about your income, property, and personal details.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods.

Following these steps carefully can help ensure a smooth application process.

Form Submission Methods

The Wisconsin H Ez Homestead Credit Form can be submitted through various methods. Applicants can choose to:

- File the form online through the Wisconsin Department of Revenue's e-filing system.

- Mail the completed form to the appropriate state office.

- Deliver the form in person at designated state offices.

Choosing the right submission method can impact the processing time and ease of your application.

Required Documents

When completing the Wisconsin H Ez Homestead Credit Form, certain documents are required to support your application. These may include:

- Proof of income, such as tax returns or W-2 forms.

- Documentation of property ownership, like a deed or mortgage statement.

- Identification, such as a driver's license or state ID.

Having these documents ready can facilitate a smoother completion and submission process.

Legal Use of the Wisconsin H Ez Homestead Credit Form

The Wisconsin H Ez Homestead Credit Form is legally binding when completed and submitted according to state regulations. It is essential for applicants to provide truthful and accurate information, as any discrepancies can lead to penalties or denial of the credit. The form must be signed and dated by the applicant to validate the submission. Understanding the legal implications of this form can help ensure compliance with state laws.

Quick guide on how to complete wisconsin h ez homestead credit 2016 form

Effortlessly Prepare Wisconsin H Ez Homestead Credit Form on Any Device

Digital document management is increasingly favored by businesses and individuals alike. It offers an ideal, environmentally friendly option to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Wisconsin H Ez Homestead Credit Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Alter and eSign Wisconsin H Ez Homestead Credit Form with Ease

- Obtain Wisconsin H Ez Homestead Credit Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Wisconsin H Ez Homestead Credit Form and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin h ez homestead credit 2016 form

Create this form in 5 minutes!

How to create an eSignature for the wisconsin h ez homestead credit 2016 form

How to generate an electronic signature for the Wisconsin H Ez Homestead Credit 2016 Form online

How to make an eSignature for your Wisconsin H Ez Homestead Credit 2016 Form in Google Chrome

How to generate an electronic signature for putting it on the Wisconsin H Ez Homestead Credit 2016 Form in Gmail

How to create an electronic signature for the Wisconsin H Ez Homestead Credit 2016 Form straight from your smartphone

How to make an eSignature for the Wisconsin H Ez Homestead Credit 2016 Form on iOS

How to generate an eSignature for the Wisconsin H Ez Homestead Credit 2016 Form on Android devices

People also ask

-

What is the Wisconsin H Ez Homestead Credit Form?

The Wisconsin H Ez Homestead Credit Form is designed for homeowners in Wisconsin to claim property tax credits. It simplifies the application process for eligible residents, ensuring they can efficiently submit their claims. Understanding this form is essential for maximizing potential refunds on your property taxes.

-

How can I obtain the Wisconsin H Ez Homestead Credit Form?

You can obtain the Wisconsin H Ez Homestead Credit Form online through the Wisconsin Department of Revenue's website or through authorized tax preparation software. Additionally, airSlate SignNow offers services that can help you manage and eSign the form easily, streamlining your application process.

-

What are the eligibility criteria for the Wisconsin H Ez Homestead Credit Form?

To qualify for the Wisconsin H Ez Homestead Credit Form, applicants must be homeowners who meet certain income limits and occupancy requirements. Reviewing the specific eligibility guidelines is crucial before applying. Ensuring you meet the criteria can lead to substantial property tax savings.

-

How much does it cost to use the Wisconsin H Ez Homestead Credit Form within airSlate SignNow?

Using airSlate SignNow to manage your Wisconsin H Ez Homestead Credit Form comes at a competitive price, typically featuring various subscription options. This cost-effective solution allows you to send, eSign, and store your documents securely without unnecessary expenses. Visit our pricing page for detailed information.

-

What features does airSlate SignNow offer for managing the Wisconsin H Ez Homestead Credit Form?

airSlate SignNow offers features such as easy document upload, electronic signatures, and automated workflows specifically for the Wisconsin H Ez Homestead Credit Form. These tools enhance efficiency, allowing users to complete and submit their forms quickly and accurately. Additionally, cloud storage ensures your documents are always accessible.

-

Can I integrate airSlate SignNow with other applications for the Wisconsin H Ez Homestead Credit Form?

Yes, airSlate SignNow integrates seamlessly with various applications to facilitate a smooth process for the Wisconsin H Ez Homestead Credit Form. This includes popular accounting and taxation software, optimizing your workflow and simplifying document management. Check our integrations page for more details.

-

What are the benefits of using airSlate SignNow for the Wisconsin H Ez Homestead Credit Form?

Using airSlate SignNow for the Wisconsin H Ez Homestead Credit Form provides numerous benefits, including time savings, enhanced security, and improved accuracy. Electronic signing reduces delays caused by traditional paperwork, while secure storage keeps your documents safe. Experience a hassle-free application process with our intuitive platform.

Get more for Wisconsin H Ez Homestead Credit Form

- Ucsf authorization form

- Tjnf 2 sfusd research apllication rev2012 sfusd form

- Direct deposit computershare form

- Cms 20031pdffillercom form

- Application for specialty plates dmv dmv ne form

- Va form 10 5345a

- Graduation sunday recognition form tanner chapel ame church tannerchapel

- Eepe application form semester ii

Find out other Wisconsin H Ez Homestead Credit Form

- Sign Kentucky Hold Harmless (Indemnity) Agreement Simple

- Sign Maryland Hold Harmless (Indemnity) Agreement Now

- Sign Minnesota Hold Harmless (Indemnity) Agreement Safe

- Sign Mississippi Hold Harmless (Indemnity) Agreement Now

- Sign Nevada Hold Harmless (Indemnity) Agreement Easy

- Sign South Carolina Letter of Intent Later

- Sign Texas Hold Harmless (Indemnity) Agreement Computer

- Sign Connecticut Quitclaim Deed Free

- Help Me With Sign Delaware Quitclaim Deed

- How To Sign Arkansas Warranty Deed

- How Can I Sign Delaware Warranty Deed

- Sign California Supply Agreement Checklist Online

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online