POMS HI 01120 045 Use of Amended Income Tax Returns 2024-2026

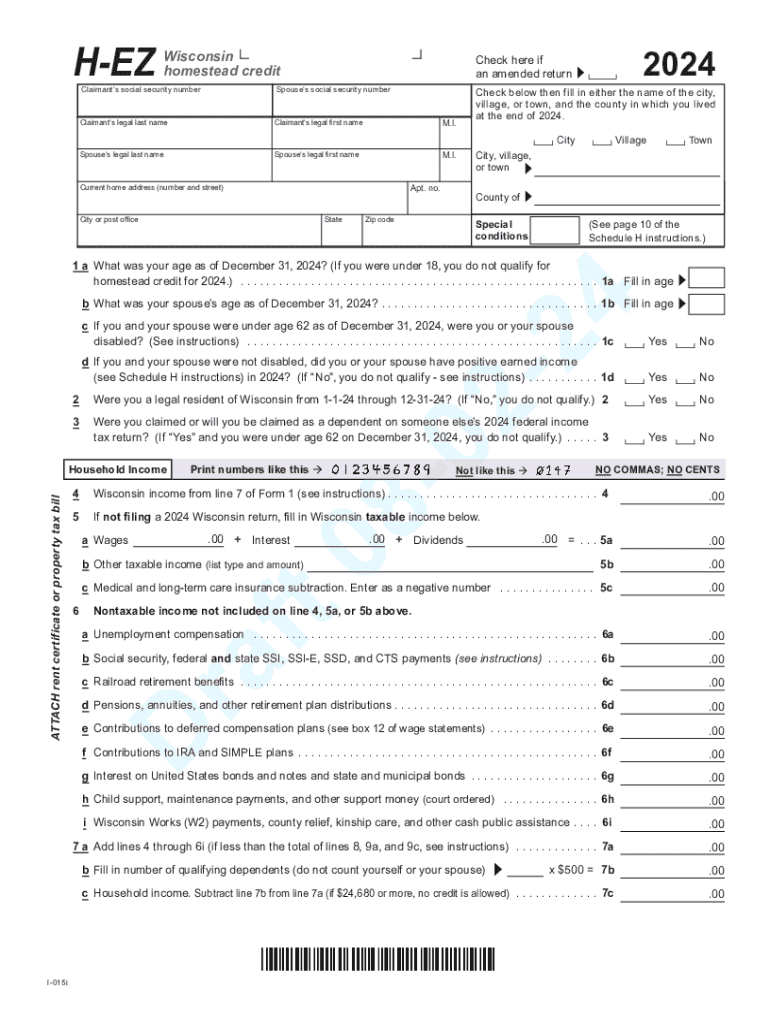

Understanding the 2013 Wisconsin Homestead Credit

The 2013 Wisconsin Homestead Credit is designed to provide financial relief to eligible homeowners and renters in Wisconsin. This credit helps reduce property taxes for low-income individuals and families. To qualify, applicants must meet specific income limits and residency requirements. The program aims to support those who may struggle with housing costs, ensuring that more residents can afford to live in their homes.

Eligibility Criteria for the Homestead Credit

To qualify for the 2013 Wisconsin Homestead Credit, applicants must meet the following criteria:

- Must be a Wisconsin resident.

- Must own or rent a home in Wisconsin.

- Must meet the income limits set by the state for the tax year.

- Must not have received a homestead credit for the same property from another state.

It is essential to review these criteria carefully to ensure eligibility before applying for the credit.

Required Documents for Application

When applying for the 2013 Wisconsin Homestead Credit, several documents are necessary to support your application. These include:

- Proof of income, such as tax returns or W-2 forms.

- Documentation of property ownership or rental agreements.

- Any previous tax credit forms, if applicable.

Gathering these documents in advance can help streamline the application process.

Steps to Complete the Homestead Credit Application

Completing the application for the 2013 Wisconsin Homestead Credit involves several key steps:

- Obtain the appropriate form, which can be found on the Wisconsin Department of Revenue website.

- Fill out the form accurately, ensuring all required information is included.

- Attach the necessary documentation to support your application.

- Submit the completed application by the deadline set by the state.

Following these steps can help ensure a successful application process.

Filing Deadlines for the Homestead Credit

It is crucial to be aware of the filing deadlines for the 2013 Wisconsin Homestead Credit. Applications must typically be submitted by the end of the tax year to qualify for that year’s credit. Late submissions may not be considered, so it is advisable to file as early as possible to avoid missing the deadline.

Form Submission Methods

Applicants can submit the 2013 Wisconsin Homestead Credit form through various methods:

- Online submission via the Wisconsin Department of Revenue website.

- Mailing the completed form to the appropriate state office.

- In-person submission at designated state offices.

Choosing the right submission method can help ensure your application is processed efficiently.

Create this form in 5 minutes or less

Find and fill out the correct poms hi 01120 045 use of amended income tax returns

Create this form in 5 minutes!

How to create an eSignature for the poms hi 01120 045 use of amended income tax returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2013 Wisconsin homestead program?

The 2013 Wisconsin homestead program provides property tax relief to eligible homeowners and renters in Wisconsin. This program allows qualifying individuals to receive a credit based on their property taxes or rent paid, making it easier to manage housing costs. Understanding the 2013 Wisconsin homestead can help you maximize your benefits.

-

How can airSlate SignNow assist with the 2013 Wisconsin homestead application process?

airSlate SignNow simplifies the application process for the 2013 Wisconsin homestead by allowing you to easily fill out and eSign necessary documents. With our user-friendly platform, you can ensure that your application is submitted accurately and on time. This efficiency can help you secure your homestead benefits without hassle.

-

What are the eligibility requirements for the 2013 Wisconsin homestead?

To qualify for the 2013 Wisconsin homestead, applicants must meet specific income and residency criteria. Generally, homeowners must be at least 18 years old and have lived in the property for a minimum period. Reviewing these requirements is crucial to ensure you can take advantage of the 2013 Wisconsin homestead benefits.

-

Are there any costs associated with applying for the 2013 Wisconsin homestead?

Applying for the 2013 Wisconsin homestead is typically free, but there may be costs related to document preparation or filing. Using airSlate SignNow can help you avoid additional fees by streamlining the eSigning process. Our platform is designed to be cost-effective, ensuring you can focus on your homestead benefits.

-

What features does airSlate SignNow offer for managing homestead documents?

airSlate SignNow offers a range of features for managing your 2013 Wisconsin homestead documents, including customizable templates, secure eSigning, and document tracking. These tools help you stay organized and ensure that all necessary paperwork is completed efficiently. Our platform is designed to enhance your experience with homestead applications.

-

Can I integrate airSlate SignNow with other tools for my 2013 Wisconsin homestead needs?

Yes, airSlate SignNow can be integrated with various tools and applications to streamline your 2013 Wisconsin homestead processes. This includes integration with cloud storage services and CRM systems, allowing for seamless document management. These integrations enhance your workflow and make handling homestead-related tasks more efficient.

-

What are the benefits of using airSlate SignNow for the 2013 Wisconsin homestead?

Using airSlate SignNow for the 2013 Wisconsin homestead offers numerous benefits, including time savings, increased accuracy, and enhanced security for your documents. Our platform allows you to eSign and manage documents from anywhere, making the application process more convenient. This can lead to a smoother experience when applying for homestead benefits.

Get more for POMS HI 01120 045 Use Of Amended Income Tax Returns

Find out other POMS HI 01120 045 Use Of Amended Income Tax Returns

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors