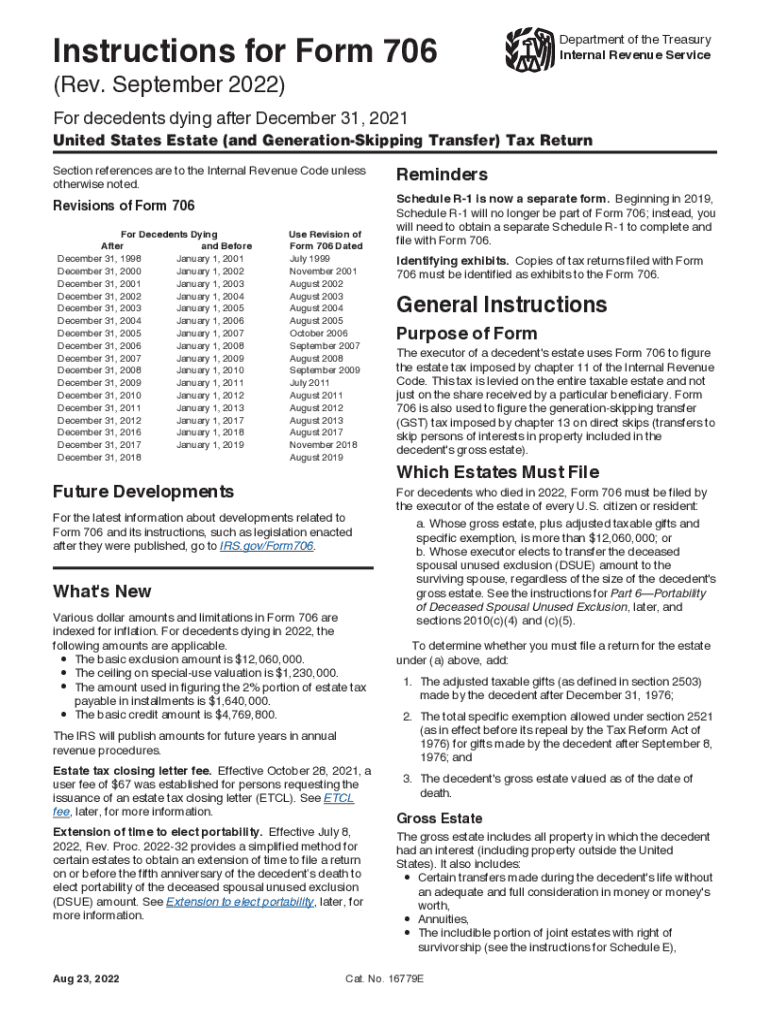

Instructions for Form 706 Rev September Instructions for Form 706, United States Estate and Generation Skipping Transfer Tax Ret 2022

What is Form 706 and Its Instructions?

The Form 706, officially titled the United States Estate (and Generation-Skipping Transfer) Tax Return, is used to report the estate tax liability of a deceased individual. The 2016 instructions for Form 706 provide essential guidance on how to properly complete the form, including details on what information must be reported, how to calculate the estate tax owed, and the necessary documentation required for submission. This form is crucial for estates that exceed the federal estate tax exemption limit, ensuring compliance with U.S. tax laws.

Steps to Complete the 2016 Instructions for Form 706

Completing the 2016 Form 706 involves several key steps:

- Gather all necessary documents, including the decedent's financial records, property valuations, and previous tax returns.

- Follow the instructions carefully to fill out each section of the form, ensuring accuracy in reporting assets and liabilities.

- Calculate the total value of the estate and any applicable deductions or credits.

- Review the completed form for errors and ensure all required signatures are included.

- Submit the form by the appropriate deadline, either electronically or by mail.

Filing Deadlines for Form 706

It is essential to be aware of the filing deadlines associated with the 2016 Form 706. Generally, the return must be filed within nine months of the decedent's date of death. If additional time is needed, an extension may be requested, but it is crucial to file the extension before the original due date to avoid penalties. Understanding these timelines helps ensure compliance and avoids unnecessary complications.

Legal Use of Form 706 Instructions

The 2016 instructions for Form 706 outline the legal requirements for filing the estate tax return. Proper adherence to these instructions is vital for the return to be considered valid by the IRS. This includes following the guidelines for reporting assets, deductions, and credits. Failure to comply with these legal requirements can result in penalties or delays in processing the estate tax return.

Required Documents for Form 706

When preparing to file the 2016 Form 706, certain documents are required to substantiate the information reported. These may include:

- Death certificate of the decedent.

- Financial statements, including bank accounts, investment portfolios, and real estate valuations.

- Documentation of any debts or liabilities owed by the estate.

- Prior tax returns, if applicable, to provide context for the estate's financial history.

Examples of Using the 2016 Instructions for Form 706

Understanding how to apply the 2016 instructions for Form 706 can be enhanced through practical examples. For instance, if an estate includes a family home valued at five hundred thousand dollars and a life insurance policy worth two hundred thousand dollars, the instructions guide the executor on how to report these assets accurately. Additionally, examples within the instructions can clarify common scenarios, such as how to handle joint property or gifts made prior to death.

Quick guide on how to complete instructions for form 706 rev september 2022 instructions for form 706 united states estate and generation skipping transfer

Effortlessly prepare Instructions For Form 706 Rev September Instructions For Form 706, United States Estate and Generation Skipping Transfer Tax Ret on any device

The management of online documents has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents promptly without delays. Manage Instructions For Form 706 Rev September Instructions For Form 706, United States Estate and Generation Skipping Transfer Tax Ret on any platform using airSlate SignNow apps for Android or iOS and enhance any document-focused operation today.

The easiest way to alter and eSign Instructions For Form 706 Rev September Instructions For Form 706, United States Estate and Generation Skipping Transfer Tax Ret with no hassle

- Locate Instructions For Form 706 Rev September Instructions For Form 706, United States Estate and Generation Skipping Transfer Tax Ret and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that task.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Form 706 Rev September Instructions For Form 706, United States Estate and Generation Skipping Transfer Tax Ret and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 706 rev september 2022 instructions for form 706 united states estate and generation skipping transfer

Create this form in 5 minutes!

People also ask

-

What are the 2016 instructions 706 for estate tax returns?

The 2016 instructions 706 provide guidance on how to file the federal estate tax return, which is essential for reporting the value of a deceased person's estate. These instructions help executors and administrators understand what is required for compliance and help prevent costly mistakes. Following the 2016 instructions 706 ensures that the estate tax return is submitted accurately and on time.

-

How can airSlate SignNow assist with completing the 2016 instructions 706?

AirSlate SignNow offers features that streamline the signing and submitting process for 2016 instructions 706, allowing users to electronically sign documents and manage paperwork efficiently. With an easy-to-use interface, you can quickly create, send, and store important estate documents. This convenience can save time and reduce the stress associated with compliance.

-

Is airSlate SignNow cost-effective for managing documents related to the 2016 instructions 706?

Yes, airSlate SignNow provides a cost-effective solution for managing documents needed for the 2016 instructions 706. With competitive pricing plans, users can access powerful features that simplify the eSigning process without breaking the bank. This affordability makes it accessible for individuals and businesses alike.

-

What features does airSlate SignNow offer for addressing the 2016 instructions 706?

AirSlate SignNow offers features such as document templates, automated workflows, and secure storage which are vital for handling the 2016 instructions 706. These tools help users maintain compliance by ensuring that all necessary forms are filled out correctly and securely stored. Furthermore, real-time collaboration between parties simplifies the process of completing estate tax documents.

-

Can airSlate SignNow integrate with other software to assist with the 2016 instructions 706?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting and tax preparation software, which can assist with the 2016 instructions 706. This integration ensures that all necessary data is accurately transferred and that the documents align with the information required for the tax return. As a result, users can streamline their workflows while maintaining compliance.

-

How does airSlate SignNow ensure the security of documents related to the 2016 instructions 706?

AirSlate SignNow employs robust security protocols to protect documents associated with the 2016 instructions 706. Features such as encryption, password protection, and secure cloud storage ensure that sensitive information remains confidential. Given the importance of estate documents, users can trust that their information is safeguarded throughout the entire signing process.

-

Are there any mobile options for using airSlate SignNow with the 2016 instructions 706?

Yes, airSlate SignNow offers a mobile app that allows users to manage and eSign documents related to the 2016 instructions 706 on the go. This flexibility ensures that users can access, review, and sign necessary documents from anywhere, even while traveling. The mobile solution enhances productivity and convenience for busy professionals.

Get more for Instructions For Form 706 Rev September Instructions For Form 706, United States Estate and Generation Skipping Transfer Tax Ret

- New hampshire letter 497318830 form

- Js 44 civil cover sheet federal district court new hampshire form

- Lead based paint disclosure for sales transaction new hampshire form

- Lead based paint disclosure for rental transaction new hampshire form

- Notice of lease for recording new hampshire form

- Sample cover letter for filing of llc articles or certificate with secretary of state new hampshire form

- Supplemental residential lease forms package new hampshire

- Nh landlord 497318838 form

Find out other Instructions For Form 706 Rev September Instructions For Form 706, United States Estate and Generation Skipping Transfer Tax Ret

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online