PDF Instructions for Form 706 Internal Revenue Service 2020

What is the PDF Instructions for Form 706?

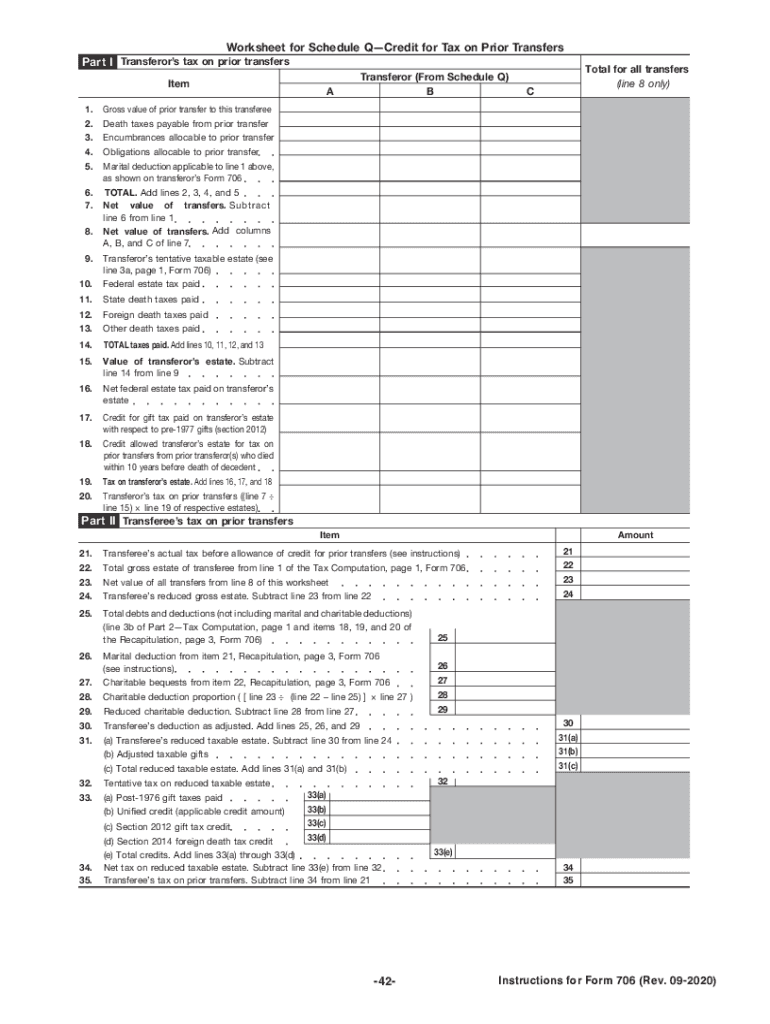

The PDF Instructions for Form 706 serve as a comprehensive guide provided by the Internal Revenue Service (IRS) for individuals who need to file estate tax returns. This form is essential for reporting the value of an estate and calculating any estate taxes owed at the time of a person's death. The instructions detail the necessary steps to accurately complete the form, including information on exemptions, deductions, and various schedules that may need to be included. Understanding these instructions is crucial for ensuring compliance with federal tax laws.

Steps to Complete the PDF Instructions for Form 706

Completing the PDF Instructions for Form 706 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the deceased's assets, liabilities, and any prior gift tax returns. Next, carefully read through the instructions to understand the specific requirements for each section of the form. Fill out the form systematically, ensuring that all relevant information is accurately reported. Pay special attention to the schedules that may apply to your situation, such as those for specific deductions or credits. Finally, review the completed form for any errors before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with Form 706 to avoid penalties. Generally, Form 706 must be filed within nine months of the date of death of the decedent. If additional time is needed, an extension can be requested, but this must be done before the original deadline. Knowing these critical dates helps ensure timely compliance with IRS regulations and avoids potential late fees or interest charges.

Required Documents

When preparing to file Form 706, certain documents are essential to support the information reported on the form. These documents typically include the decedent's death certificate, a copy of any prior gift tax returns, and documentation of all assets and liabilities. This may encompass bank statements, property deeds, stock certificates, and appraisals for valuable personal property. Having these documents organized and accessible will facilitate the accurate completion of the form and help substantiate the reported values.

Legal Use of the PDF Instructions for Form 706

The legal use of the PDF Instructions for Form 706 is vital for ensuring that the estate tax return is filed correctly and in accordance with federal law. These instructions provide the legal framework necessary for understanding the obligations of the executor or administrator of the estate. Adhering to these guidelines helps prevent legal disputes and ensures that the estate is settled in compliance with IRS regulations. Failure to follow the instructions can lead to penalties, including fines and interest on unpaid taxes.

Examples of Using the PDF Instructions for Form 706

Utilizing the PDF Instructions for Form 706 can vary based on individual circumstances. For instance, an executor managing a large estate may find specific guidance on reporting complex assets, such as business interests or real estate holdings. Additionally, those dealing with estates that include charitable contributions can refer to the instructions for details on applicable deductions. Each example underscores the importance of following the instructions to ensure accurate reporting and compliance with tax obligations.

Quick guide on how to complete pdf instructions for form 706 internal revenue service

Effortlessly Prepare PDF Instructions For Form 706 Internal Revenue Service on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and efficiently. Manage PDF Instructions For Form 706 Internal Revenue Service on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to Modify and eSign PDF Instructions For Form 706 Internal Revenue Service with Ease

- Find PDF Instructions For Form 706 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form: via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign PDF Instructions For Form 706 Internal Revenue Service and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf instructions for form 706 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the pdf instructions for form 706 internal revenue service

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What are the form 706 instructions?

The form 706 instructions provide detailed guidance on completing the U.S. Estate Tax Return. This includes information on what assets must be reported, how to calculate the taxable estate, and important deadlines. Properly following these instructions is crucial to ensure compliance and avoid penalties.

-

How can airSlate SignNow help with form 706 instructions?

airSlate SignNow offers a seamless way to manage and sign your estate documents, including those requiring form 706 instructions. With its intuitive platform, you can easily upload documents, add eSignatures, and ensure that all required fields are completed accurately. This simplifies the process and can save you valuable time.

-

Is there a cost associated with using airSlate SignNow for form 706 instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. These plans come with features like document management and unlimited eSignatures, providing great value for those needing help with form 706 instructions. It's advisable to review the pricing page to find the best option for your situation.

-

Can I integrate airSlate SignNow with other tools while using form 706 instructions?

Absolutely! airSlate SignNow supports numerous integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This allows you to streamline your workflow while managing documents related to form 706 instructions. Integration makes it easy to access, update, and store your important documents in one place.

-

What are the key benefits of using airSlate SignNow for form 706 instructions?

Using airSlate SignNow for form 706 instructions offers several benefits, including enhanced security and rapid document turnaround times. The platform's user-friendly interface ensures that completing and signing your forms is hassle-free. Additionally, you can track the status of your forms in real-time, providing peace of mind during the filing process.

-

Are the form 706 instructions updated regularly?

Yes, the IRS updates form 706 instructions periodically to reflect changes in tax laws and regulations. It’s essential to use the most current version available to avoid any discrepancies or issues during filing. With airSlate SignNow, you can easily stay informed about updates and ensure that you're using the latest instructions.

-

What types of documents can I sign using airSlate SignNow aside from form 706 instructions?

In addition to form 706 instructions, airSlate SignNow allows you to sign a wide range of documents, including contracts, agreements, and various legal forms. This flexibility makes it an ideal tool for businesses and individuals managing multiple document types. You can streamline your signing processes across your entire organization.

Get more for PDF Instructions For Form 706 Internal Revenue Service

- Washington response petition form

- Wpf dr 060400 motion declaration for default child support modification mtdfl washington form

- Washington child support 497429405 form

- What do i write in my motion to enforce child support form

- Wpf dr 060520 response regarding oral testimony child support modification rsp washington form

- Wpf dr 060540 order regarding oral testimony child support modification orh washington form

- Child support modification sample form

- Schedule hearing form

Find out other PDF Instructions For Form 706 Internal Revenue Service

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors