Form 706 Example 2017

What is the Form 706 Example

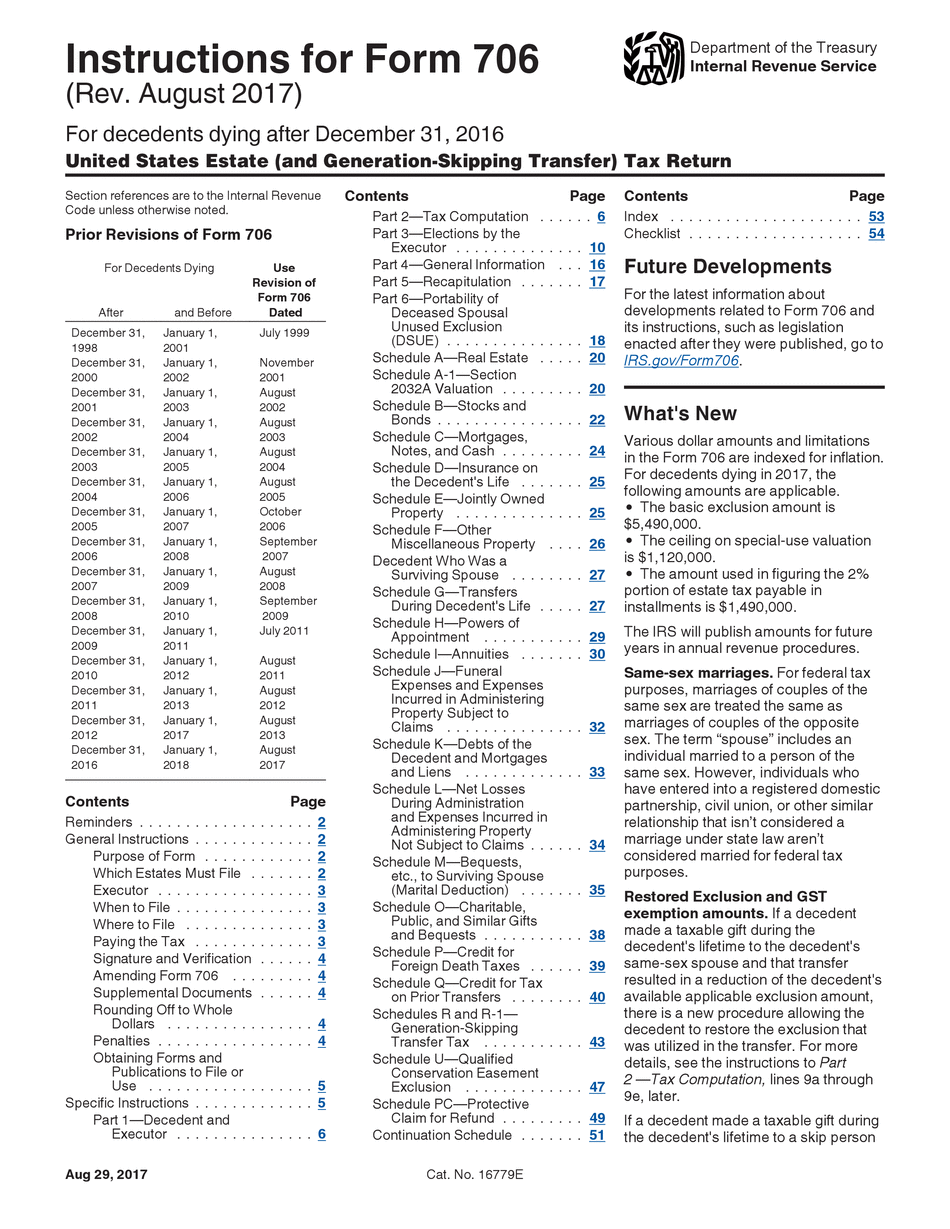

The Form 706 Example, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a critical document used for reporting the estate tax obligations of a deceased individual. This form is required when the gross estate exceeds a certain threshold, which is subject to change based on current tax laws. It is essential for the executor of the estate to accurately complete this form to ensure compliance with federal tax regulations.

How to use the Form 706 Example

Using the Form 706 Example involves several steps. First, gather all necessary financial information related to the deceased's estate, including assets, liabilities, and any applicable deductions. Next, carefully fill out the form, ensuring that all required sections are completed. It is advisable to consult with a tax professional to navigate complex areas, such as valuations and deductions. Once the form is completed, it must be submitted to the Internal Revenue Service (IRS) by the specified deadline.

Steps to complete the Form 706 Example

Completing the Form 706 Example involves a systematic approach to ensure accuracy. Follow these steps:

- Collect all relevant financial documents, including property appraisals and bank statements.

- Fill out the identification section, providing details about the deceased and the executor.

- Report all assets, including real estate, investments, and personal property, with accurate valuations.

- Document any debts or liabilities that reduce the gross estate.

- Include any deductions, such as funeral expenses and debts of the deceased.

- Review the completed form for accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 706 Example. It is important to refer to the latest IRS instructions to ensure compliance with current tax laws. These guidelines outline the necessary information to include, the correct filing procedures, and any applicable deadlines. Staying informed about IRS updates can help prevent errors that may lead to penalties or delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 706 Example are crucial to avoid penalties. Generally, the form must be filed within nine months of the date of death. However, an extension may be available if requested. It is important to keep track of these deadlines and any changes to tax laws that may affect filing requirements. Missing the deadline can result in significant financial consequences for the estate.

Required Documents

When preparing to file the Form 706 Example, certain documents are required to support the information reported. These may include:

- Death certificate of the deceased.

- Financial statements detailing assets and liabilities.

- Appraisals for real estate and significant personal property.

- Documentation of any debts, including mortgages and loans.

- Records of any gifts made by the deceased prior to death.

Quick guide on how to complete form 706 example 2017

Explore the easiest method to complete and endorse your Form 706 Example

Are you still spending time drafting your official documents on paper instead of doing it digitally? airSlate SignNow presents a more efficient way to fill out and endorse your Form 706 Example and associated forms for public services. Our advanced electronic signature platform provides you with all the tools necessary to handle paperwork swiftly and in line with official standards - powerful PDF editing, managing, securing, signing, and sharing capabilities are all available within a user-friendly interface.

Only a few steps are required to fill out and endorse your Form 706 Example:

- Upload the editable template to the editor using the Get Form button.

- Review what information you need to input in your Form 706 Example.

- Move between the fields using the Next button to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the gaps with your information.

- Update the content using Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Blackout sections that are no longer relevant.

- Click on Sign to generate a legally enforceable electronic signature using any method you prefer.

- Add the Date alongside your signature and finish your task with the Done button.

Store your completed Form 706 Example in the Documents folder of your profile, download it, or export it to your preferred cloud storage. Our platform also offers versatile form sharing options. There's no need to print your forms when you need to send them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 706 example 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the form 706 example 2017

How to make an eSignature for the Form 706 Example 2017 online

How to generate an electronic signature for the Form 706 Example 2017 in Google Chrome

How to make an eSignature for signing the Form 706 Example 2017 in Gmail

How to generate an electronic signature for the Form 706 Example 2017 straight from your smart phone

How to create an electronic signature for the Form 706 Example 2017 on iOS devices

How to make an eSignature for the Form 706 Example 2017 on Android devices

People also ask

-

What is a Form 706 Example?

A Form 706 example refers to a sample rendition of the United States Estate (and Generation-Skipping Transfer) Tax Return, which is used to report the estate tax due. This example helps individuals understand the required information and format for completing the form correctly, making it easier to meet tax obligations.

-

How can airSlate SignNow assist with Form 706 Example submissions?

airSlate SignNow provides an efficient solution for electronically signing and sending documents, including Form 706 examples. Our platform allows you to streamline the process, ensuring all required signatures are collected easily and securely.

-

What features should I look for in a Form 706 Example tool?

When selecting a tool to handle a Form 706 example, look for features like e-signature capabilities, document tracking, and secure document storage. airSlate SignNow offers all these features, enhancing your document management and ensuring compliance.

-

Is airSlate SignNow cost-effective for managing Form 706 Example documentation?

Yes, airSlate SignNow is designed to be a cost-effective solution for all your document signing needs, including Form 706 examples. Our affordable pricing plans allow businesses of any size to benefit from our powerful e-signature capabilities without breaking the bank.

-

What benefits does airSlate SignNow provide for users handling Form 706 Example?

By using airSlate SignNow for Form 706 examples, users enjoy increased efficiency and reduced turnaround times for document signing. The platform makes it easy to manage documents, ensuring that everything is organized and accessible, which is particularly important for tax-related paperwork.

-

What integrations does airSlate SignNow support for Form 706 Example management?

airSlate SignNow seamlessly integrates with various applications, such as Google Drive and Dropbox, allowing you to manage your Form 706 examples alongside your everyday tools. These integrations enhance user experience and streamline your workflow, making document management simpler.

-

Can I create a customized Form 706 Example using airSlate SignNow?

Absolutely! With airSlate SignNow, you can customize your Form 706 example templates according to your specific needs. This flexibility allows you to add fields, adjust formatting, and ensure all necessary information is clearly captured for compliance.

Get more for Form 706 Example

- Police voluntary statement form

- Uspa b license proficiency card form

- Soap medical transcription form

- Recp application form navmc 11505 10 04 naval forms online

- 1033 application form

- Form for open records request department of agriculture of kentucky

- Cdphp fitness reimbursement form

- Visa and mastercard consumer credit card application form

Find out other Form 706 Example

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA