Form CT 706 NT Connecticut Estate Tax Return for Form CT 706 NT Estate Tax Return for NontaxableCT 706 NT Instructions, Connecti 2022

Understanding the CT Form 706 NT

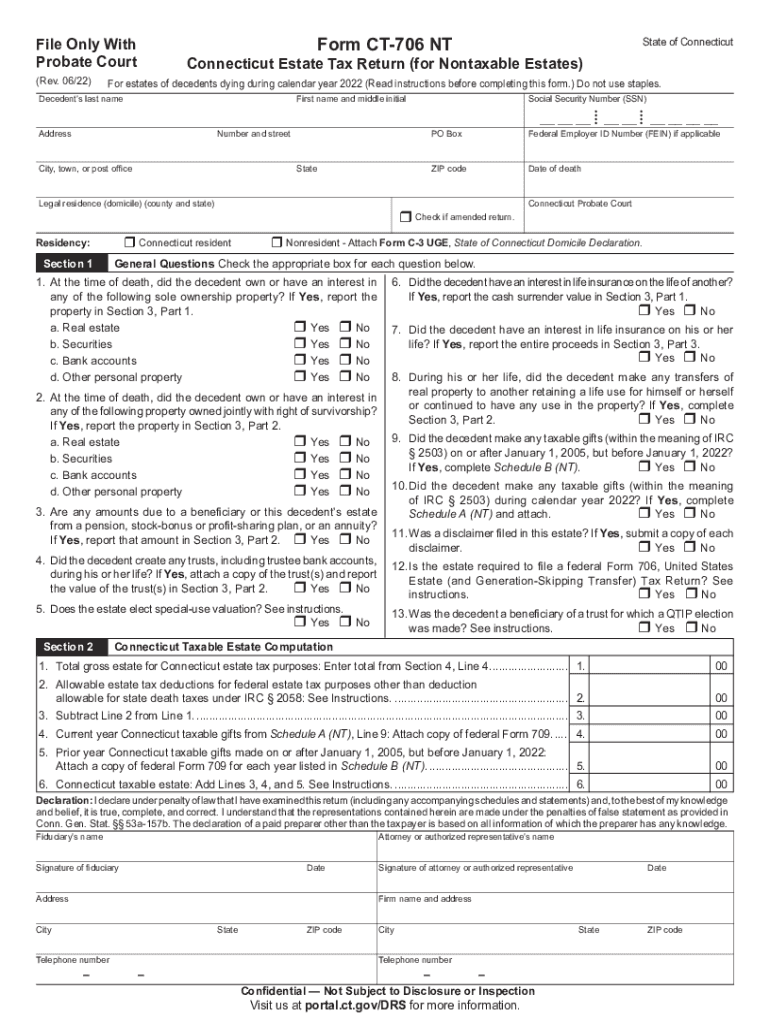

The CT Form 706 NT is the Connecticut Estate Tax Return for Nontaxable Estates. This form is essential for individuals whose estates do not exceed the state's taxable threshold. It serves as a declaration to the Connecticut Department of Revenue Services, confirming that the estate does not owe any estate tax. Completing this form accurately is crucial for compliance with state regulations and to avoid potential penalties.

Steps to Complete the CT Form 706 NT

Filling out the CT Form 706 NT involves several important steps. Begin by gathering all necessary documentation related to the estate, including asset valuations and any relevant financial records. Next, provide the decedent's information, including full name, date of birth, and date of death. Ensure that you accurately list all assets and liabilities, as this will determine the estate's value. Finally, review the completed form for accuracy before submission to avoid delays or issues with the Connecticut Department of Revenue Services.

Legal Use of the CT Form 706 NT

The CT Form 706 NT is legally binding when properly completed and submitted. It must adhere to Connecticut's estate tax laws, which require accurate reporting of the estate's value. The form serves as a formal declaration that the estate is exempt from taxation under current laws. Failure to file this form when required can lead to legal consequences, including fines or penalties. Therefore, it's vital to understand the legal implications of submitting this form.

Required Documents for the CT Form 706 NT

To successfully complete the CT Form 706 NT, certain documents are necessary. These typically include the decedent's death certificate, a detailed list of all assets and liabilities, and any appraisals or valuations of property. Additionally, any prior tax returns related to the estate should be included to provide a comprehensive overview. Having these documents ready will streamline the filing process and ensure compliance with state requirements.

Filing Deadlines for the CT Form 706 NT

Timely submission of the CT Form 706 NT is crucial. The form must be filed within nine months of the decedent's date of death. If additional time is needed, an extension can be requested, but it is essential to submit the request before the original deadline. Missing this deadline may result in penalties or interest charges, making it vital to adhere to the established timelines.

Form Submission Methods for the CT Form 706 NT

The CT Form 706 NT can be submitted through various methods. It can be filed electronically via the Connecticut Department of Revenue Services online portal, which offers a secure and efficient way to submit documents. Alternatively, the form can be mailed directly to the department or delivered in person. Each submission method has its own guidelines, so it's important to follow the specific instructions provided by the state.

Key Elements of the CT Form 706 NT

Several key elements must be included in the CT Form 706 NT for it to be considered complete. These include the decedent's personal information, a comprehensive list of assets and liabilities, and a declaration of the estate's nontaxable status. Additionally, the form requires the signature of the executor or administrator of the estate, affirming that the information provided is accurate and complete. Ensuring that all these elements are properly addressed will facilitate a smooth filing process.

Quick guide on how to complete form ct 706 nt connecticut estate tax return forfree form ct 706 nt estate tax return for nontaxablect 706 nt instructions

Complete Form CT 706 NT Connecticut Estate Tax Return for Form CT 706 NT Estate Tax Return For NontaxableCT 706 NT Instructions, Connecti effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing easy access to the appropriate form and secure online storage. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form CT 706 NT Connecticut Estate Tax Return for Form CT 706 NT Estate Tax Return For NontaxableCT 706 NT Instructions, Connecti across any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric procedure today.

How to edit and eSign Form CT 706 NT Connecticut Estate Tax Return for Form CT 706 NT Estate Tax Return For NontaxableCT 706 NT Instructions, Connecti with ease

- Find Form CT 706 NT Connecticut Estate Tax Return for Form CT 706 NT Estate Tax Return For NontaxableCT 706 NT Instructions, Connecti and click on Get Form to begin.

- Utilize the tools we offer to complete your document submission.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to submit your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, and mistakes necessitating printing new copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choosing. Edit and eSign Form CT 706 NT Connecticut Estate Tax Return for Form CT 706 NT Estate Tax Return For NontaxableCT 706 NT Instructions, Connecti to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 706 nt connecticut estate tax return forfree form ct 706 nt estate tax return for nontaxablect 706 nt instructions

Create this form in 5 minutes!

People also ask

-

What is the ct form 706 nt, and why is it important?

The ct form 706 nt is a tax form used to report the estate of a deceased person in Connecticut, especially when no Connecticut estate taxes are owed. This form is important for ensuring compliance with state regulations and provides a clear record of the estate's value. Properly completing the ct form 706 nt can help beneficiaries avoid legal issues during the estate settlement process.

-

How can airSlate SignNow assist with submitting the ct form 706 nt?

airSlate SignNow allows you to eSign and send the ct form 706 nt quickly and securely. Our platform simplifies the process by providing templates and a user-friendly interface, ensuring that you can complete your documentation efficiently. With airSlate SignNow, you won't have to worry about manual errors or delays in submission.

-

What are the pricing options for using airSlate SignNow for the ct form 706 nt?

airSlate SignNow offers various pricing plans to accommodate different needs, starting with a free trial. Our pricing is tailored to ensure you get the best value while managing documents like the ct form 706 nt effectively. Whether you're an individual or a business, we provide cost-effective solutions to streamline your document signing process.

-

Is it easy to integrate airSlate SignNow with other applications for handling the ct form 706 nt?

Yes, airSlate SignNow offers seamless integration with various applications, which simplifies the management of the ct form 706 nt. You can easily connect our platform with CRMs, cloud storage, and more to ensure your documents are always organized and accessible. This flexibility allows you to enhance your workflows and improve efficiency.

-

What features does airSlate SignNow offer for managing tax forms like the ct form 706 nt?

airSlate SignNow provides powerful features such as templating, bulk sending, and real-time tracking, which are essential for handling tax forms like the ct form 706 nt. With the ability to manage document workflows effectively, you can ensure all required signatures are obtained without unnecessary delays. Our platform prioritizes security, so your sensitive information remains protected.

-

Can airSlate SignNow help ensure compliance when filling out the ct form 706 nt?

Absolutely, airSlate SignNow helps users maintain compliance when filling out the ct form 706 nt by offering easy-to-follow templates and guidance. Our service ensures that all necessary fields are completed accurately, reducing the risk of errors that could lead to compliance issues. This way, you can focus on what matters most without stressing about documentation.

-

What are the benefits of using airSlate SignNow for the estate document process, including the ct form 706 nt?

Using airSlate SignNow for estate documents like the ct form 706 nt streamlines the signing process, saving you time and effort. With an easy-to-use interface, secure storage, and features that enhance collaboration, you can manage complex estate paperwork effortlessly. Additionally, our platform ensures that you have a clear audit trail for all signed documents, providing peace of mind.

Get more for Form CT 706 NT Connecticut Estate Tax Return for Form CT 706 NT Estate Tax Return For NontaxableCT 706 NT Instructions, Connecti

- Painting contractor package new hampshire form

- Framing contractor package new hampshire form

- Foundation contractor package new hampshire form

- Plumbing contractor package new hampshire form

- Brick mason contractor package new hampshire form

- Roofing contractor package new hampshire form

- Electrical contractor package new hampshire form

- Sheetrock drywall contractor package new hampshire form

Find out other Form CT 706 NT Connecticut Estate Tax Return for Form CT 706 NT Estate Tax Return For NontaxableCT 706 NT Instructions, Connecti

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe