Ct 706 Nt Form 2017

What is the Ct 706 Nt Form

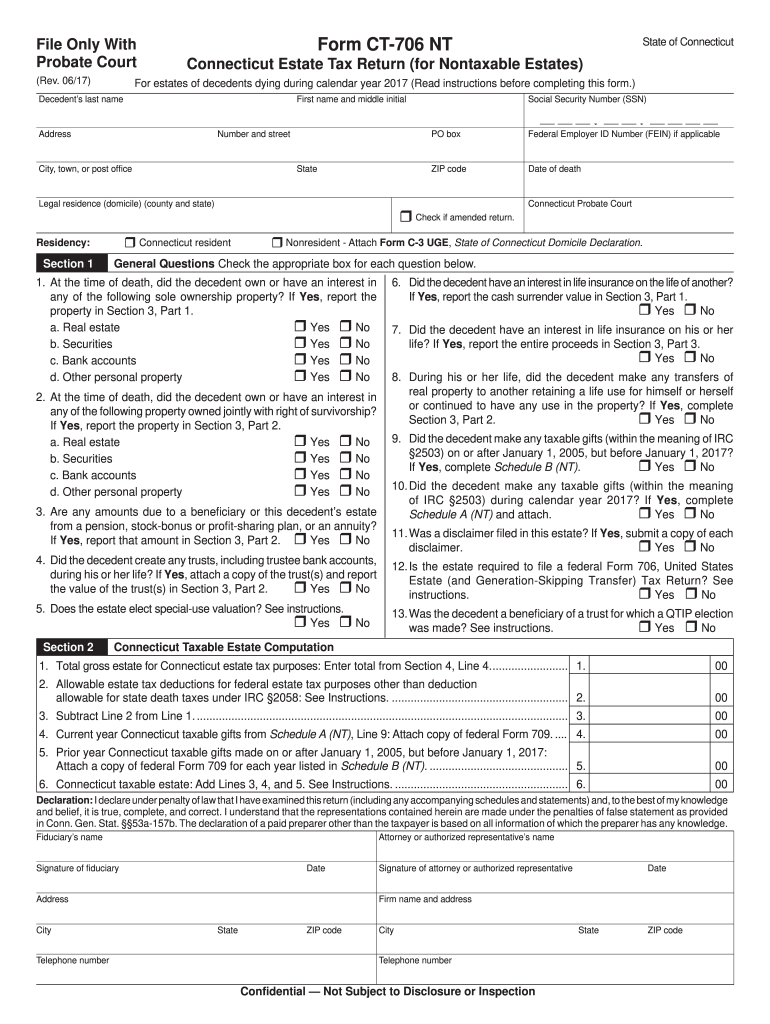

The Ct 706 Nt Form is a tax document used in the United States for reporting estate taxes. Specifically, it is utilized by estates that are not subject to federal estate tax but may still have state-level obligations. This form allows executors or administrators to provide necessary information about the estate's assets, debts, and beneficiaries. It serves as a means to ensure compliance with state tax laws while facilitating the proper distribution of the estate's assets.

How to use the Ct 706 Nt Form

To effectively use the Ct 706 Nt Form, individuals should first gather all relevant financial information regarding the estate. This includes details about assets, liabilities, and any previous tax payments made. Once the necessary information is compiled, the form can be filled out online or printed for manual completion. It is essential to ensure that all fields are accurately completed to avoid delays or issues with processing. After filling out the form, it should be submitted according to state-specific guidelines, which may include electronic filing or mailing to the appropriate tax authority.

Steps to complete the Ct 706 Nt Form

Completing the Ct 706 Nt Form involves several key steps:

- Gather all necessary documentation, including asset valuations, debts, and prior tax returns.

- Access the form through an official source or a reliable eSignature platform.

- Fill in the required fields, ensuring accuracy in reporting all financial information.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified filing methods, either electronically or through the mail.

Legal use of the Ct 706 Nt Form

The Ct 706 Nt Form is legally recognized for reporting estate taxes in jurisdictions that require it. Proper completion and submission of this form help ensure compliance with state tax laws, potentially avoiding penalties for non-compliance. Executors or administrators are responsible for the accuracy of the information provided, and any discrepancies may lead to legal repercussions. It is advisable to consult with a tax professional or legal advisor to navigate any complexities associated with estate tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Ct 706 Nt Form can vary by state, but it is generally required to be submitted within a specific timeframe after the death of the estate owner. Typically, this deadline falls within nine months of the date of death, although extensions may be available under certain circumstances. It is crucial to check with the state tax authority for precise deadlines and any potential changes due to special circumstances, such as natural disasters or public health emergencies.

Form Submission Methods

The Ct 706 Nt Form can be submitted through various methods, depending on state regulations. Common submission options include:

- Online filing through designated state tax portals.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at local tax offices, if permitted.

Choosing the correct submission method is essential for ensuring timely processing and compliance with state requirements.

Quick guide on how to complete ct 706 nt 2017 form

Your assistance manual on how to prepare your Ct 706 Nt Form

If you’re wondering about creating and submitting your Ct 706 Nt Form, here are some straightforward instructions on how to simplify tax declaration.

To begin, you just need to create your airSlate SignNow account to revolutionize your online document handling. airSlate SignNow is an exceptionally user-friendly and powerful document tool that enables you to edit, draft, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, allowing you to return and modify information as necessary. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to finish your Ct 706 Nt Form in just a few minutes:

- Set up your account and start managing PDFs in a matter of minutes.

- Utilize our directory to obtain any IRS tax document; explore various forms and schedules.

- Click Get form to access your Ct 706 Nt Form in our editor.

- Populate the required fields with your details (text, numbers, check marks).

- Employ the Sign Tool to include your legally recognized eSignature (if required).

- Review your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that paper submissions can lead to return errors and delays in refunds. Furthermore, before e-filing your taxes, review the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 706 nt 2017 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

When will I can fill the form of CT 1 as a non member in ifoa for 2017?

Registration starts on 30th January for April 2017 Exam. The process is simple.A link will show up on website (actuaries.org.uk) on 30th jan using which you will have to sign up filling in very basic details like name and DOB etc. Do not Forget to tick the option to apply for reduced rate fees if you are earning less than GBP 7140. If you forget to tick the option of reduced rate fees than you will have to pay almost twice after you sign up.Once you sign up, you will get ARN no on your registered email id within 48 hours. You will have to wait till then, It may drop in 5 mins as well sometimes.using this ARN no. you have to log in, select exam centre in India and make the payment.Fees is GBP 130 (if you are eligible for reduced fees i.e. Your annual income is less than GBP 7140, if you are earning more than your fees will be almost twice). You need to have international debit/credit card to make the payment. You can always call the institute for any help. They are very receptive.

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the ct 706 nt 2017 form

How to make an electronic signature for your Ct 706 Nt 2017 Form in the online mode

How to create an eSignature for the Ct 706 Nt 2017 Form in Chrome

How to generate an electronic signature for putting it on the Ct 706 Nt 2017 Form in Gmail

How to generate an electronic signature for the Ct 706 Nt 2017 Form from your smartphone

How to generate an eSignature for the Ct 706 Nt 2017 Form on iOS

How to generate an electronic signature for the Ct 706 Nt 2017 Form on Android OS

People also ask

-

What is the Ct 706 Nt Form and why is it important?

The Ct 706 Nt Form is a tax document used in Connecticut for estate tax purposes. It is crucial for ensuring compliance with state regulations regarding estate taxation. Properly completing the Ct 706 Nt Form can help you avoid penalties and streamline the estate settlement process.

-

How can airSlate SignNow help with the Ct 706 Nt Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Ct 706 Nt Form. Our solution simplifies the document workflow, making it faster and more efficient to handle important tax documents like the Ct 706 Nt Form, ensuring you meet deadlines without hassle.

-

What features does airSlate SignNow offer for the Ct 706 Nt Form?

With airSlate SignNow, you can quickly upload, edit, and eSign the Ct 706 Nt Form. Our platform offers features like document templates, in-app collaboration, and secure storage, all designed to enhance your experience with managing important tax documents.

-

Is airSlate SignNow cost-effective for managing the Ct 706 Nt Form?

Yes, airSlate SignNow is a cost-effective solution for managing the Ct 706 Nt Form and other documents. We offer flexible pricing plans tailored to fit various business needs, ensuring you can efficiently handle your document signing without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for the Ct 706 Nt Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage the Ct 706 Nt Form alongside your existing tools. Whether it's CRM systems or cloud storage services, these integrations enhance your workflow and document management.

-

What are the benefits of using airSlate SignNow for the Ct 706 Nt Form?

Using airSlate SignNow for the Ct 706 Nt Form brings numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care and allows you to track the signing process in real-time.

-

How secure is airSlate SignNow when handling the Ct 706 Nt Form?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like the Ct 706 Nt Form. We utilize advanced encryption and authentication measures to protect your data, ensuring that your information remains confidential and secure throughout the signing process.

Get more for Ct 706 Nt Form

- Blank for for vr 217 10 14 form

- Pre ep meeting parent feedback form broward k12 fl

- Accredited investor certification form

- Contractor registration form city of forney cityofforney

- Forensic drug testing custody and control form

- Motion and order in supplemental proceedings motion form

- Non disclosure intellectual property agreement template form

- Music book agent contract template form

Find out other Ct 706 Nt Form

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template