Form Ct 706 Nt 2018

What is the Form Ct 706 Nt

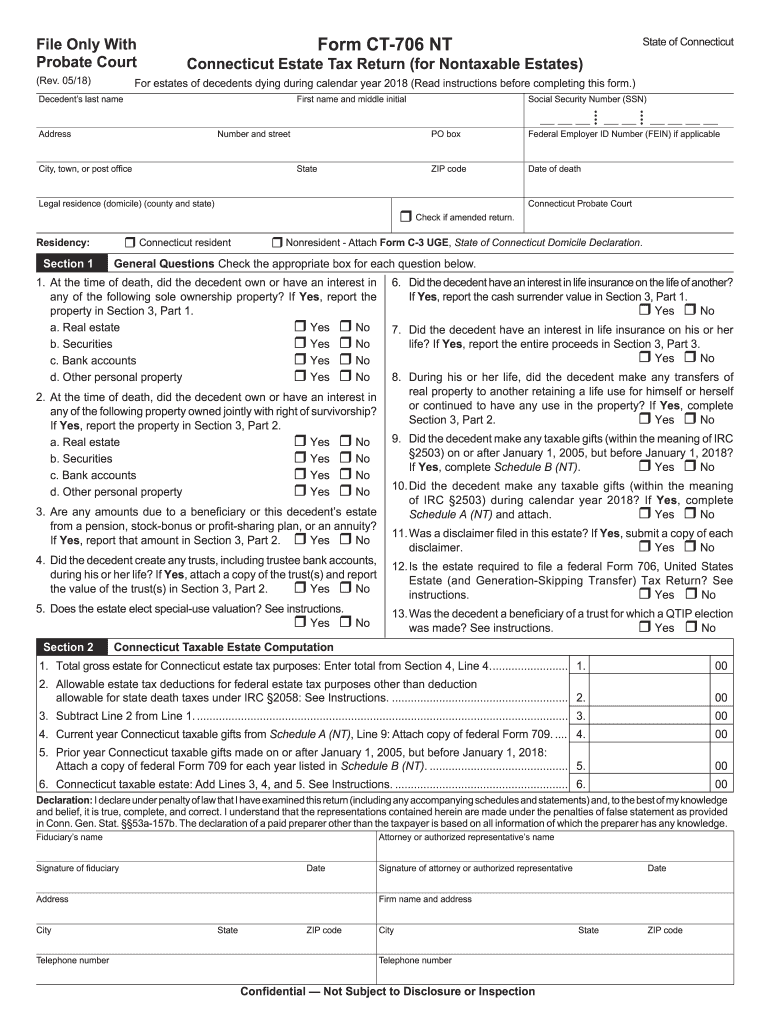

The Form Ct 706 Nt, also known as the Connecticut Estate Tax Return, is a crucial document for individuals who are required to report estate tax obligations in the state of Connecticut. This form is specifically designed for estates that exceed the state’s exemption threshold. It is essential for ensuring compliance with Connecticut tax laws and for the proper assessment of estate taxes owed. The form captures detailed information about the decedent's assets, liabilities, and the overall value of the estate, which is necessary for calculating the tax due.

How to use the Form Ct 706 Nt

Using the Form Ct 706 Nt involves several steps to ensure accurate completion and compliance with state regulations. First, gather all necessary financial documents related to the decedent's estate, including property deeds, bank statements, and investment records. Next, fill out the form with precise details about the estate's total value, deductions, and any applicable credits. After completing the form, it should be signed and dated by the executor or administrator of the estate. Finally, submit the form to the Connecticut Department of Revenue Services by the specified deadline to avoid penalties.

Steps to complete the Form Ct 706 Nt

Completing the Form Ct 706 Nt requires careful attention to detail. Follow these steps for accurate filing:

- Gather all relevant documentation, including asset valuations and liabilities.

- Fill in the decedent's information, including name, date of death, and Social Security number.

- List all assets and their fair market values on the form.

- Calculate total liabilities and any deductions allowed under Connecticut law.

- Determine the net taxable estate by subtracting liabilities and deductions from total assets.

- Calculate the estate tax owed based on the net taxable estate.

- Review the completed form for accuracy, then sign and date it.

Filing Deadlines / Important Dates

Filing deadlines for the Form Ct 706 Nt are critical to avoid penalties. Generally, the form must be filed within nine months of the decedent's date of death. If additional time is needed, an extension may be requested, but it is essential to ensure that any estate taxes owed are paid by the original deadline to avoid interest and penalties. Keeping track of these dates helps in maintaining compliance with Connecticut tax laws.

Required Documents

To successfully complete the Form Ct 706 Nt, certain documents are required. These include:

- Death certificate of the decedent.

- Documentation of all assets, such as property deeds and bank statements.

- Records of any liabilities, including mortgages and debts.

- Previous tax returns, if applicable.

- Any relevant estate planning documents, such as wills or trusts.

Penalties for Non-Compliance

Failing to file the Form Ct 706 Nt on time can lead to significant penalties. The Connecticut Department of Revenue Services imposes fines for late submissions, which can accumulate daily until the form is filed. Additionally, interest may accrue on any unpaid taxes, increasing the total amount owed. It is essential for executors and administrators to be aware of these penalties to ensure timely and accurate filing.

Quick guide on how to complete ct 706 nt 2018 2019 form

Your assistance manual on how to prepare your Form Ct 706 Nt

If you’re wondering how to create and submit your Form Ct 706 Nt, here are some straightforward instructions on how to simplify tax submission.

To get started, you just need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that allows you to edit, draft, and finalize your tax forms effortlessly. With its editing tools, you can toggle between text, checkboxes, and eSignatures, and revisit to modify details as needed. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Form Ct 706 Nt in a matter of minutes:

- Set up your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; sift through variations and schedules.

- Click Obtain form to access your Form Ct 706 Nt in our editor.

- Populate the necessary fields with your information (text, numbers, check marks).

- Make use of the Signing Tool to add your legally-binding eSignature (if necessary).

- Review your file and correct any mistakes.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can increase return errors and delays in refunds. Of course, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ct 706 nt 2018 2019 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the ct 706 nt 2018 2019 form

How to create an eSignature for your Ct 706 Nt 2018 2019 Form in the online mode

How to make an eSignature for your Ct 706 Nt 2018 2019 Form in Chrome

How to generate an eSignature for putting it on the Ct 706 Nt 2018 2019 Form in Gmail

How to generate an eSignature for the Ct 706 Nt 2018 2019 Form straight from your smartphone

How to generate an eSignature for the Ct 706 Nt 2018 2019 Form on iOS devices

How to create an eSignature for the Ct 706 Nt 2018 2019 Form on Android devices

People also ask

-

What is Form CT 706 NT and how is it used?

Form CT 706 NT is a state tax form used in Connecticut for the estate tax return. It is specifically designed for estates that do not owe any taxes, allowing executors to file for a tax waiver. Utilizing airSlate SignNow, you can easily complete and eSign Form CT 706 NT, streamlining the submission process.

-

How can airSlate SignNow help with completing Form CT 706 NT?

airSlate SignNow offers an intuitive platform that simplifies the completion of Form CT 706 NT. With features like templates and eSignature capabilities, users can fill out the form efficiently and ensure that all necessary information is captured correctly. This not only saves time but also reduces the likelihood of errors.

-

Is airSlate SignNow a cost-effective solution for managing Form CT 706 NT?

Yes, airSlate SignNow is a cost-effective solution for managing Form CT 706 NT and other documents. With competitive pricing plans, businesses can choose the option that best fits their needs without overspending. Plus, the efficiency gained from using the platform can lead to overall cost savings.

-

What features does airSlate SignNow offer for Form CT 706 NT?

airSlate SignNow provides a variety of features for managing Form CT 706 NT, including customizable templates, secure eSigning, and real-time tracking of document status. Additionally, the platform is user-friendly, making it accessible for users of all tech levels. These features enhance the overall experience of completing and submitting tax forms.

-

Can I integrate airSlate SignNow with other software while using Form CT 706 NT?

Absolutely! airSlate SignNow offers integrations with popular software such as Google Drive, Dropbox, and CRM systems. This means you can easily import or export your data when working on Form CT 706 NT, creating a seamless workflow that enhances productivity.

-

Is it secure to eSign Form CT 706 NT using airSlate SignNow?

Yes, using airSlate SignNow to eSign Form CT 706 NT is secure. The platform employs industry-standard encryption and security protocols to safeguard your data and signatures. This ensures that your sensitive information remains protected throughout the signing process.

-

What are the benefits of using airSlate SignNow for Form CT 706 NT?

The benefits of using airSlate SignNow for Form CT 706 NT include faster processing times, reduced paperwork, and enhanced accuracy in form completion. Additionally, the ability to eSign documents electronically means you can finalize important tax forms from anywhere, making it a flexible solution for busy professionals.

Get more for Form Ct 706 Nt

- 500 figures in clay form

- Ics 217 form

- Application for roadside assistance reimbursement for aaa allied group inc club code 007 details of your recent roadside form

- Application for tenancy woolgoolga real estate form

- North america permanent trailer plate application pdf idaho itd idaho form

- Certificate of agreement form

- Patient intake form sunshine health

- Land na contract template form

Find out other Form Ct 706 Nt

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free