Print Form Reset Form Form CT 706 NT File Only Wit 2023-2026

Understanding the CT 706 NT 2023 Form

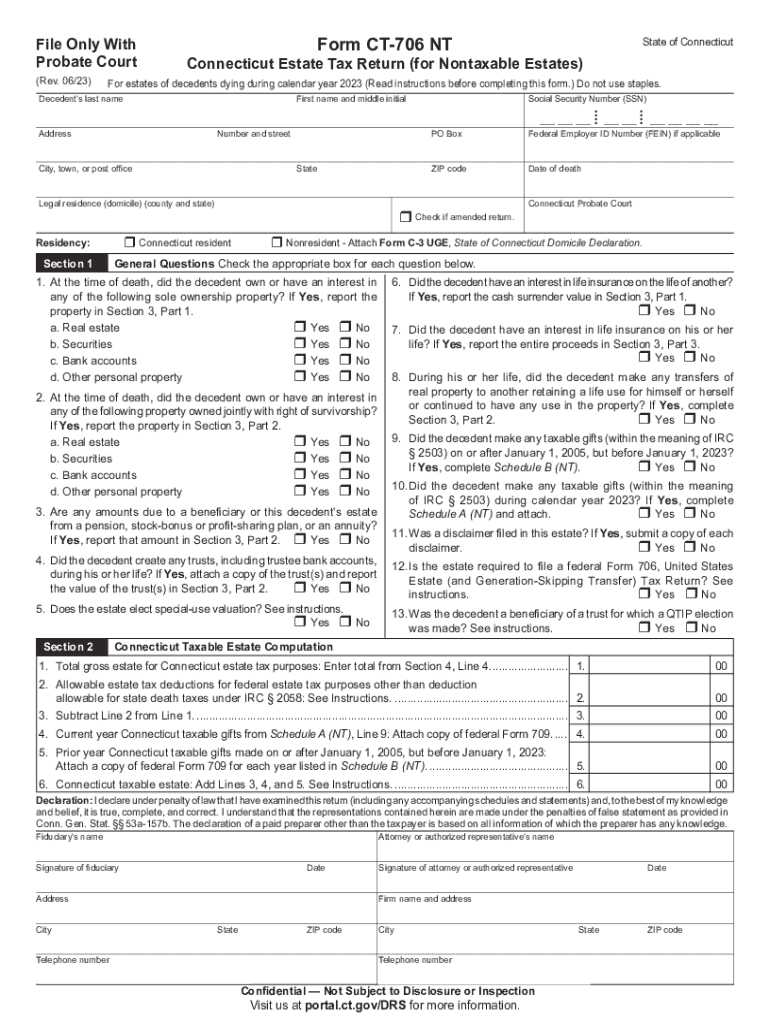

The CT 706 NT 2023 form is a critical document used in the estate tax process in Connecticut. This form is specifically designed for estates that are not subject to federal estate tax but may still be liable for Connecticut estate tax. It provides a means for the executor or administrator of an estate to report the value of the estate and any applicable deductions. Understanding the nuances of this form is essential for compliance with state tax regulations.

Steps to Complete the CT 706 NT 2023 Form

Completing the CT 706 NT 2023 form involves several key steps:

- Gather necessary documentation, including the decedent's financial records and asset valuations.

- Fill out the form accurately, ensuring all required fields are completed, including information about the decedent and the estate.

- Calculate the total value of the estate and any deductions that may apply.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines for the CT 706 NT 2023 Form

It is crucial to be aware of the filing deadlines associated with the CT 706 NT 2023 form. Generally, the form must be filed within nine months of the date of death of the decedent. Extensions may be available in certain circumstances, but it is important to file timely to avoid penalties. Keeping track of these deadlines helps ensure compliance with Connecticut tax laws.

Legal Use of the CT 706 NT 2023 Form

The CT 706 NT 2023 form serves a legal purpose in the estate administration process. It is used to report the estate's value to the Connecticut Department of Revenue Services. Proper completion and submission of this form are essential for the legal transfer of assets and for fulfilling the estate's tax obligations. Failure to file this form can result in penalties and complications in the estate settlement process.

Required Documents for the CT 706 NT 2023 Form

To complete the CT 706 NT 2023 form, several documents are typically required:

- The decedent's death certificate.

- Financial statements detailing the decedent's assets and liabilities.

- Documentation of any debts or expenses that may be deducted from the estate's value.

- Any prior tax returns that may be relevant to the estate's tax situation.

Form Submission Methods for the CT 706 NT 2023

The CT 706 NT 2023 form can be submitted through various methods. Executors or administrators may choose to file the form online through the Connecticut Department of Revenue Services website, or they may opt to submit it via mail. In-person submissions may also be available, depending on local regulations. Each method has its own guidelines and processing times, so it is important to choose the one that best fits the situation.

Quick guide on how to complete print form reset form form ct 706 nt file only wit

Prepare Print Form Reset Form Form CT 706 NT File Only Wit effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, as you can easily access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Print Form Reset Form Form CT 706 NT File Only Wit on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Print Form Reset Form Form CT 706 NT File Only Wit effortlessly

- Locate Print Form Reset Form Form CT 706 NT File Only Wit and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to store your modifications.

- Choose how you wish to deliver your form, either via email, SMS, shareable link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Print Form Reset Form Form CT 706 NT File Only Wit to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct print form reset form form ct 706 nt file only wit

Create this form in 5 minutes!

How to create an eSignature for the print form reset form form ct 706 nt file only wit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 706 nt 2023 and how does it relate to airSlate SignNow?

The ct 706 nt 2023 is a crucial document for businesses that need to comply with tax regulations. airSlate SignNow facilitates the easy signing and sending of this document, ensuring you can manage your compliance efficiently. Our platform streamlines the process, making it simple for users to eSign and submit the ct 706 nt 2023.

-

How can airSlate SignNow help with the ct 706 nt 2023 document preparation?

airSlate SignNow offers templates and customizable features that assist in preparing the ct 706 nt 2023. You can easily fill out the necessary fields, ensuring all details are accurate before sending it for signatures. This feature speeds up document preparation while maintaining compliance with regulations.

-

What are the pricing options for airSlate SignNow when handling ct 706 nt 2023?

airSlate SignNow provides flexible pricing plans that cater to various business sizes, ideal for handling documents like ct 706 nt 2023. Each plan includes essential features for eSigning and sending documents seamlessly. By choosing airSlate SignNow, businesses can save costs while ensuring compliance with the ct 706 nt 2023 requirements.

-

What key features does airSlate SignNow offer for the ct 706 nt 2023?

Key features of airSlate SignNow for handling the ct 706 nt 2023 include secure eSigning, document tracking, and customizable templates. These features simplify the process of collecting signatures and ensure that you are always aware of the document's status. By leveraging these tools, you can manage your ct 706 nt 2023 more effectively.

-

Can airSlate SignNow integrate with other tools for managing ct 706 nt 2023?

Yes, airSlate SignNow offers integrations with popular business tools and software, making it easier to manage the ct 706 nt 2023. Whether you use CRM, accounting, or other platforms, our seamless integrations allow you to handle documents efficiently. This enhances your workflow signNowly when dealing with the ct 706 nt 2023.

-

What are the benefits of using airSlate SignNow for the ct 706 nt 2023?

Using airSlate SignNow for the ct 706 nt 2023 provides numerous benefits such as enhanced security, increased efficiency, and compliance assurance. Our platform employs advanced encryption to ensure your documents are protected while enabling quick access and easy signing. This results in a smoother process when dealing with compliance needs like the ct 706 nt 2023.

-

How secure is airSlate SignNow for managing ct 706 nt 2023 documents?

airSlate SignNow prioritizes security, utilizing industry-leading encryption and security measures for managing ct 706 nt 2023 documents. Your sensitive information is protected throughout the signing process, and access controls are established to safeguard your data. Trust our platform to maintain the integrity and confidentiality of your ct 706 nt 2023.

Get more for Print Form Reset Form Form CT 706 NT File Only Wit

- End of assignment letter form

- Finnair raskaustodistus form

- 8283a claim for family coverage death benefits use this form to file a claim for a family sgli death benefit benefits va

- Mn paper id template form

- Veterinary certificate for export of fishery products intended for human consumption into the republic of india form

- Over the counter otc medication consent form parent

- Writ summons pleading in maryland form

- Mortgage note example pdf form

Find out other Print Form Reset Form Form CT 706 NT File Only Wit

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple