Instructions for Form 1040X Department of the Treasury Internal Revenue 2021

Understanding Form 1045

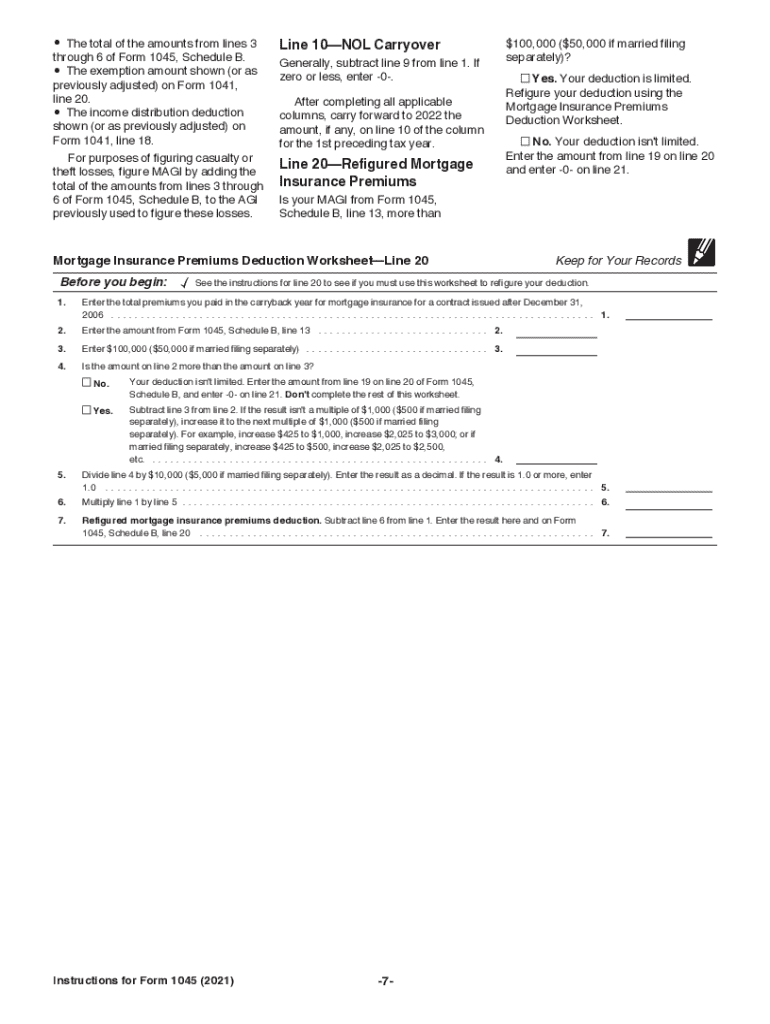

Form 1045, known as the Application for Tentative Refund, is utilized by taxpayers seeking a quick refund of overpaid taxes. This form allows individuals to apply for a refund based on a carryback of a net operating loss, unused credits, or certain other deductions. The 2020 instructions for Form 1045 provide essential guidelines on eligibility and the process for filing. It is crucial for taxpayers to understand the specific circumstances under which they can use this form to ensure compliance with IRS regulations.

Steps to Complete Form 1045

Completing Form 1045 involves several key steps to ensure accuracy and compliance with IRS requirements. First, gather all necessary documentation, including prior tax returns and any relevant financial statements that support your claim for a refund. Next, fill out the form by providing your personal information, including your Social Security number and filing status. Ensure that you accurately calculate the amount of the tentative refund you are requesting. Finally, review the completed form for any errors before submitting it to the IRS.

Filing Deadlines for Form 1045

Timeliness is essential when submitting Form 1045. The IRS requires that this form be filed within one year of the end of the tax year in which the net operating loss occurred. For example, if your loss occurred in 2020, you must file Form 1045 by the end of 2021. Missing this deadline may result in the loss of your right to claim the refund. It is advisable to keep track of these important dates to avoid complications.

Required Documents for Form 1045

To successfully file Form 1045, you will need to provide several documents that support your application for a tentative refund. These documents typically include:

- Copy of your most recent tax return

- Financial statements detailing the net operating loss

- Any relevant schedules or forms that pertain to credits or deductions

Having these documents ready will facilitate a smoother filing process and help ensure that your refund is processed without delays.

IRS Guidelines for Form 1045

The IRS has established specific guidelines that govern the use of Form 1045. These guidelines outline who is eligible to file the form, the types of deductions that can be claimed, and the necessary calculations for determining the amount of the refund. It is essential to familiarize yourself with these guidelines to ensure that your application meets all IRS requirements. Non-compliance with these guidelines can lead to delays or denials of your refund request.

Penalties for Non-Compliance

Failure to comply with IRS regulations when filing Form 1045 can result in significant penalties. This may include fines for inaccurate information or late submissions. Additionally, if the IRS determines that the information provided was intentionally misleading, further legal actions could be pursued. It is vital to ensure that all information is accurate and submitted in a timely manner to avoid these potential penalties.

Quick guide on how to complete instructions for form 1040x department of the treasury internal revenue

Complete Instructions For Form 1040X Department Of The Treasury Internal Revenue effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to access the necessary forms and securely store them on the internet. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Instructions For Form 1040X Department Of The Treasury Internal Revenue on any device using airSlate SignNow's Android or iOS apps and enhance any document-centric process today.

How to modify and eSign Instructions For Form 1040X Department Of The Treasury Internal Revenue with ease

- Locate Instructions For Form 1040X Department Of The Treasury Internal Revenue and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you want to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or errors that necessitate reprinting. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Form 1040X Department Of The Treasury Internal Revenue while ensuring smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 1040x department of the treasury internal revenue

Create this form in 5 minutes!

People also ask

-

What is the 1045 form used for?

The 1045 form is used by taxpayers to request a quick refund of overpayments. This form allows individuals to reclaim excess tax withheld and get their money back faster. Understanding the 1045 form is essential for efficient tax management.

-

How does airSlate SignNow support the 1045 filing process?

airSlate SignNow provides an intuitive platform for eSigning the 1045 form and other tax documents. Our solution ensures that your signatures are legally binding and securely stored, making the 1045 filing process faster and more reliable. With airSlate SignNow, you can manage all your tax documents in one place.

-

What are the pricing options for airSlate SignNow for 1045 document management?

airSlate SignNow offers competitive pricing plans that cater to different business needs when managing 1045 documents. Whether you are a small business or a large enterprise, our cost-effective solutions ensure you can eSign and send 1045 forms efficiently. Explore our pricing page to find the best fit for your organization.

-

Can airSlate SignNow integrate with accounting software for 1045 forms?

Yes, airSlate SignNow seamlessly integrates with various accounting software to streamline the 1045 form process. This integration allows for easy access to your tax documents while ensuring accurate data transfer. By linking to your favorite accounting tools, managing 1045 documents becomes hassle-free.

-

What features does airSlate SignNow offer for handling 1045 forms?

airSlate SignNow offers features like document templates, eSignature tracking, and secure storage specifically for handling 1045 forms. With customizable workflows, our platform enhances the efficiency of your tax-related processes. These features help keep your document management organized and compliant.

-

What are the benefits of using airSlate SignNow for 1045 processing?

Using airSlate SignNow for 1045 processing provides numerous benefits, including faster turnaround times and enhanced security for sensitive tax documents. Our platform allows for easy collaboration between stakeholders, ensuring that everyone has access to the latest version of the 1045 form. This empowers businesses to focus on their core operations while we handle the paperwork.

-

Is airSlate SignNow secure for signing sensitive 1045 documents?

Absolutely, airSlate SignNow prioritizes security when it comes to handling sensitive 1045 documents. Our platform utilizes encryption and complies with industry standards to ensure that your information is protected throughout the signing process. You can rest assured that your 1045 forms are secure with us.

Get more for Instructions For Form 1040X Department Of The Treasury Internal Revenue

- Legal last will and testament form for a widow or widower with adult children new hampshire

- Legal last will and testament form for widow or widower with minor children new hampshire

- Legal last will form for a widow or widower with no children new hampshire

- Legal last will and testament form for a widow or widower with adult and minor children new hampshire

- Legal last will and testament form for divorced and remarried person with mine yours and ours children new hampshire

- Legal last will and testament form with all property to trust called a pour over will new hampshire

- Written revocation of will new hampshire form

- Last will and testament for other persons new hampshire form

Find out other Instructions For Form 1040X Department Of The Treasury Internal Revenue

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy