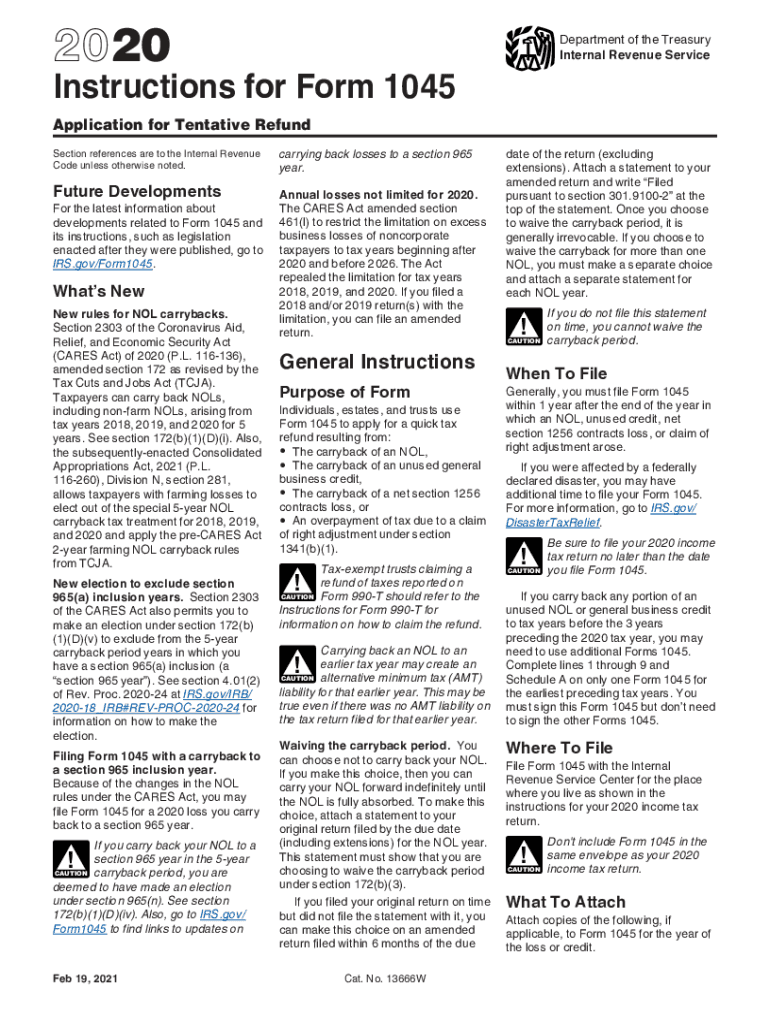

Instructions for Form 1045 Instructions for Form 1045,Application for Tentative Refund 2020

What is Form 1045?

The 1045 form, officially known as the Application for Tentative Refund, is used by taxpayers to request a quick refund of overpaid taxes. This form is particularly beneficial for individuals who have experienced a change in circumstances that may affect their tax liability, such as a net operating loss. By submitting Form 1045, taxpayers can expedite the refund process instead of waiting for the standard refund timeline associated with their tax returns.

Steps to Complete Form 1045

Completing the 1045 form involves several key steps:

- Gather necessary documents: Collect all relevant tax documents, including your previous tax returns and any records of overpayments.

- Fill out the form: Provide your personal information, including your name, address, and Social Security number. Clearly state the reason for your refund request and the amount you believe you are owed.

- Calculate your refund: Use the instructions provided with the form to accurately compute the tentative refund amount based on your changes in tax liability.

- Review your application: Ensure all information is accurate and complete before submission to avoid delays.

- Submit the form: Send your completed 1045 form to the appropriate IRS address as indicated in the instructions.

IRS Guidelines for Form 1045

The IRS has specific guidelines that govern the use of Form 1045. It is essential to ensure compliance with these regulations to avoid penalties. The form must be filed within a certain timeframe after the event that caused the overpayment, typically within one year. Additionally, the IRS requires that all claims for tentative refunds are substantiated with appropriate documentation to support the request.

Eligibility Criteria for Form 1045

To qualify for filing the 1045 form, taxpayers must meet specific eligibility criteria. Generally, this includes having incurred a net operating loss in the current tax year or having overpaid taxes in prior years. Taxpayers should also be aware that certain restrictions may apply, such as limitations based on the type of income or deductions claimed. It is advisable to review the form instructions carefully to determine eligibility.

Legal Use of Form 1045

The 1045 form is legally binding when completed and submitted according to IRS regulations. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. Using a reliable eSignature platform can enhance the legal standing of your submission, ensuring that it meets all necessary requirements for authenticity and security.

Form Submission Methods

Taxpayers have multiple options for submitting Form 1045. The form can be mailed directly to the IRS, or in some cases, it may be submitted electronically through approved software. Each submission method has its own processing times and requirements, so it is important to choose the one that best fits your needs. Ensure that you keep a copy of your submitted form for your records.

Quick guide on how to complete 2020 instructions for form 1045 instructions for form 1045application for tentative refund

Effortlessly Prepare Instructions For Form 1045 Instructions For Form 1045,Application For Tentative Refund on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Instructions For Form 1045 Instructions For Form 1045,Application For Tentative Refund across any platform using the airSlate SignNow Android or iOS applications, streamlining any document-oriented task today.

Simplest Method to Modify and eSign Instructions For Form 1045 Instructions For Form 1045,Application For Tentative Refund with Ease

- Locate Instructions For Form 1045 Instructions For Form 1045,Application For Tentative Refund and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of the documents or obscure sensitive information using tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as an ink signature.

- Review all information and click on the Done button to save your changes.

- Choose your preferred method for sending your document, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Instructions For Form 1045 Instructions For Form 1045,Application For Tentative Refund while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 instructions for form 1045 instructions for form 1045application for tentative refund

Create this form in 5 minutes!

How to create an eSignature for the 2020 instructions for form 1045 instructions for form 1045application for tentative refund

The best way to make an e-signature for your PDF online

The best way to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the significance of the number 1045 in airSlate SignNow?

The number 1045 refers to our standard pricing plan, which is designed to provide businesses with a cost-effective solution for eSigning documents. With this plan, you gain access to a range of features that simplify document management and eSigning. By choosing 1045, you are selecting a service that enhances productivity without breaking the bank.

-

How does airSlate SignNow's 1045 plan compare to other pricing options?

The 1045 plan offers a balanced mix of essential features at a competitive price, making it an excellent choice for small to medium-sized businesses. Compared to other pricing tiers, 1045 includes robust eSigning capabilities while ensuring affordability. Users often find that this plan meets their needs effectively without unnecessary costs.

-

What features are included in the 1045 plan for airSlate SignNow?

The 1045 plan includes essential features such as unlimited document signing, templates, and integration with popular business tools. This allows users to streamline their document workflows and improve efficiency. Additionally, the plan supports secure storage to ensure that all documents remain safe.

-

Are there any benefits to using the 1045 plan for eSigning documents?

Yes, the 1045 plan provides numerous benefits, such as increased efficiency in document signing and improved response times. By utilizing airSlate SignNow, businesses can track the status of documents and ensure timely completions. The plan also enhances collaboration among team members, which is crucial for business operations.

-

Can I integrate airSlate SignNow with other apps while using the 1045 plan?

Absolutely! The 1045 plan supports integration with various apps like Google Drive, Dropbox, and Salesforce, enhancing your workflow flexibility. This means you can easily send, sign, and manage documents from one place. These integrations help streamline your processes, saving time and reducing errors.

-

Is the 1045 plan suitable for larger organizations?

While the 1045 plan is designed with small to medium-sized businesses in mind, larger organizations can also benefit from its features. However, enterprises may eventually need to consider higher-tier plans for additional customization or user management options. The affordability and features of the 1045 plan make it a great starting point for many businesses.

-

How can the 1045 plan improve my team's productivity?

By using the 1045 plan from airSlate SignNow, teams can dramatically improve their productivity through simplified document management and faster eSigning processes. The ability to track documents in real time means that your team can focus on core tasks without delays. Additionally, the software’s user-friendly interface allows for quick onboarding and minimizes learning curves.

Get more for Instructions For Form 1045 Instructions For Form 1045,Application For Tentative Refund

Find out other Instructions For Form 1045 Instructions For Form 1045,Application For Tentative Refund

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast