Instructions for Form 1045 IRS Gov Irs 2015

What is the Instructions For Form 1045 IRS gov Irs

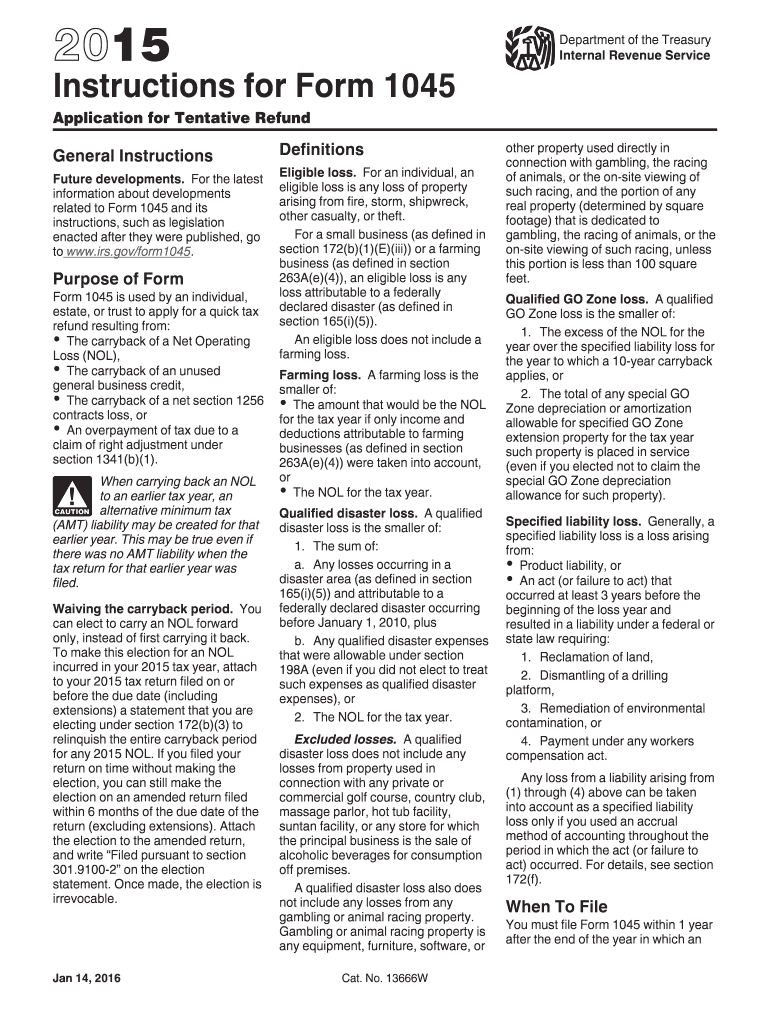

The Instructions for Form 1045 are essential guidelines provided by the IRS for taxpayers who wish to apply for a quick refund of overpaid taxes. This form is primarily used to claim a refund based on a carryback of a net operating loss, unused general business credits, or other specific tax attributes. Understanding these instructions helps ensure that taxpayers accurately complete the form and submit it in compliance with IRS regulations.

Steps to complete the Instructions For Form 1045 IRS gov Irs

Completing the Instructions for Form 1045 involves several key steps:

- Gather necessary financial documents, including prior year tax returns and records of any losses or credits.

- Review the specific eligibility criteria outlined in the instructions to confirm that you qualify for a refund.

- Fill out the form accurately, ensuring all required fields are completed and calculations are correct.

- Attach any supporting documents that substantiate your claims, such as schedules or forms related to the losses or credits.

- Sign and date the form, ensuring that all information is accurate before submission.

Legal use of the Instructions For Form 1045 IRS gov Irs

The legal use of the Instructions for Form 1045 is crucial for ensuring that the submission is valid and accepted by the IRS. The form must be completed in accordance with IRS guidelines to be considered legally binding. This includes providing accurate information and adhering to deadlines. Utilizing a reliable e-signature platform can enhance the legal standing of the document by ensuring compliance with regulations such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for Form 1045 are critical for taxpayers seeking timely refunds. Generally, the form must be filed within one year of the end of the tax year in which the loss occurred. It is important to keep track of these dates to avoid missing the opportunity for a refund. Taxpayers should also be aware of any changes in deadlines that may arise due to legislative updates or IRS announcements.

Required Documents

To complete the Instructions for Form 1045, several documents are typically required:

- Prior year tax returns to establish the basis for the claim.

- Documentation of the net operating loss or credits being carried back.

- Any relevant schedules or forms that support the calculations made on the 1045.

Who Issues the Form

The Form 1045 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides the instructions and guidelines necessary for taxpayers to accurately complete the form and ensure compliance with federal tax laws.

Quick guide on how to complete 2015 instructions for form 1045 irsgov irs

Easily Create Instructions For Form 1045 IRS gov Irs on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Instructions For Form 1045 IRS gov Irs on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The Simplest Way to Edit and Electronically Sign Instructions For Form 1045 IRS gov Irs

- Obtain Instructions For Form 1045 IRS gov Irs and click Get Form to begin.

- Use the tools at your disposal to complete your document.

- Highlight important sections of the documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that demand the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Instructions For Form 1045 IRS gov Irs and guarantee excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 instructions for form 1045 irsgov irs

Create this form in 5 minutes!

How to create an eSignature for the 2015 instructions for form 1045 irsgov irs

How to make an eSignature for your 2015 Instructions For Form 1045 Irsgov Irs online

How to generate an eSignature for the 2015 Instructions For Form 1045 Irsgov Irs in Chrome

How to make an eSignature for signing the 2015 Instructions For Form 1045 Irsgov Irs in Gmail

How to make an eSignature for the 2015 Instructions For Form 1045 Irsgov Irs right from your mobile device

How to make an eSignature for the 2015 Instructions For Form 1045 Irsgov Irs on iOS devices

How to make an eSignature for the 2015 Instructions For Form 1045 Irsgov Irs on Android OS

People also ask

-

What are the Instructions for Form 1045 on IRS.gov?

The Instructions for Form 1045 IRS gov Irs provide detailed guidance on how to file for a quick tax refund. They outline eligibility, required documentation, and specific steps to complete the form accurately. Familiarizing yourself with these instructions is crucial for ensuring compliance and maximizing your refund.

-

How can airSlate SignNow help with signing the Instructions for Form 1045?

airSlate SignNow makes it easy to electronically sign documents like the Instructions for Form 1045 IRS gov Irs. Our platform allows you to securely eSign and send your completed forms seamlessly, saving you time and ensuring you meet filing deadlines.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow provides a range of features for tax form management, including easy document editing, templates for common forms, and the ability to collect signatures electronically. These functionalities help you efficiently handle the Instructions for Form 1045 IRS gov Irs and other important documents.

-

Is there a mobile app for airSlate SignNow to access Instructions for Form 1045?

Yes, airSlate SignNow has a mobile app that enables users to access and manage their documents, including the Instructions for Form 1045 IRS gov Irs, from anywhere. This ensures you can sign and send your forms on the go, making it convenient to keep up with tax obligations.

-

What pricing options does airSlate SignNow provide for users needing to file tax forms?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you are an individual or a large organization, you can find a plan that fits your budget while effectively managing documents like the Instructions for Form 1045 IRS gov Irs. Each plan includes essential features for efficient document handling.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow while managing documents such as the Instructions for Form 1045 IRS gov Irs. These integrations streamline the process of filling out and filing essential tax forms.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, including the Instructions for Form 1045 IRS gov Irs, offers numerous benefits like enhanced security, easy accessibility, and faster turnaround times for document signing. Our user-friendly interface ensures that both individuals and businesses can handle their tax forms efficiently.

Get more for Instructions For Form 1045 IRS gov Irs

Find out other Instructions For Form 1045 IRS gov Irs

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online