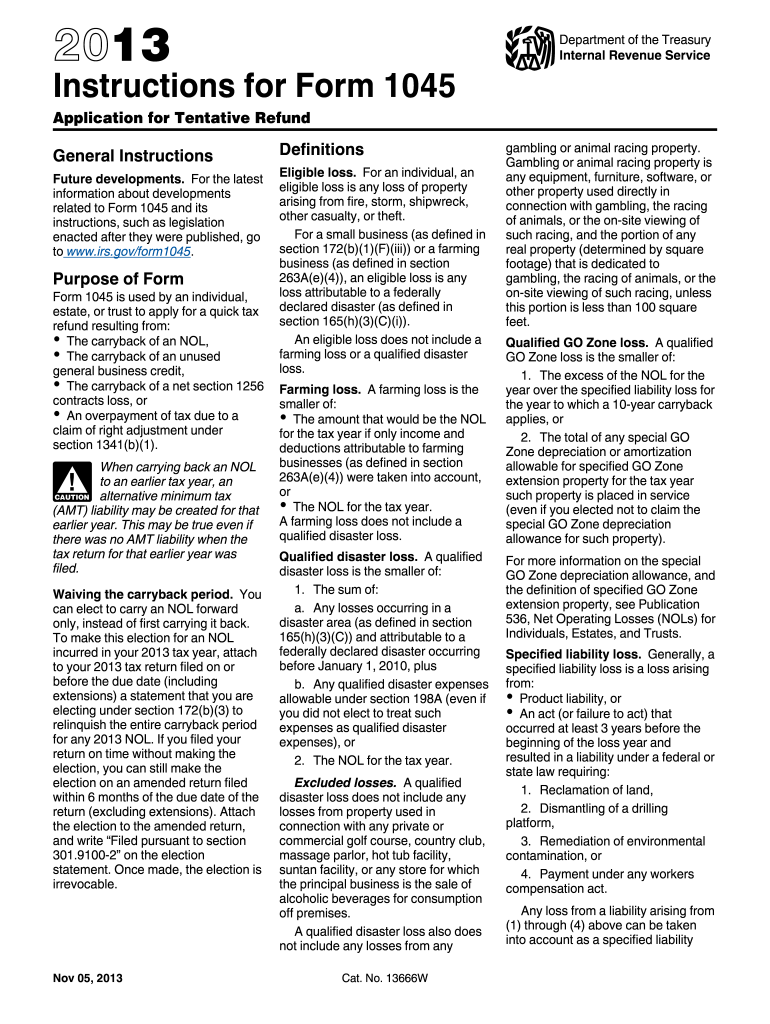

Instructions for Form 1045 Instructions for Form 1045, Application for Tentative Refund Irs 2013

What is the Instructions For Form 1045, Application For Tentative Refund IRS

The Instructions For Form 1045, Application For Tentative Refund, are provided by the IRS to guide taxpayers through the process of applying for a tentative refund of overpaid taxes. This form allows individuals and businesses to quickly receive refunds based on changes to their tax situation, such as carrybacks of net operating losses or unused credits. Understanding these instructions is essential for ensuring compliance and maximizing potential refunds.

Steps to Complete the Instructions For Form 1045, Application For Tentative Refund IRS

Completing the Instructions For Form 1045 involves several key steps:

- Gather necessary documentation, including prior tax returns and any relevant financial statements.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the amount of the tentative refund based on your current tax situation.

- Review the form for accuracy and completeness before submission.

- Submit the form to the IRS either electronically or via mail, depending on your preference and circumstances.

Legal Use of the Instructions For Form 1045, Application For Tentative Refund IRS

The legal use of the Instructions For Form 1045 is crucial for maintaining compliance with IRS regulations. The form must be completed accurately to ensure that the refund request is valid. Failure to adhere to the guidelines provided can result in delays or denials of the refund. Additionally, electronic signatures can be used to enhance the legitimacy of the submission, provided that the eSignature solution complies with relevant laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Form 1045 are critical to ensure timely processing of your tentative refund. Typically, the form must be filed within one year of the due date of the original return for the tax year in which the overpayment occurred. It is essential to keep track of these deadlines to avoid missing out on potential refunds.

Required Documents

When completing the Instructions For Form 1045, certain documents are necessary to support your application. Required documents may include:

- Copies of prior tax returns.

- Documentation of net operating losses or credits.

- Any correspondence from the IRS related to your tax situation.

Having these documents ready will facilitate a smoother application process and help ensure that your request is processed efficiently.

IRS Guidelines

The IRS provides specific guidelines that must be followed when using the Instructions For Form 1045. These guidelines cover eligibility criteria, the calculation of refunds, and the proper submission methods. Familiarizing yourself with these guidelines can help prevent errors and ensure that your application meets all necessary requirements.

Quick guide on how to complete 2013 instructions for form 1045 instructions for form 1045 application for tentative refund irs

Easily Set Up Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund Irs on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without delays. Handle Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund Irs on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

How to Alter and eSign Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund Irs Effortlessly

- Obtain Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund Irs and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Identify important sections of the documents or obscure sensitive information using tools provided by airSlate SignNow designed specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you'd like to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund Irs and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 instructions for form 1045 instructions for form 1045 application for tentative refund irs

Create this form in 5 minutes!

How to create an eSignature for the 2013 instructions for form 1045 instructions for form 1045 application for tentative refund irs

How to make an electronic signature for a PDF file online

How to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What are the key features of airSlate SignNow for Form 1045?

airSlate SignNow offers a streamlined platform for handling 'Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund IRS'. Users can easily create, send, and eSign documents securely, ensuring compliance with IRS requirements while improving efficiency.

-

How can airSlate SignNow help with the completion of Form 1045?

Using airSlate SignNow simplifies the process of filling out 'Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund IRS'. The platform allows users to upload necessary documents, collaborate in real-time, and ensure that all required information is accurately captured before submission.

-

What pricing plans does airSlate SignNow offer for businesses?

airSlate SignNow provides flexible pricing plans catering to different business needs, ensuring you have access to 'Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund IRS' features. Pricing tiers allow businesses to choose the right level of functionality without overspending, making it accessible for organizations of all sizes.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows potential customers to explore 'Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund IRS' functionalities. This trial helps users test drive the features before committing to a paid plan.

-

Can airSlate SignNow integrate with other software applications?

Absolutely, airSlate SignNow seamlessly integrates with a variety of popular software applications to enhance functionality for 'Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund IRS'. This includes integration with platforms such as Salesforce, Google Drive, and more, ensuring a smooth workflow.

-

How does airSlate SignNow ensure document security?

airSlate SignNow takes security seriously, implementing robust measures such as encryption and compliance with industry standards to safeguard 'Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund IRS' documents. This commitment ensures that user data and sensitive information remain protected at all times.

-

What support options are available for airSlate SignNow users?

Users can access various support options through airSlate SignNow, including a comprehensive knowledge base, email support, and live chat for immediate assistance. This ensures that anyone dealing with 'Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund IRS' can get their questions answered efficiently.

Get more for Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund Irs

- Florida commercial contract 497302605 form

- Excavator contract for contractor florida form

- Renovation contract for contractor florida form

- Concrete mason contract for contractor florida form

- Demolition contract for contractor florida form

- Framing contract 497302610 form

- Security contract contractor form

- Insulation contract 497302612 form

Find out other Instructions For Form 1045 Instructions For Form 1045, Application For Tentative Refund Irs

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy