About Form 8804, Annual Return for Partnership WithholdingAbout Form 8804, Annual Return for Partnership WithholdingFederal Form 2022-2026

Understanding Form 8804: Annual Return for Partnership Withholding

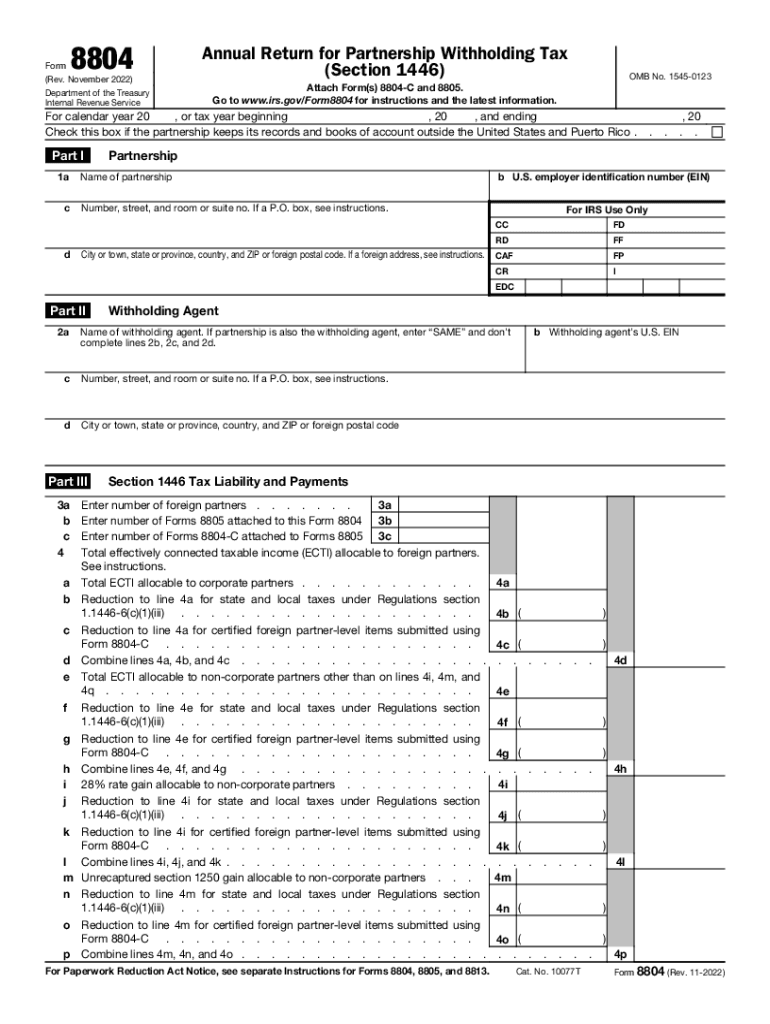

The IRS Form 8804 is essential for partnerships that are required to withhold tax on income effectively connected with a U.S. trade or business. This form serves as the annual return for partnership withholding, ensuring that the appropriate taxes are reported and remitted to the IRS. Partnerships must file this form to report the total amount withheld and to provide information about each partner's share of the income. Understanding the specific requirements and implications of Form 8804 is crucial for compliance and accurate tax reporting.

Steps to Complete Form 8804

Completing Form 8804 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the partnership's details and the income figures. Next, accurately calculate the total withholding amount based on the partnership's income. The form requires specific entries for each partner's share of the income and the corresponding withholding amounts. After filling out the form, review it for any errors before submission. Finally, ensure that the form is filed by the due date to avoid penalties.

Legal Use of Form 8804

Form 8804 is legally binding when completed correctly and submitted on time. It fulfills the partnership's obligation to report and remit withholding taxes to the IRS. For the form to be considered valid, it must include accurate information about the partnership and its partners. Additionally, the form must be signed by an authorized representative of the partnership. Understanding the legal implications of this form is essential for maintaining compliance with federal tax regulations.

Filing Deadlines for Form 8804

Partnerships must be aware of the filing deadlines for Form 8804 to avoid penalties. Generally, the form is due on the 15th day of the fourth month following the close of the partnership's tax year. For partnerships that operate on a calendar year, this means the form is typically due by April 15. If the deadline falls on a weekend or holiday, the due date may be extended to the next business day. Keeping track of these deadlines is crucial for timely compliance.

Obtaining Form 8804

Form 8804 can be obtained directly from the IRS website or through various tax preparation software. It is essential to ensure that the most current version of the form is used, as tax regulations may change. Partnerships should also consider consulting a tax professional to ensure they are using the correct form and following all necessary guidelines for completion and submission.

Penalties for Non-Compliance with Form 8804

Failing to file Form 8804 on time or providing inaccurate information can lead to significant penalties. The IRS imposes fines for late filings, which can accumulate quickly. Additionally, if the partnership fails to withhold the correct amount of tax, it may face further penalties and interest on unpaid taxes. Understanding these potential consequences emphasizes the importance of accurate and timely filing of Form 8804.

Quick guide on how to complete about form 8804 annual return for partnership withholdingabout form 8804 annual return for partnership withholdingfederal form

Complete About Form 8804, Annual Return For Partnership WithholdingAbout Form 8804, Annual Return For Partnership WithholdingFederal Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper format and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any hold-ups. Manage About Form 8804, Annual Return For Partnership WithholdingAbout Form 8804, Annual Return For Partnership WithholdingFederal Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign About Form 8804, Annual Return For Partnership WithholdingAbout Form 8804, Annual Return For Partnership WithholdingFederal Form effortlessly

- Locate About Form 8804, Annual Return For Partnership WithholdingAbout Form 8804, Annual Return For Partnership WithholdingFederal Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive content with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information carefully and then click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign About Form 8804, Annual Return For Partnership WithholdingAbout Form 8804, Annual Return For Partnership WithholdingFederal Form and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8804 annual return for partnership withholdingabout form 8804 annual return for partnership withholdingfederal form

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 8804?

airSlate SignNow is an eSignature solution that simplifies the process of sending and signing documents electronically. The reference to 8804 highlights key features that enhance the user experience, such as seamless document management and secure signing capabilities. By utilizing airSlate SignNow, businesses can ensure compliance while streamlining their workflows.

-

How much does airSlate SignNow cost per month for the 8804 service?

The pricing for airSlate SignNow varies based on the plan and features chosen. For the 8804 service, plans typically start at a budget-friendly rate, providing excellent value for businesses needing efficient document management solutions. Additionally, airSlate SignNow often offers discounts for annual subscriptions.

-

What features does airSlate SignNow offer related to 8804?

With airSlate SignNow, customers can access a range of features associated with 8804, including automated workflows, template creation, and advanced security protocols. These features are designed to enhance productivity and ensure that documents are managed efficiently, without compromising on security.

-

Can airSlate SignNow integrate with other software for 8804 users?

Yes, airSlate SignNow provides integration with various software tools for those looking at the 8804 options. It seamlessly connects with popular applications like Salesforce, Google Drive, and Microsoft Office, enabling users to streamline their document processes without needing to switch platforms constantly.

-

What are the security measures in place for airSlate SignNow's 8804 solution?

AirSlate SignNow implements several robust security measures for its 8804 solution, such as encryption, secure cloud storage, and compliance with GDPR and HIPAA regulations. These measures ensure that your documents are safe and protected from unauthorized access, giving users peace of mind while using the platform.

-

Is there a trial available for airSlate SignNow's 8804 feature?

Yes, airSlate SignNow offers a free trial for users interested in exploring the 8804 feature. This trial allows prospective customers to test the platform’s functionalities and determine whether it meets their business needs without any financial commitment.

-

How does airSlate SignNow enhance the customer experience with 8804?

AirSlate SignNow enhances the customer experience with 8804 by providing a user-friendly interface and efficient document management tools. Users can create, send, and sign documents effortlessly, contributing to an overall positive experience and increased productivity in business operations.

Get more for About Form 8804, Annual Return For Partnership WithholdingAbout Form 8804, Annual Return For Partnership WithholdingFederal Form

Find out other About Form 8804, Annual Return For Partnership WithholdingAbout Form 8804, Annual Return For Partnership WithholdingFederal Form

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy