Annual Return for Partnership Withholding Tax Section 1446 Irs 2016

What is the Annual Return For Partnership Withholding Tax Section 1446 IRS

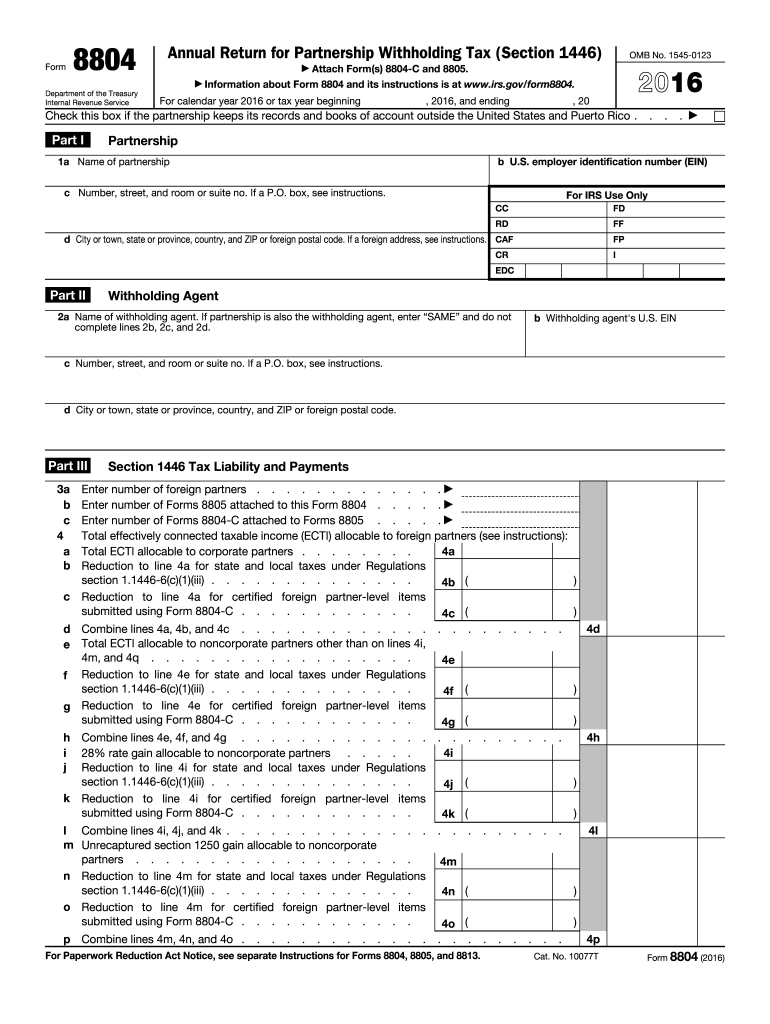

The Annual Return for Partnership Withholding Tax Section 1446 is a tax form required by the IRS for partnerships that have foreign partners. This form is used to report income effectively connected with a U.S. trade or business, ensuring that the appropriate withholding tax is applied. Partnerships must file this return to report the income allocated to foreign partners and to disclose the amount of tax withheld on their behalf. Understanding this form is crucial for compliance with U.S. tax laws and for maintaining good standing with the IRS.

Steps to Complete the Annual Return For Partnership Withholding Tax Section 1446 IRS

Completing the Annual Return for Partnership Withholding Tax Section 1446 involves several key steps:

- Gather necessary documentation, including partnership agreements and income statements.

- Identify the foreign partners and their respective shares of income.

- Calculate the total income effectively connected with a U.S. trade or business.

- Determine the amount of tax to withhold based on the income allocated to foreign partners.

- Complete the form accurately, ensuring all required information is included.

- File the form electronically or via mail by the specified deadline.

Legal Use of the Annual Return For Partnership Withholding Tax Section 1446 IRS

The Annual Return for Partnership Withholding Tax Section 1446 serves a legal purpose in the U.S. tax system. It ensures that partnerships comply with federal tax regulations regarding foreign partners. By filing this form, partnerships fulfill their obligation to withhold the appropriate taxes on income allocated to foreign partners, thereby avoiding potential penalties for non-compliance. Proper use of this form helps maintain transparency and accountability in tax reporting.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the Annual Return for Partnership Withholding Tax Section 1446. The form is typically due on the fifteenth day of the third month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by March 15. It is essential to be aware of these deadlines to avoid late filing penalties and interest charges.

Required Documents

To complete the Annual Return for Partnership Withholding Tax Section 1446, several documents are necessary:

- Partnership agreement detailing the distribution of income among partners.

- Financial statements showing income effectively connected with a U.S. trade or business.

- Records of any prior withholding tax payments made on behalf of foreign partners.

- Identification details for all foreign partners, including their tax identification numbers.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the Annual Return for Partnership Withholding Tax Section 1446. These guidelines outline the necessary steps for accurate reporting, including how to calculate withholding amounts and the importance of timely filing. Partnerships should refer to the IRS instructions for this form to ensure compliance with current tax laws and regulations.

Quick guide on how to complete annual return for partnership withholding tax section 1446 irs

Effortlessly prepare Annual Return For Partnership Withholding Tax Section 1446 Irs on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Manage Annual Return For Partnership Withholding Tax Section 1446 Irs on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

The easiest way to modify and eSign Annual Return For Partnership Withholding Tax Section 1446 Irs without hassle

- Locate Annual Return For Partnership Withholding Tax Section 1446 Irs and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional pen-and-ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you want to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Annual Return For Partnership Withholding Tax Section 1446 Irs and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct annual return for partnership withholding tax section 1446 irs

Create this form in 5 minutes!

How to create an eSignature for the annual return for partnership withholding tax section 1446 irs

How to create an eSignature for the Annual Return For Partnership Withholding Tax Section 1446 Irs in the online mode

How to generate an electronic signature for the Annual Return For Partnership Withholding Tax Section 1446 Irs in Google Chrome

How to create an electronic signature for putting it on the Annual Return For Partnership Withholding Tax Section 1446 Irs in Gmail

How to create an electronic signature for the Annual Return For Partnership Withholding Tax Section 1446 Irs straight from your smart phone

How to make an electronic signature for the Annual Return For Partnership Withholding Tax Section 1446 Irs on iOS

How to create an eSignature for the Annual Return For Partnership Withholding Tax Section 1446 Irs on Android devices

People also ask

-

What is the Annual Return for Partnership Withholding Tax Section 1446 IRS?

The Annual Return for Partnership Withholding Tax Section 1446 IRS is a tax form that partnerships must file to report the income of foreign partners subject to U.S. withholding tax. It provides the IRS with information on the tax obligations of partnerships regarding foreign entities.

-

How does airSlate SignNow simplify the filing of the Annual Return for Partnership Withholding Tax Section 1446 IRS?

airSlate SignNow streamlines the process of completion and submission of the Annual Return for Partnership Withholding Tax Section 1446 IRS by providing easy document templates and eSignature capabilities. Users can fill out, sign, and send documents efficiently, reducing the chance of errors.

-

Is there a cost associated with using airSlate SignNow for the Annual Return for Partnership Withholding Tax Section 1446 IRS?

While there is a subscription fee for airSlate SignNow, the cost is competitive and reflects the comprehensive tools provided for managing your documents, including the Annual Return for Partnership Withholding Tax Section 1446 IRS. Users can choose from various plans to find the best fit for their needs.

-

What features does airSlate SignNow offer for managing tax documents like the Annual Return for Partnership Withholding Tax Section 1446 IRS?

airSlate SignNow offers a range of features for tax document management, including customizable templates, document tracking, secure storage, and team collaboration options. These tools simplify the handling of the Annual Return for Partnership Withholding Tax Section 1446 IRS.

-

Can I integrate airSlate SignNow with other accounting software for processing the Annual Return for Partnership Withholding Tax Section 1446 IRS?

Yes, airSlate SignNow supports integrations with various accounting and tax software applications, making it easier to manage your Annual Return for Partnership Withholding Tax Section 1446 IRS alongside your financial data. This ensures a seamless flow of information across platforms.

-

What are the benefits of using airSlate SignNow for eSigning the Annual Return for Partnership Withholding Tax Section 1446 IRS?

Using airSlate SignNow for eSigning the Annual Return for Partnership Withholding Tax Section 1446 IRS enhances efficiency and security. The platform ensures that your documents are signed quickly while maintaining compliance with legal eSignature standards.

-

How does airSlate SignNow ensure the security of my documents related to the Annual Return for Partnership Withholding Tax Section 1446 IRS?

airSlate SignNow employs robust security measures, including document encryption, secure storage, and compliance with data protection regulations, to safeguard your sensitive information related to the Annual Return for Partnership Withholding Tax Section 1446 IRS. Your data is protected at all stages.

Get more for Annual Return For Partnership Withholding Tax Section 1446 Irs

- Joint tenants warranty deed nm form

- Illinois agreement or contract for deed for sale and purchase of real estate aka land or executory contract form

- Maine landlord tenant closing statement to reconcile security deposit form

- Agreement form of sale of land

- Delaware legal last will and testament form for divorced person not remarried with adult and minor children

- Last will and testament form california

- Tx land gift deed form

- Joint tenancy warranty deedpdffillercom form

Find out other Annual Return For Partnership Withholding Tax Section 1446 Irs

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF