Form 8804 PDF Internal Revenue Service 2020

What is the Form 8804 PDF Internal Revenue Service

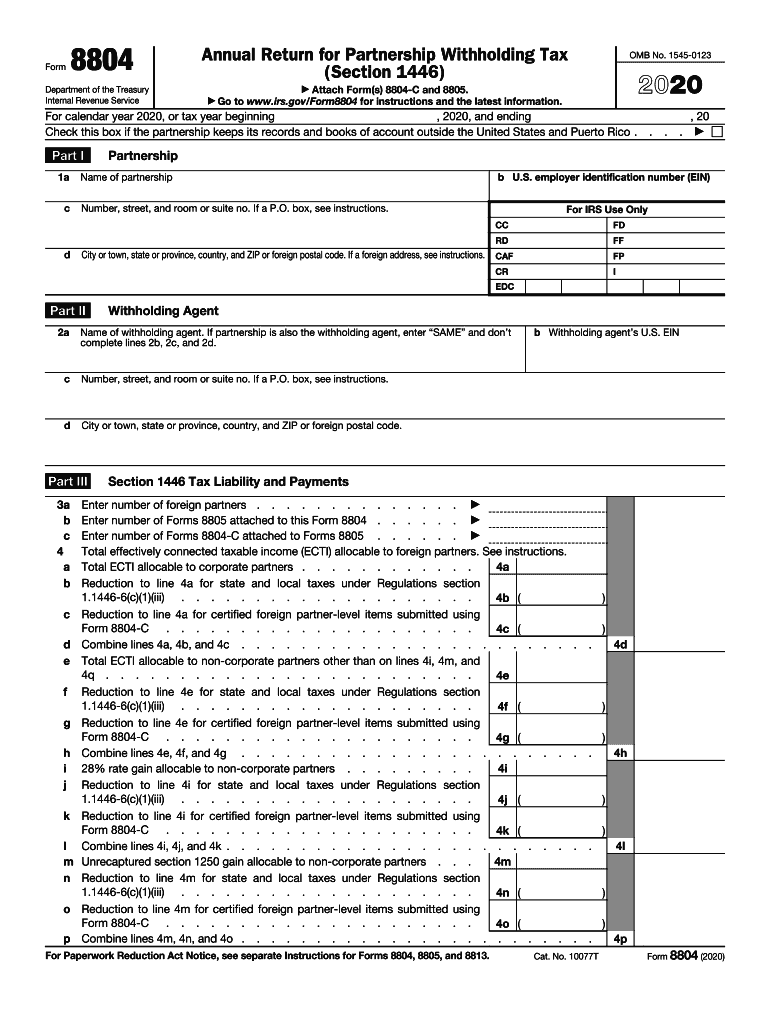

The Form 8804 is a tax document used by partnerships to report their annual withholding tax obligations on effectively connected income allocable to foreign partners. This form is essential for ensuring compliance with U.S. tax laws and regulations. The IRS requires partnerships to file this form if they have foreign partners who are subject to withholding tax on their share of income. The form provides a comprehensive overview of the partnership's income, deductions, and the amounts withheld for each foreign partner.

How to use the Form 8804 PDF Internal Revenue Service

Using the Form 8804 involves several steps to ensure accurate reporting. First, partnerships must gather all relevant financial information, including income, deductions, and partner information. Once the necessary data is collected, the form can be filled out, detailing the income allocated to each foreign partner and the corresponding withholding amounts. After completing the form, partnerships must ensure that it is submitted to the IRS by the specified deadline to avoid penalties. It is advisable to review the form for accuracy before submission.

Steps to complete the Form 8804 PDF Internal Revenue Service

Completing the Form 8804 involves a systematic approach:

- Gather all financial records related to the partnership's income and deductions.

- Identify the foreign partners and determine their respective shares of income.

- Calculate the withholding tax amounts based on the income allocated to each foreign partner.

- Fill out the Form 8804 accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the appropriate deadline.

Legal use of the Form 8804 PDF Internal Revenue Service

The legal use of Form 8804 is crucial for partnerships with foreign partners. This form serves as a declaration of the withholding tax obligations that the partnership has towards the IRS. It ensures that the partnership complies with U.S. tax law, which mandates withholding on income earned by foreign partners. Failure to use this form correctly can result in significant penalties, including fines and interest on unpaid taxes. Therefore, it is essential for partnerships to understand their legal responsibilities when it comes to filing this form.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for Form 8804 to remain compliant with IRS regulations. Generally, the form is due on the 15th day of the fourth month following the close of the partnership's tax year. For partnerships operating on a calendar year, this typically means the form is due by April 15. It is important to keep track of these dates to avoid late filing penalties. Additionally, if the partnership requires an extension, Form 8804 can be filed with an extension request, but the withholding taxes must still be paid on time.

Penalties for Non-Compliance

Non-compliance with the filing requirements for Form 8804 can lead to various penalties imposed by the IRS. These penalties may include fines for late filing, failure to file, or inaccuracies in the information provided. The IRS may also impose interest on any unpaid taxes related to the withholding obligations. It is vital for partnerships to understand these potential consequences and to ensure that they file the form accurately and on time to avoid unnecessary financial burdens.

Quick guide on how to complete form 8804 pdf internal revenue service

Easily prepare Form 8804 PDF Internal Revenue Service on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and store it securely online. airSlate SignNow supplies you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 8804 PDF Internal Revenue Service on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to modify and eSign Form 8804 PDF Internal Revenue Service effortlessly

- Obtain Form 8804 PDF Internal Revenue Service and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only moments and carries the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to store your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Alter and eSign Form 8804 PDF Internal Revenue Service and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8804 pdf internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 8804 pdf internal revenue service

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is 8804 c in the context of airSlate SignNow?

The term 8804 c refers to a specific compliance standard relevant to electronic signatures. airSlate SignNow ensures that all documents signed using its platform meet the necessary legal requirements, including those specified under 8804 c. This provides users with the confidence that their eSigning processes are both secure and legally binding.

-

How does airSlate SignNow handle pricing for 8804 c compliance?

airSlate SignNow offers competitive pricing packages that account for features related to 8804 c compliance. This means businesses can choose a plan that fits their budget while ensuring all their signing needs, including compliance aspects, are comprehensively met. Potential customers are encouraged to explore various pricing tiers available to maximize their investment.

-

What features does airSlate SignNow provide for 8804 c compliance?

Key features of airSlate SignNow related to 8804 c compliance include secure document storage, audit trails, and customizable workflows. These functionalities not only streamline the signing process but also ensure that all electronic signatures are tracked and validated according to 8804 c standards. This helps businesses maintain compliance effortlessly while improving operational efficiency.

-

What are the benefits of using airSlate SignNow with 8804 c compliance?

Using airSlate SignNow ensures your documents are signed in line with 8804 c compliance, which enhances legal protection for your business. Additionally, it offers an intuitive interface that simplifies the eSigning process for users, reducing turnaround time on document signing. Overall, this leads to enhanced productivity and a signNow reduction in paper usage.

-

Does airSlate SignNow integrate with other platforms for 8804 c compliance?

Yes, airSlate SignNow integrates seamlessly with various business applications to enhance 8804 c compliance efforts. Popular tools like CRM systems, project management software, and cloud storage solutions can be connected easily. This integration ensures that all your document management processes align with compliance standards effortlessly.

-

Is airSlate SignNow suitable for small businesses seeking 8804 c compliance?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises that need to meet 8804 c compliance requirements. Its intuitive features and attractive pricing structures make it an ideal choice for small businesses looking to streamline their document signing processes without compromising on compliance.

-

How secure is airSlate SignNow for documents under 8804 c?

airSlate SignNow prioritizes security for all documents, particularly those requiring 8804 c compliance. The platform uses advanced encryption techniques and secure servers to protect sensitive information. Additionally, audit logs and user authentication processes further ensure that all signed documents remain secure and compliant.

Get more for Form 8804 PDF Internal Revenue Service

Find out other Form 8804 PDF Internal Revenue Service

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free