Form 8804 Department of the Treasury Internal Revenue 2021

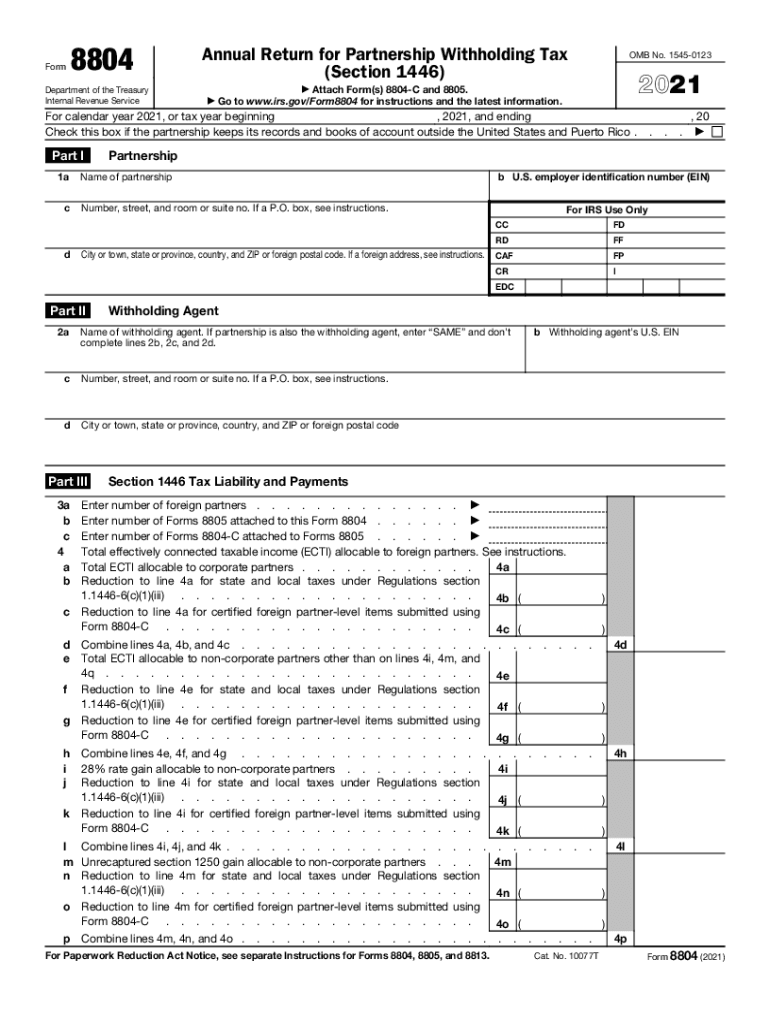

What is the Form 8804?

The Form 8804 is a tax document issued by the Department of the Treasury Internal Revenue Service (IRS) that is used to report the withholding tax obligations of partnerships. This form is specifically designed for partnerships that are required to withhold tax on effectively connected income allocable to foreign partners. The form helps ensure compliance with U.S. tax laws and provides the IRS with necessary information regarding the partnership's tax obligations.

How to use the Form 8804

Using the Form 8804 involves several steps to ensure accurate reporting and compliance with IRS regulations. Partnerships must first determine if they are required to file this form based on their foreign partner allocations. Once eligibility is established, the partnership should complete the form by providing details such as the partnership's name, address, and the amount of tax withheld. After completing the form, it must be submitted along with the required payment to the IRS to fulfill the withholding tax obligation.

Steps to complete the Form 8804

Completing the Form 8804 requires careful attention to detail. Follow these steps:

- Gather all necessary information, including partnership details and foreign partner allocations.

- Fill out the form, ensuring that all fields are completed accurately.

- Calculate the total amount of tax withheld from foreign partners.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS by the appropriate deadline.

Legal use of the Form 8804

The legal use of the Form 8804 is essential for partnerships that have foreign partners. Filing this form ensures that the partnership complies with U.S. tax laws, specifically regarding withholding taxes on income that is effectively connected to the U.S. It is important for partnerships to understand the legal implications of the form, as failure to file or incorrect filing can lead to penalties and interest charges from the IRS.

Filing Deadlines / Important Dates

Partnerships must be aware of the filing deadlines associated with the Form 8804. Generally, the form is due on the fifteenth day of the fourth month following the close of the partnership's tax year. For partnerships operating on a calendar year, this typically means the deadline is April 15. It is crucial for partnerships to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file the Form 8804 or inaccuracies in the information provided can result in significant penalties. The IRS may impose fines based on the amount of tax that should have been withheld but was not. Additionally, partnerships may face interest charges on any unpaid taxes. Understanding these potential penalties emphasizes the importance of accurate and timely filing of the Form 8804.

Quick guide on how to complete form 8804 department of the treasury internal revenue

Complete Form 8804 Department Of The Treasury Internal Revenue effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8804 Department Of The Treasury Internal Revenue on any platform with the airSlate SignNow Android or iOS applications and simplify any document-based task today.

How to modify and eSign Form 8804 Department Of The Treasury Internal Revenue effortlessly

- Find Form 8804 Department Of The Treasury Internal Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form 8804 Department Of The Treasury Internal Revenue and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8804 department of the treasury internal revenue

Create this form in 5 minutes!

How to create an eSignature for the form 8804 department of the treasury internal revenue

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an e-signature for putting it on PDFs in Gmail

The way to create an e-signature right from your smart phone

How to create an e-signature for a PDF on iOS devices

The way to create an e-signature for a PDF on Android OS

People also ask

-

What is the significance of the '8804' feature in airSlate SignNow?

The '8804' feature in airSlate SignNow provides users with a streamlined e-signature solution that simplifies document management. This feature enhances workflow efficiency and reduces the time spent on signing documents. As part of our platform, '8804' ensures that your signing processes are secure and compliant with legal standards.

-

How much does it cost to use the '8804' service with airSlate SignNow?

The pricing for using the '8804' service with airSlate SignNow varies depending on the plan you choose. We offer flexible subscription options that cater to different business sizes and needs, ensuring you get the best value. Our pricing structure is designed to be cost-effective, providing features like '8804' for optimal document management.

-

What are the key benefits of the '8804' e-signature feature?

The '8804' e-signature feature allows businesses to sign documents quickly and securely, saving both time and resources. It facilitates remote signing, which is particularly beneficial in today's digital landscape. Moreover, '8804' is designed to improve collaboration among teams, making it a valuable tool for any organization.

-

Can the '8804' feature integrate with other software applications?

Yes, the '8804' feature in airSlate SignNow seamlessly integrates with various applications, enhancing its utility. Popular integrations include CRM systems, project management tools, and document storage solutions. This interoperability allows businesses to incorporate '8804' into their existing workflows easily.

-

Is the '8804' feature secure and compliant with regulations?

Absolutely! The '8804' feature meets industry-leading security standards and complies with necessary regulations such as GDPR and HIPAA. airSlate SignNow ensures that all documents signed through '8804' are protected with advanced encryption methods, keeping your sensitive information safe.

-

How can I get started with the '8804' feature in airSlate SignNow?

Getting started with the '8804' feature is simple. Just sign up for an airSlate SignNow account, choose a plan that suits your needs, and you will have immediate access to '8804'. Our user-friendly interface will guide you through the setup process, allowing you to start sending and signing documents effortlessly.

-

What types of documents can I sign using the '8804' feature?

You can sign a wide variety of documents using the '8804' feature, including contracts, agreements, and forms. airSlate SignNow supports multiple file formats, making it versatile for all types of business needs. Whether it's a simple PDF or a complex contract, '8804' is equipped to handle it.

Get more for Form 8804 Department Of The Treasury Internal Revenue

- Framing contractor package delaware form

- Foundation contractor package delaware form

- Plumbing contractor package delaware form

- Brick mason contractor package delaware form

- Roofing contractor package delaware form

- Electrical contractor package delaware form

- Sheetrock drywall contractor package delaware form

- Flooring contractor package delaware form

Find out other Form 8804 Department Of The Treasury Internal Revenue

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template