8804 2018

What is the 8804?

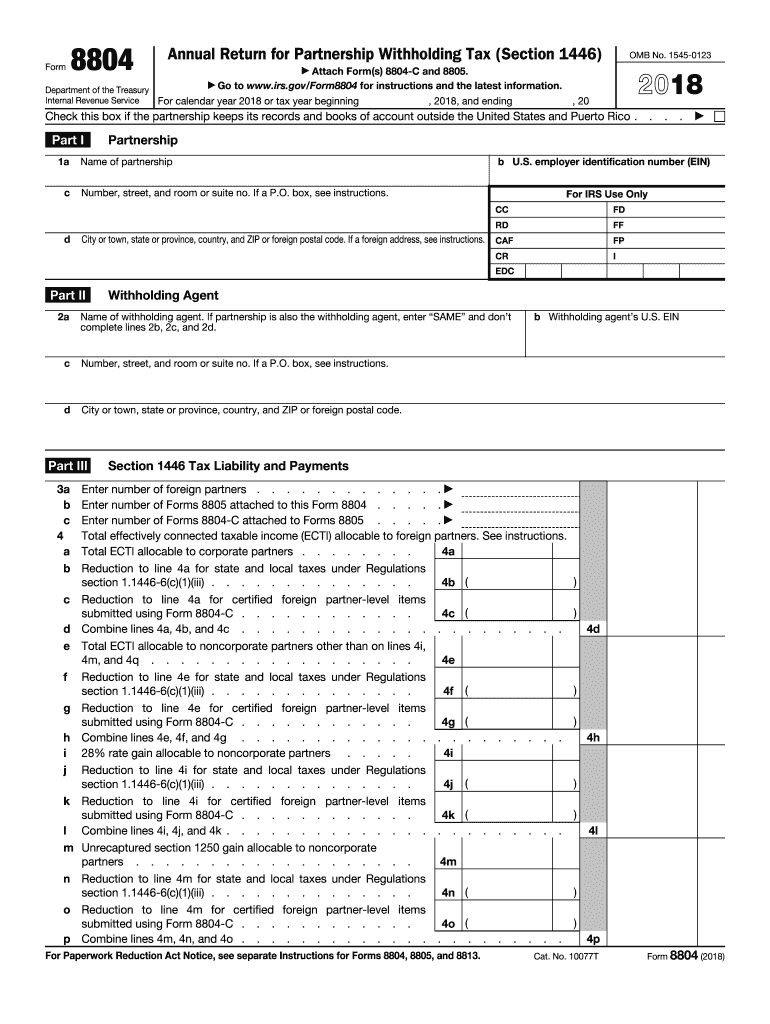

The 8804 form, officially known as the Annual Return for Partnership Withholding Tax (Section 1446), is a tax document used by partnerships to report and pay withholding tax on effectively connected income allocable to foreign partners. This form is essential for ensuring compliance with U.S. tax laws regarding foreign investment in partnerships. The form captures the total amount of income subject to withholding, the amount withheld, and the distribution of this income among partners.

How to use the 8804

Using the 8804 form involves several steps to ensure accurate reporting and compliance. Partnerships must first determine the amount of effectively connected income that is allocable to foreign partners. Next, the partnership calculates the withholding tax based on this income. The completed form is then submitted to the IRS along with any required payments. It is crucial to keep records of all calculations and payments made, as these may be needed for future reference or audits.

Steps to complete the 8804

Completing the 8804 form requires careful attention to detail. Here are the key steps:

- Gather all necessary information about the partnership's income and foreign partners.

- Calculate the effectively connected income and the corresponding withholding tax.

- Fill out the 8804 form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form to the IRS by the appropriate deadline, along with any payment due.

IRS Guidelines

The IRS provides specific guidelines regarding the 8804 form, including who must file, when to file, and how to calculate withholding amounts. Partnerships must adhere to these guidelines to avoid penalties. The IRS also outlines the necessary documentation that should accompany the form, including any schedules or additional forms that may be required based on the partnership's specific situation.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 8804 form is crucial for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to these deadlines, as the IRS may adjust them due to holidays or other considerations.

Penalties for Non-Compliance

Failure to file the 8804 form or to pay the required withholding tax can result in significant penalties. The IRS may impose fines for late filing, underpayment, or inaccuracies on the form. Additionally, partnerships may face increased scrutiny during audits if they do not demonstrate compliance with withholding requirements. It is advisable for partnerships to consult with a tax professional to ensure they meet all obligations associated with the 8804 form.

Quick guide on how to complete 8804 2018 form

Explore the simplest method to complete and sign your 8804

Are you still spending unnecessary time preparing your official paperwork on paper instead of online? airSlate SignNow provides an improved approach to finalize and endorse your 8804 and associated forms for public services. Our advanced eSignature solution equips you with all the necessary tools to handle documents swiftly and according to formal standards - robust PDF editing, organizing, securing, signing, and sharing features are all accessible through an easy-to-use interface.

Only a few steps are needed to complete and sign your 8804:

- Introduce the fillable template into the editor by utilizing the Get Form button.

- Determine what information you need to enter in your 8804.

- Move between fields using the Next button to ensure nothing is overlooked.

- Employ Text, Check, and Cross features to fill in the blanks with your information.

- Update the content with Text boxes or Images from the top menu.

- Emphasize important items or Obscure irrelevant sections.

- Click on Sign to create a legally enforceable eSignature using your preferred method.

- Add the Date next to your signature and finalize your work with the Done button.

Store your finalized 8804 in the Documents section of your profile, download it, or transfer it to your chosen cloud storage. Our service also allows flexible form sharing. There’s no requirement to print your templates when you need to submit them to the appropriate public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 8804 2018 form

Create this form in 5 minutes!

How to create an eSignature for the 8804 2018 form

How to make an electronic signature for the 8804 2018 Form online

How to create an eSignature for the 8804 2018 Form in Google Chrome

How to make an electronic signature for signing the 8804 2018 Form in Gmail

How to make an electronic signature for the 8804 2018 Form right from your smartphone

How to generate an electronic signature for the 8804 2018 Form on iOS devices

How to create an electronic signature for the 8804 2018 Form on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 8804?

airSlate SignNow is a powerful electronic signature solution that allows businesses to send and eSign documents efficiently. The reference to '8804' often pertains to specific features or pricing plans that can enhance your document management experience. With airSlate SignNow, you can streamline your workflow while ensuring compliance and security.

-

How much does airSlate SignNow cost compared to other eSignature solutions for 8804?

The pricing for airSlate SignNow is competitive, especially when considering the value it offers for the features associated with 8804. You can choose from various plans that cater to different business sizes and needs, ensuring you get the most cost-effective solution for your eSigning requirements.

-

What are the key features of airSlate SignNow in relation to 8804?

airSlate SignNow includes a range of features tailored to enhance your eSigning experience, which can be associated with the term '8804.' Key features include document templates, real-time tracking, and multiple signing options, all designed to simplify and expedite your document workflows.

-

How can airSlate SignNow improve my business processes linked to 8804?

By integrating airSlate SignNow into your business processes, you can signNowly reduce turnaround times for documents associated with 8804. The platform enables seamless collaboration, ensuring that your team can efficiently manage documents and focus on more strategic tasks.

-

Does airSlate SignNow integrate with other tools related to 8804?

Yes, airSlate SignNow offers integrations with a variety of popular software applications, which can be crucial for processes involving 8804. Whether it's CRM systems, project management tools, or cloud storage solutions, these integrations help you create a cohesive workflow.

-

Is airSlate SignNow secure for handling sensitive documents associated with 8804?

Absolutely, airSlate SignNow prioritizes security and compliance, making it an ideal choice for handling sensitive documents tied to 8804. The platform employs advanced encryption and authentication protocols to ensure that your documents remain secure throughout the signing process.

-

Can I customize my documents in airSlate SignNow for 8804?

Yes, airSlate SignNow allows you to customize your documents to fit your specific needs related to 8804. With its user-friendly interface, you can easily add fields, logos, and personalized content to ensure that your documents reflect your brand and meet your specifications.

Get more for 8804

Find out other 8804

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile