Form 8892 Rev December Application for Automatic Extension of Time to File Form 709 Andor Payment of GiftGeneration Skipping Tra 2022

Understanding the Form 8892

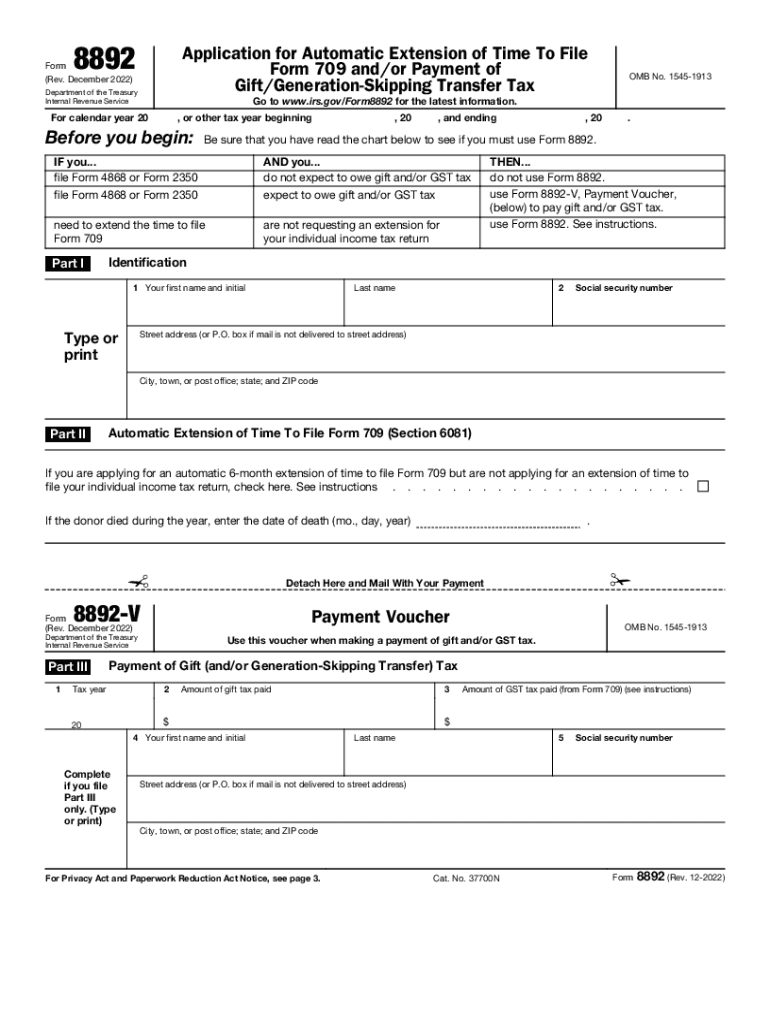

The Form 8892, officially known as the Application for Automatic Extension of Time to File Form 709 and/or Payment of Gift/Generation-Skipping Transfer Tax, is a crucial document for individuals who need additional time to file their gift tax returns. This form is specifically designed for taxpayers who are subject to the gift tax and wish to apply for an extension. By submitting this form, individuals can avoid penalties associated with late filing, provided they meet the necessary requirements. The IRS allows for this extension to ensure that taxpayers have adequate time to prepare their returns accurately.

Steps to Complete the Form 8892

Completing the Form 8892 involves several key steps to ensure accuracy and compliance with IRS requirements. Begin by gathering all necessary information, including your name, address, and Social Security number. Next, indicate the tax year for which you are requesting the extension. You will also need to provide details about any gift or generation-skipping transfer taxes owed. Carefully follow the instructions provided on the form to ensure that all sections are completed accurately. Once filled out, review the form for any errors before submitting it to the IRS.

Legal Use of the Form 8892

The legal validity of the Form 8892 hinges on its proper completion and submission. It is essential to understand that while the form grants an extension for filing, it does not extend the time to pay any taxes owed. Therefore, taxpayers must ensure that any estimated taxes are paid by the original due date to avoid penalties. The form must be submitted to the IRS by the specified deadline to be considered valid. Compliance with these regulations ensures that the extension is legally recognized and protects the taxpayer from potential legal repercussions.

IRS Guidelines for Form 8892

The IRS provides specific guidelines regarding the use and submission of Form 8892. Taxpayers should familiarize themselves with these guidelines to ensure compliance. Key points include the requirement to file the form electronically or via mail, depending on the taxpayer's situation. Additionally, the IRS outlines the necessary information that must be included on the form, such as the taxpayer's identification details and the amount of tax owed. Adhering to these guidelines is crucial for a successful extension application.

Filing Deadlines for Form 8892

Timely submission of Form 8892 is essential to avoid penalties. The form must be filed by the original due date of Form 709, which is typically April fifteenth of the year following the gift. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. Understanding these deadlines allows taxpayers to plan accordingly and ensure that their extension requests are submitted on time, thereby maintaining compliance with IRS regulations.

Form Submission Methods

Taxpayers have several options for submitting Form 8892. The form can be filed electronically through IRS-approved e-filing software, which offers a streamlined process for submission. Alternatively, individuals may choose to print the form and mail it directly to the IRS. It is important to ensure that the form is sent to the correct address, as specified by the IRS guidelines. Regardless of the submission method, obtaining confirmation of the submission is advisable to ensure that the request for an extension has been successfully processed.

Quick guide on how to complete form 8892 rev december 2022 application for automatic extension of time to file form 709 andor payment of giftgeneration

Easily Prepare Form 8892 Rev December Application For Automatic Extension Of Time To File Form 709 Andor Payment Of GiftGeneration Skipping Tra on Any Device

Web-based document management has become widespread among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Form 8892 Rev December Application For Automatic Extension Of Time To File Form 709 Andor Payment Of GiftGeneration Skipping Tra on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and eSign Form 8892 Rev December Application For Automatic Extension Of Time To File Form 709 Andor Payment Of GiftGeneration Skipping Tra Effortlessly

- Obtain Form 8892 Rev December Application For Automatic Extension Of Time To File Form 709 Andor Payment Of GiftGeneration Skipping Tra and click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your updates.

- Choose your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8892 Rev December Application For Automatic Extension Of Time To File Form 709 Andor Payment Of GiftGeneration Skipping Tra and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8892 rev december 2022 application for automatic extension of time to file form 709 andor payment of giftgeneration

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 8892?

airSlate SignNow is a comprehensive electronic signature solution that empowers businesses to send and eSign documents efficiently. The term '8892' refers to a specific feature or code within our platform that enhances the overall user experience. With airSlate SignNow, you can streamline your document workflows and improve productivity using the capabilities associated with 8892.

-

How much does airSlate SignNow cost for users interested in 8892 features?

Pricing for airSlate SignNow varies based on the plan you choose, and each plan includes access to the powerful features related to 8892. Our pricing is designed to be cost-effective, ensuring businesses can find the right plan that fits their needs and budget. To get started with the pricing that includes the 8892 features, visit our pricing page for detailed information.

-

What are the key features of airSlate SignNow pertaining to 8892?

airSlate SignNow includes a variety of key features that relate to 8892, including customizable templates, fast document turnaround, and advanced security measures. These features allow users to easily manage their eSigning processes while ensuring compliance with industry standards. Leveraging these aspects of 8892 can signNowly enhance your document handling efficiency.

-

What benefits will I gain using airSlate SignNow and the 8892 functionality?

By using airSlate SignNow, especially with the 8892 capabilities, you'll benefit from quicker transaction times and enhanced collaboration among team members. The easy-to-use interface ensures users can adapt quickly, reducing the learning curve. The integration of 8892 features helps businesses streamline their operations while saving time and costs.

-

Can airSlate SignNow integrate with other software systems related to 8892?

Yes, airSlate SignNow supports various integrations that can enhance the implementation of the 8892 features. You can connect with CRM systems, cloud storage services, and other applications to create a seamless workflow. These integrations are designed to enhance your overall experience with airSlate SignNow, making it a flexible solution for different business needs.

-

What industries can benefit from airSlate SignNow's 8892 features?

airSlate SignNow's 8892 features can benefit a variety of industries, including healthcare, real estate, and finance. Businesses in these sectors can utilize efficient eSigning processes to streamline their workflows, improve compliance, and enhance customer satisfaction. The versatility of airSlate SignNow ensures that any industry can adapt the 8892 functionalities to meet their specific needs.

-

Is there customer support available for airSlate SignNow related to 8892?

Absolutely! airSlate SignNow provides comprehensive customer support, including assistance for users navigating the 8892 features. Our support team is available through multiple channels to ensure that any queries or issues are addressed promptly. You can count on us to help you maximize your usage of airSlate SignNow and its unique functionalities.

Get more for Form 8892 Rev December Application For Automatic Extension Of Time To File Form 709 Andor Payment Of GiftGeneration Skipping Tra

Find out other Form 8892 Rev December Application For Automatic Extension Of Time To File Form 709 Andor Payment Of GiftGeneration Skipping Tra

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free