Where to Mail 8892 2008

What is the form 8892?

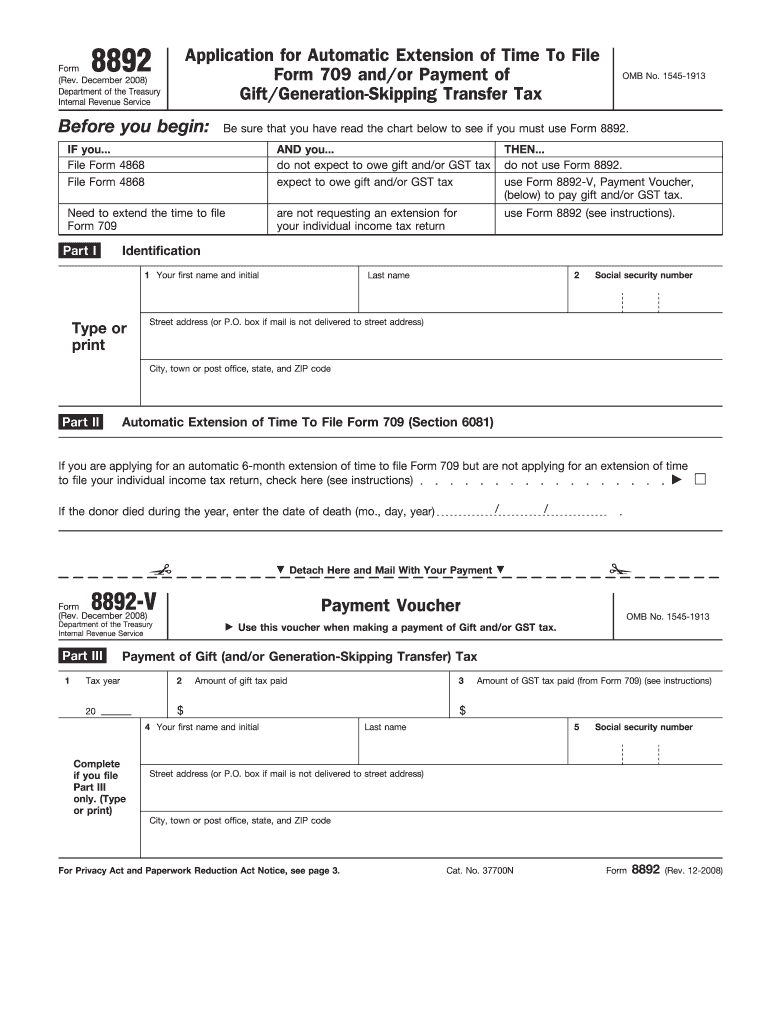

The form 8892, officially known as the IRS Form 8892, is used by taxpayers to request an extension of time to file their tax returns. This form is particularly relevant for individuals who need additional time to gather their financial information or complete their tax filings. By submitting this form, taxpayers can avoid penalties associated with late filing, provided they meet the necessary requirements and deadlines.

Steps to complete the form 8892

Completing the form 8892 involves several key steps to ensure accuracy and compliance with IRS regulations. Begin by obtaining the latest version of the form from the IRS website or a trusted source. Fill out your personal information, including your name, address, and Social Security number. Specify the tax year for which you are requesting an extension. It is crucial to accurately indicate the type of return you are filing. Review the instructions carefully to ensure that all required fields are completed. Once filled out, sign and date the form before mailing it to the appropriate address.

Where to mail form 8892

Mailing the form 8892 requires attention to detail to ensure it reaches the IRS promptly. The mailing address for the form depends on whether you are enclosing a payment. If you are not sending a payment, mail the form to the address specified in the instructions for Form 8892. If you are submitting a payment, use the address designated for payments. It is advisable to send the form via certified mail or a similar service to confirm delivery.

IRS guidelines for form 8892

The IRS provides specific guidelines for completing and submitting form 8892. It is essential to adhere to these guidelines to avoid delays or rejections. The form must be submitted by the original due date of the tax return to qualify for an extension. Additionally, the IRS requires that taxpayers provide a valid reason for the extension request. Familiarizing yourself with the IRS guidelines can help ensure that your submission is compliant and processed efficiently.

Filing deadlines for form 8892

Understanding the filing deadlines associated with form 8892 is crucial for taxpayers. The form must be filed by the original due date of the tax return, typically April 15 for individual taxpayers. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to note that while form 8892 grants an extension for filing, it does not extend the deadline for paying any taxes owed. Timely submission of the form is essential to avoid penalties.

Legal use of form 8892

The legal use of form 8892 is governed by IRS regulations. When properly completed and submitted, the form serves as a formal request for an extension to file a tax return. Taxpayers must ensure that they meet all eligibility criteria and follow the prescribed process to avoid issues with the IRS. The form must be signed and dated by the taxpayer, affirming that the information provided is accurate and complete. This legal acknowledgment is vital for the form's validity.

Quick guide on how to complete where to mail 8892

Effortlessly Prepare Where To Mail 8892 on Any Device

The management of online documents has gained popularity among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Take care of Where To Mail 8892 on any device with the airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Modify and eSign Where To Mail 8892 with Ease

- Locate Where To Mail 8892 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically designed for this purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or disorganized documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Where To Mail 8892 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct where to mail 8892

Create this form in 5 minutes!

How to create an eSignature for the where to mail 8892

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8892 and why do I need to know where to mail 8892?

Form 8892 is used to apply for an automatic extension of time to file a return for a partnership or corporation. Knowing where to mail 8892 is crucial to ensure your application is processed without delays. It's important to send this form to the correct address provided by the IRS to avoid any penalties.

-

How can airSlate SignNow help me with submitting Form 8892?

airSlate SignNow provides a seamless document signing and submission process that allows you to fill out and e-sign Form 8892 digitally. Once you complete the form, airSlate SignNow can assist you with submitting it to the correct mailing address, ensuring you know where to mail 8892 in a timely manner.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to accommodate different business needs, including individual and team plans. Each plan provides access to essential e-signing features, with cost-effective solutions for businesses of all sizes. Understanding the pricing structure will help you choose the right plan while ensuring you know where to mail 8892, should you need to submit it.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including e-signature, document templates, and team collaboration tools. These features streamline the document management process and make it easier for you to prepare and send documents, including Form 8892. You'll have confidence in knowing where to mail 8892 once it's signed and ready.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Salesforce, and more. These integrations enhance your workflow, allowing you to manage documents efficiently and easily access information about where to mail 8892 within your existing applications.

-

Can airSlate SignNow help with tracking the status of my submitted Form 8892?

While airSlate SignNow primarily focuses on the document signing process, it provides features that allow you to track the status of document submissions. This capability is crucial for keeping tabs on your Form 8892 and ensuring you know where to mail 8892 as part of your filing process.

-

What benefits can I expect from using airSlate SignNow for business?

Using airSlate SignNow can signNowly enhance business efficiency by simplifying the document signing process and reducing turnaround time. You will benefit from cost-effective solutions which help you save resources and stay organized. Additionally, knowing where to mail 8892 will become easier through streamlined document management.

Get more for Where To Mail 8892

Find out other Where To Mail 8892

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form