About Form 8892Internal Revenue Service 2019

What is the 8892 form?

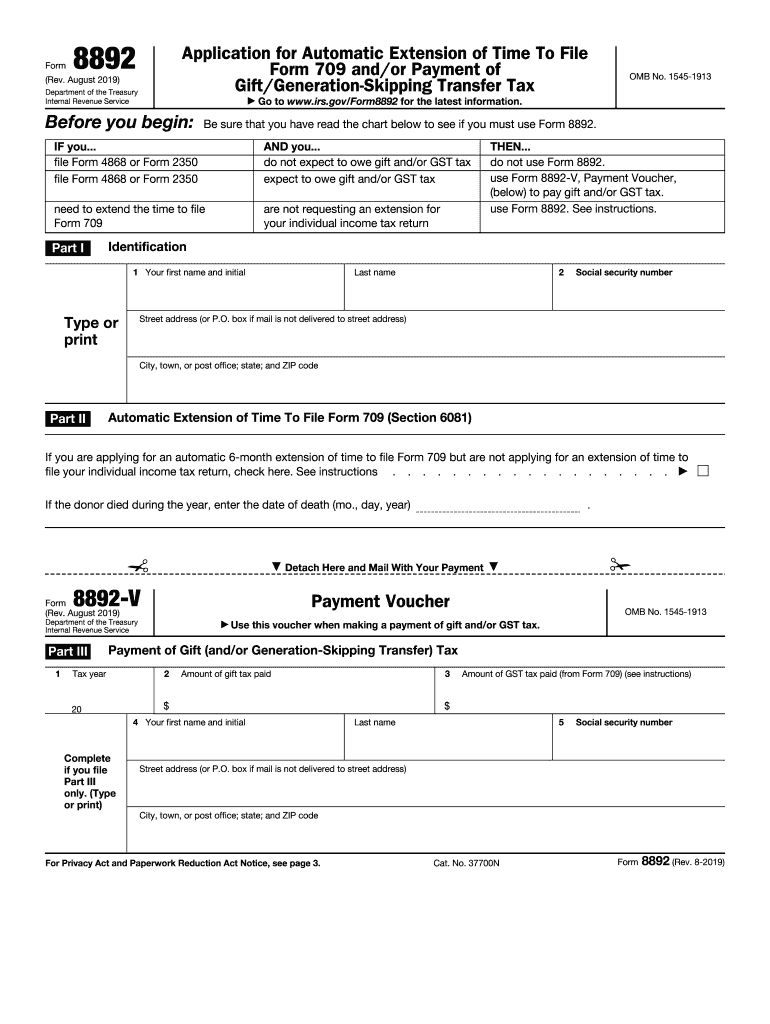

The 8892 form, officially known as the IRS Form 8892, is a tax document used by U.S. taxpayers to request an extension of time to file their gift tax return. This form is essential for individuals who need additional time to prepare their Form 709, which is the United States Gift (and Generation-Skipping Transfer) Tax Return. By submitting the 8892 form, taxpayers can ensure they meet their filing obligations while avoiding potential penalties for late submissions.

Steps to complete the 8892 form

Completing the 8892 form involves several straightforward steps:

- Gather necessary information, including your name, address, and taxpayer identification number.

- Indicate the type of extension you are requesting and the reason for the extension.

- Provide details regarding the gifts made during the tax year, if applicable.

- Sign and date the form to validate your request.

- Submit the completed form to the IRS by the specified deadline.

It is important to ensure that all information is accurate and complete to avoid delays in processing your extension request.

Legal use of the 8892 form

The 8892 form is legally recognized as a valid request for an extension of time to file a gift tax return. To ensure its legal standing, it must be completed accurately and submitted on time. The form adheres to the guidelines set forth by the IRS, making it an essential tool for compliance with federal tax laws. Utilizing electronic signature tools, such as those offered by signNow, can further enhance the legal validity of your submission by providing a secure and verifiable signature.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 8892 form is crucial for maintaining compliance. Generally, the form must be submitted by the original due date of your Form 709, which is typically April fifteenth of the year following the tax year in question. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should be aware of these dates to avoid penalties associated with late filing.

Required Documents

When preparing to submit the 8892 form, certain documents may be required to support your extension request. These can include:

- Your completed Form 709, if applicable.

- Documentation of any gifts made during the tax year.

- Identification information, such as your Social Security number or Employer Identification Number.

Having these documents ready can facilitate a smoother filing process and help ensure that your extension request is processed without issues.

Form Submission Methods

The 8892 form can be submitted through various methods, including:

- Online submission through the IRS e-file system, if eligible.

- Mailing a paper copy of the form to the appropriate IRS address.

- In-person delivery at designated IRS offices, if necessary.

Choosing the right submission method can affect the processing time, so it is advisable to select the option that best suits your needs and timeline.

Quick guide on how to complete about form 8892internal revenue service

Prepare About Form 8892Internal Revenue Service with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and safely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage About Form 8892Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign About Form 8892Internal Revenue Service effortlessly

- Obtain About Form 8892Internal Revenue Service and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign About Form 8892Internal Revenue Service and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8892internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the about form 8892internal revenue service

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 8892 form, and how is it used?

The 8892 form, often used for tax-related purposes, allows businesses to request a refund or adjustment to their tax filings. Utilizing airSlate SignNow, you can quickly and securely send the 8892 form for electronic signatures, streamlining your submission process.

-

How can airSlate SignNow help me with the 8892 form?

airSlate SignNow provides a user-friendly platform to prepare, send, and eSign your 8892 form efficiently. Its intuitive interface enables you to fill out the form digitally, track its status, and ensure compliance with electronic signatures.

-

Are there any costs associated with using airSlate SignNow for the 8892 form?

airSlate SignNow offers various pricing plans tailored to different business needs, starting from a cost-effective option. You can choose a plan that fits your requirements for handling the 8892 form and other documents, ensuring you get value without overspending.

-

Is the 8892 form legally valid if signed electronically?

Yes, the 8892 form can be signed electronically using airSlate SignNow, making it legally valid and compliant with federal regulations. Electronic signatures on documents like the 8892 form are recognized as binding, which simplifies the filing process.

-

What features does airSlate SignNow offer for handling the 8892 form?

airSlate SignNow boasts a range of features, including document templates, real-time tracking, and automated reminders. These features enhance the efficiency of processing the 8892 form, allowing you to stay organized and ensure timely submissions.

-

Can I integrate airSlate SignNow with other software to manage the 8892 form?

Yes, airSlate SignNow can seamlessly integrate with various CRM and productivity tools, allowing for a smoother workflow when handling the 8892 form. This interoperability means you can manage your documents and signatures in one place without unnecessary disruptions.

-

What are the benefits of using airSlate SignNow for the 8892 form?

Using airSlate SignNow for the 8892 form offers numerous benefits, including faster processing times and increased accuracy. The platform’s electronic signature capabilities reduce the likelihood of errors, ensuring that your tax-related submissions are handled efficiently.

Get more for About Form 8892Internal Revenue Service

- Authorization to release health records wyoming department of form

- Authorization to release health records form

- Hospital application for reregistration form dhhs 226 a

- Florida physician assistant application form

- Council on physician assistants form

- Wyoming department of health institutional review board hipaa form

- How to use the customer portal city of lubbock utilities form

- Primary care clinicstamps health servicesgeorgia tech form

Find out other About Form 8892Internal Revenue Service

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now